This market allows you to invest in an automated trading strategy. Add your name to the Free Response and buy however much you want to put in, and you will be given shares in the strategy. Shares are issued based on actual mana put in, not by the displayed percentage in this market; so it doesn't matter when or the order you buy in.

A multi-strategy bot is being developed for automating standardized trading strategies on Manifold. Every trade the bot makes will be tagged with a corresponding strategy, so an accounting of its strategy-specific performance can be made. The profits or losses will then be distributed to investors in the strategy, first to their "virtual account", and later to be realized as actual mana when a distribution event occurs.

This market is an investment round for arbitrage-focused strategies. Arbitrage is commonly known and used on Manifold, in the form of getting favorable spreads between similar contracts and locking in a small low-risk profit. But there are certain improvements that can be made, that will not be documented or referenced publicly, even to investors in the strategy. Every investor in this market will be given access to a private group where investment-related updates will be posted(such as accountings of profits and losses), and will have limited control over the bot such as tagging markets where these strategies will be applied.

My alternative to this organizational structure is simply borrowing mana from a whale to invest with. The main reason I'm doing it this way is to allow other people to tag markets so that I don't have to constantly scour thousands of markets, and for price discovery on investing in trading strategies.

Active investors(those who find and tag markets to invest in) will be allocated a share of the profits, with the remainder distributed to shareholders. An internal prediction market will control the active/passive split.

Theme: Arbitrage strategies

Shares: 500k(100k reserved for @Mira , 400k split proportionally according to investment in this market)

Target investment: M100k

Minimum investment per individual: M5,000

Target closing date: June 5, 2023 - date may be extended if more time is needed

Shares at or above the minimum investment will buy you:

Access to the private group

A virtual account that accumulates initial capital and a portion of profits or losses.

Limited control over the trading bot, with profits or losses from your control being partially credited to your virtual account.

Voting rights in internal markets, such as decisions to:

Open the group up more broadly, or to invite non-investors for purposes of tagging markets.

Issue dividends(a percentage of everyone's virtual account)

Borrow or raise more money

Shut down everything and return remaining capital

Set parameters such as maximum risk, maximum leverage, buyback interest rate, or active/passive split

Payments for identifying or implementing new arbitrage strategies

@Mira maintains a veto option, but I don't plan to use it often and if it's controversial I would likely buyback your shares or allow you to sell to someone else. (See Buyback below)

Early access to possible future investment rounds

Shares below the minimum individual investment will only buy you:

A virtual account that accumulates initial capital and a portion of profits or losses. Dividends, buybacks, and exit options will still be recorded as owed to you on internal reports(that you won't see), and you have equal claim as any other investor. But it would be a waste to track down hundreds of M50 investors every month to pay M1 dividends.

Shares do not buy you:

Access to the bot's source code.

Access to details sufficient to reimplement my strategies.

A direct claim on the portfolio of @MiraBot . Only a claim on a virtual account backed by such portfolio. See Errors, Buyback, and Exit option below. This is a multi-strategy bot, and you should only have a claim on the portion of the portfolio allocated to arbitrage strategies.

Miscellaneous:

"Arbitrage strategies" was chosen because they are easy for anyone to understand and low risk, not because they are the best use of money. There is a lot of uncertainty and one-time setup work in setting up this system that I want to finish before implementing more advanced strategies or automated betting features. The "virtual account," private group, limited control, internal prediction markets, and other components all need testing to validate the idea before using it on more complex strategies.

@Mira reserves the right to cancel this market if there's not enough interest, or extend the close time if it's not yet ready.

Shares are granted to the Free Response entry, not to the purchaser. So someone else can add your name and buy you shares. If you decline, I will credit the shares to the betters.

Buyback option: At any time, your shares can be "bought back" for 115% of the value of your virtual account. So if you put M100 into this market, the bot earns M100 in profit credited to you, then the bot would have to pay M230 to buyback your shares. Dividends or an internal market where it is agreed to shut down the bot do not trigger this; it is only for "dynamic pricing" such as if it's a slow week and there's nothing to invest in.

Errors: If a program error causes a portfolio loss or gain that is not synchronized with the virtual accounts, then the error will be resolved by crediting a weighted such loss or gain to virtual accounts. @Mira will not purchase mana to reimburse you for losses.

Exit option: If @Mira decides to quit using Manifold, this investment can be wound down by distributing the value of your virtual account back to you. Mira has no obligation to purchase mana. If @Mira dies or mysteriously disappears, admins are authorized to transfer money from @MiraBot according to the last issued accounting of virtual accounts. @Mira plans to generate such accountings as posts or comments in the internal group, but this market would count if needed(in other words, re-resolve this market NA and zero out @MiraBot if I die before making the first report).

Before resolving this market to take the money, @Mira will cease manually trading on @MiraBot so that it only makes automated trades after resolution, so that the likelihood of your virtual account desyncing with the portfolio value is lower. If there's a bug or other error, I still may log in manually to deleverage or exit the position; but not for general trading. Existing positions will be swapped onto @Mira 's account. @Mira reserves the right to cancel this market and investment round, and not implement any of this. Manalinks or manual trades will be documented on the internal group.

Trading of Shares: There is no guarantee that the strategy will ever need to raise money again, so you may be unable to acquire or dispose of these shares. If there's sufficient demand, I may implement buying/selling shares among internal investors, or to new investors if new access is approved by existing shareholders.

