The 18 companies listed have been described as "zombie companies." With rising interest rates, some have speculated that these companies might not be able to survive increasing debt costs.

Each answer will resolve YES individually if that company files for bankruptcy by December 31, 2024 11:59 pm ET. Mergers or acquisitions will resolve NO. In the event that one of the 18 companies merges with or is acquired by another company, and then that second company files for bankruptcy by the deadline, then that answer will resolve YES. All other outcomes will resolve NO.

Background:

Fall of the zombies? Why corporate failures could surge in 2024

Zombie Companies: Everything You Need to Know

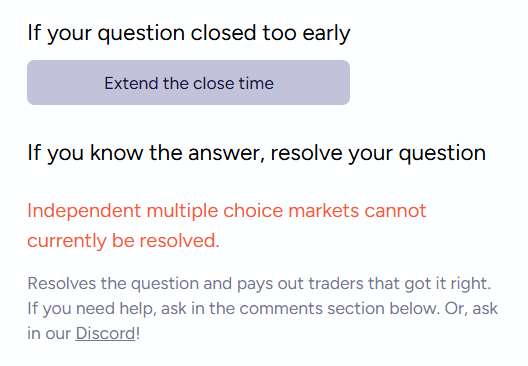

Update 2025-02-01 (PST): - All answers will resolve as NO, regardless of bankruptcy filings or mergers/acquisitions. (AI summary of creator comment)

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ279 | |

| 2 | Ṁ154 | |

| 3 | Ṁ89 | |

| 4 | Ṁ73 | |

| 5 | Ṁ67 |

People are also trading

@MickBransfield Weird! Are you trying to resolve these all NO?

(I can try as a mod—not supposed to resolve where I have a position but if asked is fine)

Zombies: Ranks of world’s most debt-hobbled companies are soaring, and not all will survive

PELOTON ANNOUNCES COST REDUCTION EFFORTS TO POSITION COMPANY TO SUSTAIN MEANINGFUL, POSITIVE FREE CASH FLOW

AMC Entertainment Shares Plunge On Proposed Stock Sale As Chain Cites Soft Box Office, Cash Burn

https://deadline.com/2024/03/amc-entertainment-shares-plunge-stock-sale-soft-box-office-1235870571/

11 digitally native retailers that could file for bankruptcy in 2024

The Rooftop Solar Industry Could Be on the Verge of Collapse

MASSACHUSETTS ENFORCEMENT ACTION AGAINST ROBINHOOD ENDS WITH HUGE WIN FOR INVESTORS AND THE STATE’S INVESTOR PROTECTION RULE