Context:

At the Bitcoin 2024 conference, Donald Trump promised to establish a strategic Bitcoin reserve if elected president.

He also made other crypto-friendly promises, including creating a "Bitcoin and crypto presidential advisory council" and opposing a central bank digital currency.

Trump expressed his intent to make the United States "the crypto capital of the world."

https://www.barrons.com/articles/trump-bitcoin-reserve-and-fire-gensler-3876ad79

https://cointelegraph.com/news/trump-implement-bitcoin-strategic-reserve-elected-president

https://manifold.markets/AndrewMcCalip/will-donald-trump-announce-a-us-bit

Resolution Criteria:

Resolves YES if:

Donald Trump is elected president in November 2024, AND

Within 1 year of his inauguration, his administration: signs an executive order, or passes legislation, or otherwise officially establishes a US strategic reserve of Bitcoin or other crypto

Actual crypto must be acquired and held for reserve purposes.

Resolves NO if:

Trump is elected, but the above conditions are not met within 1 year of inauguration.

Resolves N/A if:

Donald Trump is not elected president in November 2024.

Notes:

The total amount of cryptocurrency in the reserve does not affect the resolution.

Merely starting the legal process is not sufficient for a YES resolution; the reserve must be actually established and holding Bitcoin or other crypto.

If the reserve holds Ethereum or other currencies, instead of Bitcoin, this would still resolve as YES. CBDC does not count for YES resolution.

Update 2025-03-07 (PST) (AI summary of creator comment): Important Updates:

The source of cryptocurrency is irrelevant. Coins that are moved into the reserve, whether seized or newly acquired, will count.

A valid YES resolution requires that the reserve is established with coins being held inside, regardless of how those coins originally came into government hands.

Update 2025-03-07 (PST) (AI summary of creator comment): Access to Assets Clarification:

The reserve will count seized cryptocurrency only if the government actually has control (i.e. access to the private keys) and is able to move these assets to the strategic reserve.

Simply seizing hardware without the cryptographic keys does not qualify for a YES resolution.

Update 2025-06-21 (PST) (AI summary of creator comment): The market will resolve YES if the US government is holding a large amount of cryptocurrency (e.g. from seizures) and an official government source confirms this control. A formal declaration of a 'strategic reserve' is not required.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ9,462 | |

| 2 | Ṁ3,472 | |

| 3 | Ṁ1,998 | |

| 4 | Ṁ1,422 | |

| 5 | Ṁ1,257 |

People are also trading

This market was resolved erroneously. Here's a link to an article published two days ago stating that officially there's no actual Bitcoin Strategic reserve.

https://www.fastcompany.com/91482053/where-is-donald-trumps-strategic-bitcoin-reserve

We gotta get the mods in here to reverse this.

A mod already resolved this market. You can see discussion of the mess in the other comments on this market.

https://manifold.markets/PeterBuyukliev/will-trump-actually-establish-a-str#7aarq2r0gvv

https://manifold.markets/PeterBuyukliev/will-trump-actually-establish-a-str#cd1covvlujn

The 2025-06-21 clarifications seem to be the basis for ignoring the legal complications in favour of looking at the actual government holdings.

@ProperNig in the market description:

The source of cryptocurrency is irrelevant. Coins that are moved into the reserve, whether seized or newly acquired, will count.

@PeterBuyukliev Then this should've been resolved in early March, when Trump signed the executive order about the strategic reserve. I believe the whole reason why this market went for so long was because it was waiting for actual Bitcoin to be bought strategically but the government. Just because Trump signs a piece of paper establishing something doesn't make it actually true. Right now, it's just a Bitcoin Reserve. It's only a strategic Bitcoin reserve when the government buys Bitcoin strategically to hold. The government has yet to buy an actual Bitcoin and put that into the reserve. This market was erroneously resolved. Like what determining facts are we going by?

@ProperNig I don't know what you want me to tell you. The specific objection you raise is directly addressed in the market criteria.

Additionally, when Trump signed the EO, we still didn't have confirmation that seized crypto was being held for reserve purposes. That confirmation came much later.

@PeterBuyukliev you have nothing to tell me because you're wrong.

Here's a link to an article that says that the strategic Bitcoin reserve has yet to be established.

https://www.fastcompany.com/91482053/where-is-donald-trumps-strategic-bitcoin-reserve

So who's right and who's wrong?

@EvanDaniel @shankypanky thanks for the help and for taking the time!

To everyone else: I'm sorry that we ended up in such a situation where the resolution was unclear. I made a real good faith effort to define the resolution criteria as well as I could.