Details on what limited control is available, what strategies are available to apply, what risk processes are in place, what parameters are to be decided by internal markets, and many other details are only available to the private group. But even the group is not necessarily secure since it only requires investment, so source code and details sufficient to reimplement the strategies will be withheld even from the internal group.

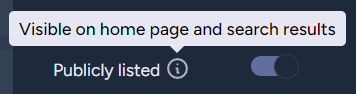

To collect the money, a new option will be added to the market, @MiraBot will purchase a share, the market will be closed, I will check with a script and also manually that nobody else has shares in the new option, and the market will be resolved 100% to the new option. If I make a mistake even despite this, I may request admins unresolve the market. After this market resolves, @Mira will give a public accounting of how many shares were acquired by everyone. This market will be unlisted before closing so it won't affect your league profits. If you prefer, you can also manalink Mira#0044 on Discord and I will have the bot account purchase shares for you.

I'm canceling this and returning the money. There's 4 different things that happened that make this less appealing. In order of importance, they are:

I have more money. This strategy was targeting M100k, and that's only 50% more than my league profits this month.

With loans, I have enough money for the foreseeable future even for capital-inefficient strategies, and if I do want to scale it up I can borrow another M100k at 5%/month from someone.

I had the possibility of borrowing money a month ago too, but it's gotten to the point that this is more of a community social thing than a real investment. And it's not my style to do something like this just as a fun social thing - people should expect that their money be used productively.

If I took your money and tried to deploy it with this, it would sit idle and not generate you any returns for at least another month. And I know some of you were trying to scrounge together M5k for this, so I'm not going to hold it for another month unnecessarily when you could be investing it yourself.

The bot tax. This doesn't affect arbitrage so much, but completely kills the next strategy I was going to do that was going to be much higher profit.

It makes it hard to place speculative limit orders without a better estimate of how likely those orders are to be hit within a given time period(i.e. "if a market is at 37% and has this trading history, what would you pay to place a limit order for YES at 5% for the next 2 weeks?").

Looking at my manual trading history, the tax would cost about .1% of my profits on WvM, 1% on general whalebaits, 5% of my profits on large markets, 10% on less liquid markets. That might not sound like much, but I have to pay it whether I profit or not, and it would probably affect the bot more.

On the other hand, once I actually do calculate how much a speculative limit order is worth, it's not hard to only place the ones that exceed some minimum amount. So the tax isn't a problem in principle, it just complicates the implementation more than I wanted for this first one.

Private groups don't support API, so the bot can't interact with private markets. See market: /Mira/will-private-markets-be-accessible

This one isn't necessary. I could make a Discord server and bot instead, and link to unlisted markets. But I'm mentioning it since it was included in the description.

Other arbitrage bots have improved. I won't mention the details, so that copycats don't have a checklist of features. But they are somewhat harder to steal profits from than a month ago, partly due to the bot tax. (They still could be improved, though.)

I have some other ideas for "automatic investing" that don't involve trading bots. I also have other ideas for trading bots. Next time, I'll use a different mechanism to collect money so there isn't all this manalink hassle, and I'll quote you a specific target yield since it will be further along. It seems like there's interest in the idea of a mana investing service, even if this specific one wasn't executed well.

List of Manalinks I need to send back:

@MiraBot has a cost basis of Ṁ210,500 in this market. These should all be manalinks.

Username - amount - Sent back?

@Gabrielle - M20k - YES

@MarcusAbramovitch - M100k(M50k already sent) - YES

@CodeandSolder - M5k - YES

@bingeworthy - M5k - YES

@jack - M10k - YES

@A - M5k - YES

@AlexbGoode - M10k - YES

@ShitakiIntaki - M5k - YES

@firstuserhere - M30k(M15k already sent) - YES

@RobertCousineau - M5250 - In transit

@BrendanFinan - M5k - YES

@Odoacre - M5250 - YES

@Gen - M5k - YES

Total: M210500

FYI: If you overinvested in this and would prefer having any portion of it back, let me know before resolution and I'll send you a manalink.

We have much more money than needed, and it would probably not be high return - I'm only planning to implement higher-return strategies as the 2nd or 3rd, once the "crowdfunded trading bot" setup has stabilized, so don't worry about missing out if you're at least keeping the minimum of M5k in.

@MarcusAbramovitch has decided to keep M50k in this and save the rest for later rounds. I've manalinked him back M50k and will deduct it from his shares, but haven't sold positions here because of the possibility of people trading.

@MayMeta Correct. Was leaving it listed before then so people can find it, and will unlist before league profits are recorded. It's also possible they'll implement my suggestion for an option to disable profits on markets, since internal markets will have a similar issue.

Though most people are sending manalinks anyways.

@A Here's one that runs a bit longer, starting from when this one should be active, and ranks all the bots.

@firstuserhere sent M30k, and @RobertCousineau sent M5250.

At this point, we have enough money - it's possible that Manifold's loans system already gives enough leverage that we won't be able to spend this amount of base capital. However, you can still acquire an ownership stake and access to the group. And once it's clearer how much we need to keep on hand, I can see an internal market on "Should we return a percentage of the money?", and you would keep your shares in this bot if we do.

So "overbuying" isn't necessarily a problem, except that it will tie up the cash until it's returned.

@MarcusAbramovitch manalinked M100k on top of his existing M10k, which I put on his option.

@A I see you bought M500 and later realized the M5k minimum and sold it. If somebody plans to actively tag lots of markets but doesn't have much money, comment here and somebody might cover M5k in for you if you repay them later from active investing profits.

@Mira Yeah it was mainly just to remind myself to come back to this -- sent you M5k by manalink. Cool idea!