At time of asking this question there were 3 banks* which have been seized in the US; all small-ish.

Is the banking crisis contained?

If a larger banking contagion becomes evident in 2023 with two or more big failures or five or more (more) regional failures or some equivalent combination thereof (1 and 3, say) then this question will resolve "no". If January 1st 2024 comes around without a cascade of failures then "yes".

A bailout counts as half a failure.

I'll be refraining from betting in here, since this is a slightly fuzzy resolution.

Edit: Current count since the first three: (4 Nov 2023)

1 Major seizure (First Republic)

1 Major bailout/acquisition (Credit Suisse)

1 Local failure (Heartland Tri-State, $140M)

1 Local failure (Citizens Bank of Sac City, $65M assets)

"No" resolution tracker:

If a major failure is 3 points and a regional failure is 1 point, for combined purposes 6 points will trigger "no" resolution.

We're currently at 4 1/2 points out of those 6 (1 1/2 pts from the CS bailout, 3 pts from the First Republic seizure, 0 pts from local banks incl Heartland and Iowa)

FAQ from the comments:

International banks with significant US presence, like CS, UBS, Deutschbank, etc., count.

IMF bailouts of central banks count as well

4 Nov 2023 clarification:

On local vs. regional

"local" being something different from "regional" and the lower end of regional being set at $10B assets is within the intent of this market, and the wording in the description. In case there's a contagion wave of smaller banks I'll add together the estimated assets of all banks below $10B, and if the sum hits $10B by the end of the year that'll count as another regional faillure. See "current count" above.

On fuzziness

Bonini's Paradox lives. I haven't bet in this market as mentioned above. When edge cases come up they will continue to be adjudicated in accordance with 1) the larger intent of the market, as represented by the original question, and 2) words chosen in the description, in that order. Fortunately, in this case, both are in alignment. The intent is to resolve on a systemic contagion becoming evident in 2023, and a 2-branch local bank going under doesn't have much to do with that, and shouldn't.

My bad

I missed that heartland was that small, originally. Lumping it into the "local" resolution category, and bringing the current points down from 5 1/2 to 4 1/2. Sorry for the confusion, I think this is the right answer.

Please continue to refrain from attempts to read the tea-leaves and find some definitional edge that means I have to resolve the market some counter-intuitive way. Save your time. Thank you all for the quality of the discussion in here so far.

*: SVB, Silvergate, Signature

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,867 | |

| 2 | Ṁ1,120 | |

| 3 | Ṁ665 | |

| 4 | Ṁ255 | |

| 5 | Ṁ215 |

People are also trading

@jacksonpolack Found $65M for IA, so far. If another $9.935B of local banks fail within the next 58 days then that'll count as another regional for this market's purposes.

@NickAllen That's the main point that caused the confusion about IA, because it's similar size to heartland tri-state which counted before.

@Fedor Got it, missed that somehow. Adding heartland tri-state assets to IA in the "local" column then re-reopening. Gah.

@NickAllen So using your own point system, we went from 6.5 and No winning to you editing the point system after No wins to then say its 4.5 and Yes is going to win? Okay then. My bad for reading the OP carefully. OP is just making up stuff somewhat at random!

@Domer yup, exactly, give me 1 star and don't bet in my markets if you don't like how I'm running it.

@NickAllen All good man, just wanted to lay out the facts of what transpired and get confirmation.

It seems like one thing I am noticing with the "write your own rules" variety of prediction markets (which Polymarket is considering adding, so its very germane) is that many OPs see that the event happened, don't like that the event has ended for whatever opinionated reason, and then edit their own criteria with new addendums that change the market. Just in the past week, have run across this in three different markets. Definitely a risk of this system, bc it injects biases and opinions as a reaction to events, rather than dispassionately writing rules without knowing what is going to happen. These OPs basically start with the answer, and then work backwards to edit the question (that was written before the answer) to make sure it doesn't count.

I think this case is a bit more subtle than that -

OP gave the ambiguous criteria of "If a larger banking contagion becomes evident in 2023 with two or more big failures or five or more (more) regional failures or some equivalent combination thereof (1 and 3, say) then this question will resolve "no". If January 1st 2024 comes around without a cascade of failures then "yes"."

And then, later in the description, wrote that heartland tri-state counted for a point as a regional failure.

One way to interpret this is that the point example demonstrated / clarified the rules, and set a precedent. Another way to interpret this is that the market creator was being careless, and applied their rules wrong - and then corrected it later, as they should.

I don't think it was obvious which of those was correct, but it wasn't, from OP's perspective, obviously a rule rewrite.

@jacksonpolack I understand the reasoning, and it obviously makes sense. He should never have counted Tristate, in hindsight. But he did count it at the time, and the rules stood for 3 MONTHS, with people trading based off of this information. And it was only when we reached 6.5 points by his criteria, and the market was OVER by his criteria, that he went back 3 months in time and edited the market. That is both a large change in the criteria, and also a large gap of time in which to go back and undo something. There's a point in time in which a "mistake" becomes not a mistake anymore.

