Background

Trading volume on prediction markets is influenced by various factors including market interest, volatility, and participant engagement. Volume typically follows a logarithmic growth pattern, with each order of magnitude increase becoming progressively more difficult to achieve.

Resolution Criteria

Each answer will resolve independently based on whether the market's total trading volume (in Ṁ) reaches or exceeds the specified threshold at any point during the market's duration. Trading volume is calculated as the sum of all trades (both buys and sells) in the market.

YES: The trading volume reaches or exceeds the specified threshold

NO: The trading volume never reaches the specified threshold

N/A: If the market closes prematurely or if there are technical issues preventing accurate volume tracking

Thresholds for resolution:

100Ṁ

500Ṁ

1,000Ṁ

5,000Ṁ

10,000Ṁ

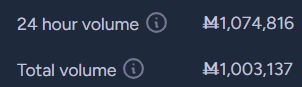

50,000Ṁ

100,000Ṁ

500,000Ṁ

1,000,000Ṁ

5,000,000Ṁ

10,000,000Ṁ

50,000,000Ṁ

100,000,000Ṁ

Considerations

Trading volume tends to be highest during periods of uncertainty or when new information becomes available

Early trading activity often predicts future volume patterns

Market maturity typically leads to decreased trading volume over time

Large individual trades can significantly impact lower volume thresholds but have less effect on higher thresholds

The logarithmic scale means each subsequent threshold requires 5-10x more trading activity than the previous one

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ3,194 | |

| 2 | Ṁ526 | |

| 3 | Ṁ398 | |

| 4 | Ṁ191 | |

| 5 | Ṁ176 |

People are also trading

Would be cool if markets had the ability to show graphs of trader numbers and trading volume over time as well, like they currently do for odds

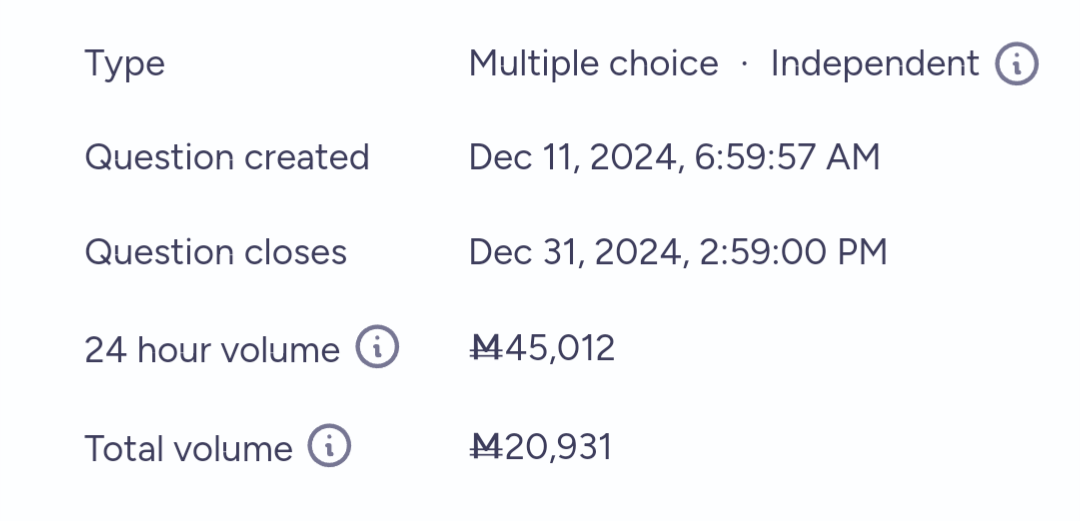

@mods I think this is a glitch - it happened earlier as well - the 24 hour volume is greater than the total volume. Probably due to wash trading.

@Gameknight I posted about this bug on the Manifold discord. The wash trading shouldn't have any effect on this though.

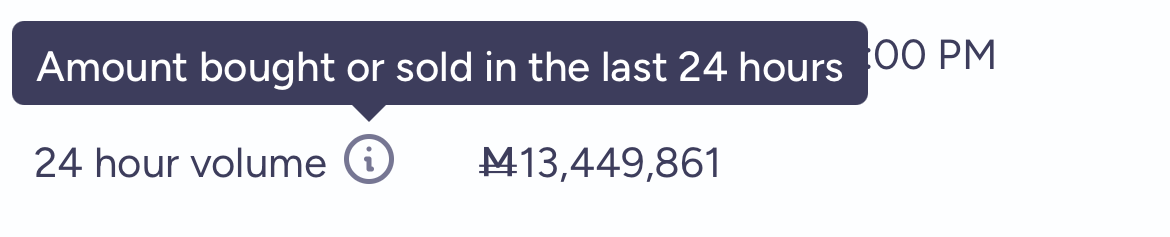

Also, a tip for these types of markets: since there are no fees, it's easy to inflate the trading volume, and someone will do it if there is enough incentive (and if it's not a really unreasonable number). See here for an example: volume was increased to 10 million by a single person, and that was even back when manifold still had fees.

@Gameknight my condolences, I too have underestimated others' ability to skyrocket trading volume in the past

@TheAllMemeingEye I just thought wash trading was not allowed - guess not! There goes $250 down the drain

@Gameknight Sorry about your loss. Perhaps a further lesson might be saying something like "simple as that" when the situation might be different may just goad someone into showing you that you are wrong.

"the whole point is lost" is possibly another example. If you haven't got the point right. I see the point here as more like lots of effort for small gains are possible so how far do people go for a small gain. You shouldn't assume the effort will be spread evenly.

@ChristopherRandles "Perhaps a further lesson might be saying something like "simple as that" when the situation might be different may just goad someone into showing you that you are wrong."

Ah, so you've done this out of spite. Well played.

@Gameknight You say spite.

I say altruistic desire to inform people.

Perhaps spite wouldn't involve discussing it in this manner? but perhaps largely a matter of perspective?

@ChristopherRandles It's a good lesson to learn, I'll admit, and I hope to never be so overconfident again; it's also quite snobbish to single-handedly resolve almost half the market just by having a lot of capital to wash-trade with. Wow, you're f*cking rich as a bank (in what is effectively fake monopoly money), and you've just shoved it in my face. Congrats, I guess? Either way, I traded 250 dollars in fake money for a life lesson: hopefully everyone else you talk to gets the same joy from you and your ego.

@Simon74fe As far as I'm aware, no manipulation of market volume is allowed, but I'll ping @LCBOB just to check.

@Gameknight Are you saying it is not possible or that doing so to change a resolution will be treated as a manipulation and punished in some way. If so by who? Market creator or manifold admins?

I just checked and found it is still possible - volume now over 50k mana from 42k when I saw this market a little earlier.

I think Louis has allowed wash trading in other questions and I haven't seen punishment implemented or suggested on those questions.

@ChristopherRandles If wash trading is allowed, this entire market would be basically "how fast can people cycle buy/sell" and the whole point is lost, but since it's clearly possible I guess the market creator isn't going to do anything.

seems 24 hour volume = total volume/days elapsed

So when less than 1 day in, 24 hour volume is higher than total volume.