@PeterBuyukliev thanks for tagging in Mods to help out! sometimes these things arise and that's why there's a team to support creators in resolutions when they don't want/feel more comfortable not to go it alone.

i guess coming out practically even is about as good of a thing as i can hope for after such a fucking rollercoaster of a market. insanity

@SG My two cents: This market probably should have resolved YES four months ago. The fact that it didn't meant that traders believed this market required a higher evidentiary standard for resolution. No additional information has come out between four months ago and now (I think), so the higher standard is not met. But the resolution criteria, as written, have been fulfilled and some traders also acted on that. Resolving to 50% might be the solution.

@SG well, no, the market shouldn't have closed 4 months ago, Trump was inaugurated in January. This is why the market was scheduled to close on 1st Feb

I appreciate the help, and I'm not opposed to 50% resolution if you think this is fair.

the market shouldn't have closed 4 months ago

If it's going to resolve Yes, the relevant event was probably a while ago? I think my take is it should have resolved then, but that this mostly isn't a big deal and you shouldn't worry about it too much, just try to learn about how markets are often messy. I think figuring this out then would have been best; figuring it out now is second best.

@mods could I ask for help in resolving this market? I feel like the resolution should be YES. LLMs agree:

chatgpt

claude

grok

However, the issue is that:

1) I am a large holder of YES

2) the market sits on 4%, for reasons i do not understand

Can I ask that a mod that is not a holder take a look and resolve, because I don't get what's going on here, and if I resolve, a lot of people will certainly be very upset

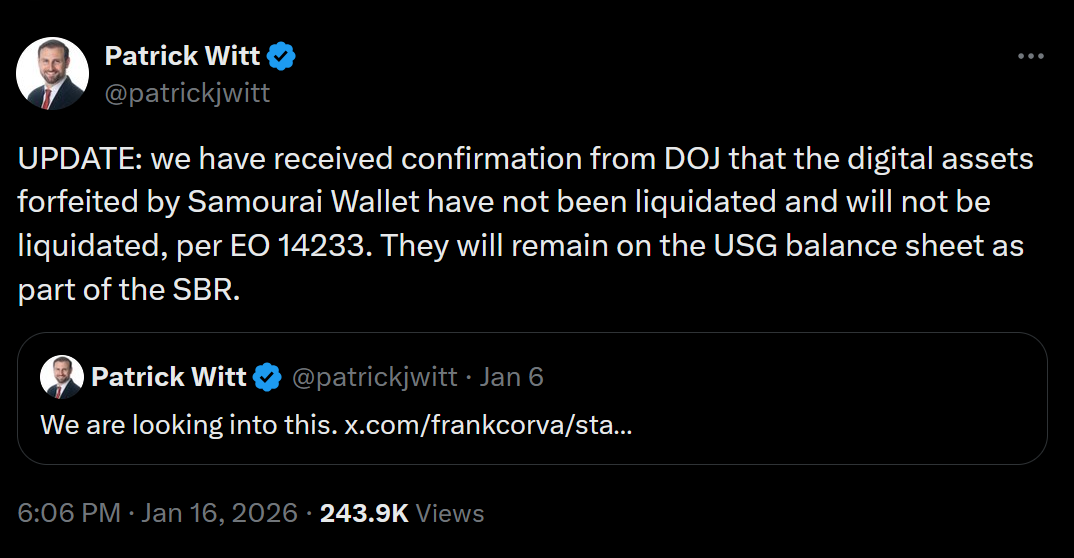

@PeterBuyukliev This sounds like there are bitcoins in the SBR (strategic bitcoin reserve).

@ChaosIsALadder @PeterBuyukliev

I see this article from Jan 18 and it seems from this, despite the EO and intention, the SBR isn't yet officially/legally established?

https://finance.yahoo.com/news/white-house-advisor-reveals-surprising-190749233.html

@shankypanky but see the AI summary update from June. it was said that government holdings should determine the resolution and not an official announcement

@shankypanky My reading of the market rules is that the SBR doesn't have to be legally established ("Within 1 year of his inauguration, his administration signs an executive order, or passes legislation, or otherwise officially establishes a US strategic reserve of Bitcoin or other crypto"). What Patrick Witt is saying is that the reserve is not legally established yet, which is irrelevant for the purposes of this market. The SBR is officially established for all practical purposes, has acquired, and is currently holding confiscated crypto assets.

@PeterBuyukliev I think one source of confusion might be that the related Kalshi markets have resolved the opposite direction, but I think that's a legitimate difference in criteria -- they require some nonzero purchases, not just transfer of confiscated assets. My read is that this should resolve Yes.

Hi y'all - I think my notifs are a bit borked, sorry I missed the earlier comments. I agree with @ChaosIsALadder that the criteria would resolve Yes to the establishment at the administrative level, even if it's stuck in legal loopholes to actually make it functional. I'll resolve Yes based on that baseline.

@bens I don't think it was resolved in any direction? the creator tagged us in to make a decision bc they didn't want to seem biased due to their position.

@shankypanky oh weird, I had a memory of this resolving to 50% already? maybe I dreamed it (I legit sometimes have dreams about markets on here resolving in certain ways XD)