In the grand scheme of things, this is not a big deal and who cares.

But the larger pattern here with user-created markets is one where instead of fallibility being embraced and persevered through, there is a bias towards infallibility and perpetuation of markets. To use a recent example, there was a market on "Did Israel blow up a hospital?" People traded it. It turns out that no hospital was blown up. Instead of ending that market as No immediately, because Israel did not blow up a hospital, the OP took the answer, and then changed the question to match the answer. His bias was to keep his market open, to keep his question valid, and to do that, he edited the past as if his previous question never existed. This type of behavior would be total, total chaos in a real-money market. Again here - in a not mean-spirited or ill-intentioned way I realize! - this OP did something very similar of keeping his market open and valid and editing the past. In my opinion (and maybe others disagree), these types of things should be handled with closing the market that has ended, and creating a new market that incorporates the information you've received.

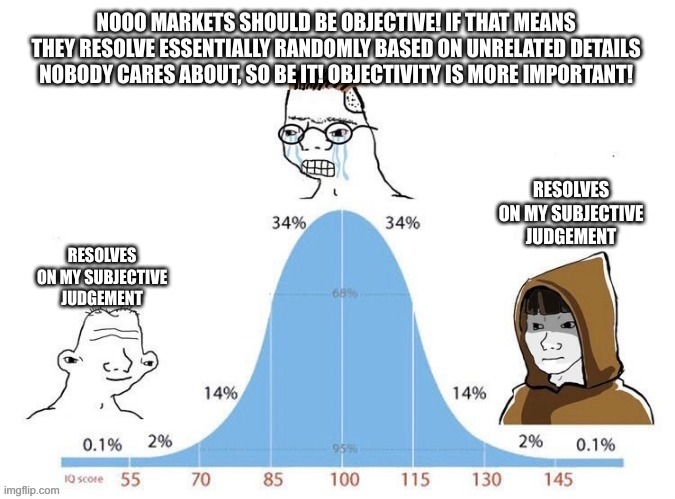

Why not just have a market that says "Is the banking crisis contained? Resolves on vibes". Then the market 1) might have something to do with whether the banking crisis is contained and 2) at least arguing over interpretation will be over interpreting whether the crisis is contained, not some arbitrary point system

@jacksonpolack He literally has a point system. It is the complete opposite of vibes. Stop being a bully ffs.

No to clarify I was not-entirely-unseriously suggesting that it might be better for future markets to just say 'this resolution criteria will depend on my judgement, but that's better than having a clear set of rules / point system that'll end up diverging from my intent in creating this market', not suggesting OP discard the point system for this market

@jacksonpolack I unironically endorse this approach and think more market creators should use it more often. The attempt to make criteria precise often ends up in unexpected territory, and there's a balance between objectivity and robustness to unanticipated situations (including simply that you made a mistake writing the criteria).

Not referring to this market, which already has criteria - unfortunately demonstrating this problem, but nonetheless should not be swapped for vibes after the fact.

@chrisjbillington Yeah, I think this market clearly resolves NO based on the criteria listed now, and that if it were 'is the banking crisis contained on vibes' it would resolve YES.

Great points all, agreed. @jacksonpolack I like that judgement disclaimer. That's what I'm getting at when I put in the "fuzzy therefore I won't bet" in the description.

@NickAllen I commiserate with the difficulty of trying to precisely define the criteria to a question like this. It does often lead to edge cases, and you can't really back away gracefully once you make those criteria.

@NickAllen we need you to weigh in on inconsistencies as discussed below. Recommend you close the market for discussion so that people aren't trading on your every comment.

@chrisjbillington I think you're trying to strong-arm inconsistencies when the OP is doing a great job of explaining everything. For instance, he never uses the term "regional bank" once, yet you said he did.

@Domer I agree the criteria are fairly clear, it's not a 'big bailout' but clearly falls under the 'regional bailout' category, for another 1/2 point, for 6 points total.

There's no prior definition about a bank needing a certain minimum size to hit the lower category, just /a/ bank failure or bailout, and this is clearly /a/ bank bailout, literally FDIC receivership.

I am at a NO position in this market, but I had completely forgotten about that for the past few months.

@Fedor There is indeed a prior definition about a bank needing a certain minimum size, and that size is $10B:

Regional banks, as defined by the Federal Reserve, are banks with $10 billion to $100 billion in assets. They’re referred to as regional banks because they’ve historically operated within a specific region of the country, but today, that’s not always the case. They differ from community banks and national banks in their size in terms of assets, not in the area they serve or the services they offer.

It's possible that OP didn't know this, and intended to include community banks as well when they said "regional". Or it's possible that they did know this, and mistakenly thought Heartland Tri-State was larger than it is (after all, "tri-state" sounds large).

We don't know which of these is the case.

@chrisjbillington I didn't know that, good find, thanks. I definitely didn't intend for a small local bank failure to be all that relevant to this question. A whole bunch of them? Sure, but not a single bank as small as Citizens Bank of Sac City IA. See more detailed edge case criteria in the description.