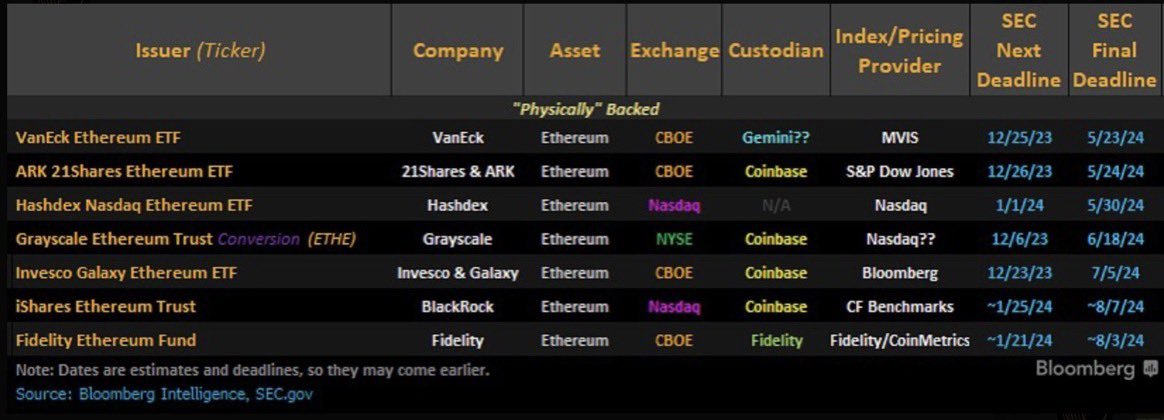

A number of applications are already in. Approval is from the US Securities Exchange Commission.

Similar to:

https://manifold.markets/JamesBills/when-will-a-spot-solana-etf-be-appr?r=SmFtZXNCaWxscw

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ623 | |

| 2 | Ṁ305 | |

| 3 | Ṁ106 | |

| 4 | Ṁ60 | |

| 5 | Ṁ20 |

People are also trading

https://x.com/EricBalchunas/status/1815489137484722333?s=19

Good enough for me. It's fully approved even if the listing is tomorrow.

Re-opening this market because the ETH ETFs are not actually approved until the SEC has approved both the 19b-4 filings (exchange rule changes) and S-1 filings (registration statement).

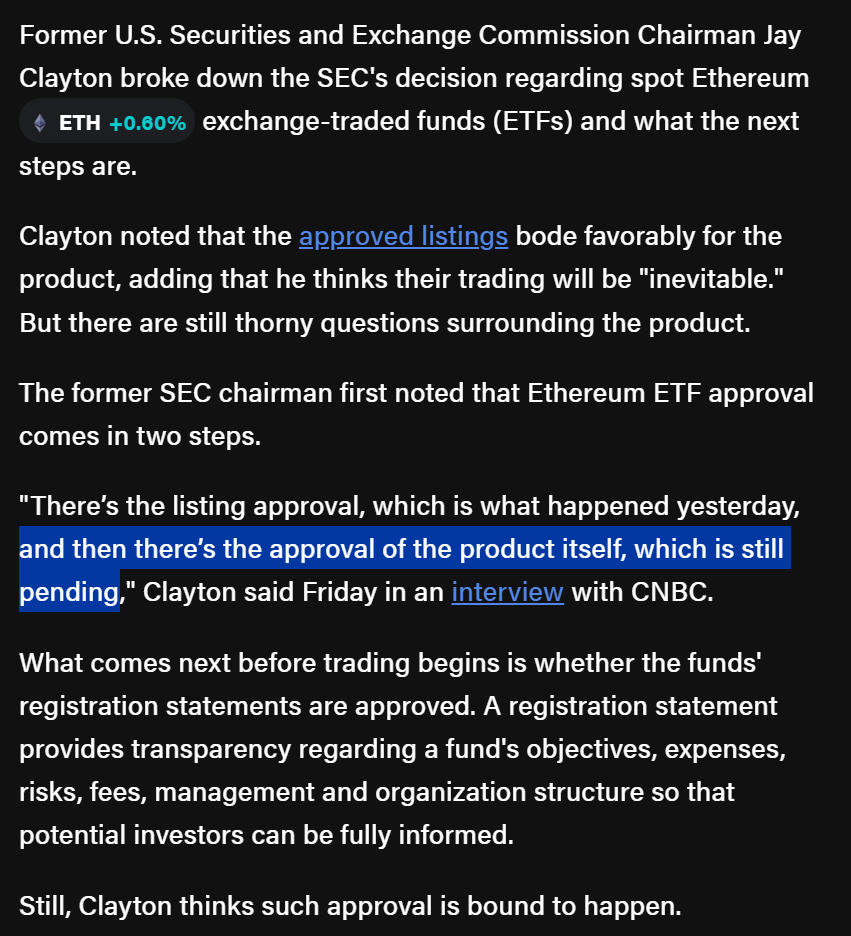

The confusion here arises from the fact that for the Bitcoin ETFs, the S-1 filings were ready before the 19b-4 filings and so it was correct to say that the Bitcoin ETFs were approved after the 19b-4 filings were approved. That was not the case for the ETH ETFs, and only the rule changes were approved on May 23rd.

To be most accurate, this market should resolve to the quarter in which the registration statement filings are approved.

Oh, also here's a quote from an interview with a former SEC chairman where he makes this exact distinction:

@JamesBills Thanks for making this market! I think it's a good market and reasonable for you to have run it as you have, but I'm going to post a wall of text at you now for reasons mostly not to do with you so please don't take it as criticism of your market😅

I spent all day today following this because of the controversial Polymarket on the subject. I also talked about it a lot with my fellow mods, particularly @jacksonpolack.

Based on everything we've read about this today, we think its factually inaccurate to say that the Ethereum ETF itself was approved today.

See this Coinpedia article, where they explain the process of approval in detail.

The journey towards the spot Ethereum ETF’s approval is a critical moment for the crypto market. A spot Ethereum ETF, which would hold Ether as its underlying asset directly, needs approval from the U.S. Securities and Exchange Commission (SEC) to trade on stock exchanges.

But there’s a lot that goes in behind the scenes to make this possible.

The journey to approval primarily traverses two crucial components: the 19b-4 filings and the S-1 registration statements.

The journey to approval of the ETF goes through the 19b-4 and the S-1. Neither on its own is the approval itself. What happened today was the approval of the proposed rule change that allows for the ETF if and only if the S-1 goes through, and so the rule change just actually is not the same thing as the final approval.

While many headlines today said "ETF approved!", headlines are often sensational about these kinds of things and I don't think it's correct to resolve on them when informed traders are expecting the market to resolve based on the actual definitions of the words used in the market.

We can see that Bloomberg took this more seriously, with a much more measured headline and article:

The Securities and Exchange Commission on Thursday paved the way for trading in exchange-traded funds that invest directly in the cryptocurrency Ether, putting the digital-asset industry on the cusp of a significant milestone.

In a first-of-its-kind blessing, the SEC signed off on a proposal by exchanges including Cboe Global Markets Inc. to list products tied to the world’s second-biggest cryptocurrency. The move, which had seemed unlikely as recently as last week, removes a key hurdle for spot Ether ETF trading in the US. Issuers now need a separate sign-off from the regulator; no deadline has been set for that decision.

Usually this kind of technicality doesn't make a difference, but in cases like this it needs to be accounted for when step 1 of approval happens just a week before the end of the quarter and technically, the ETF may not actually be approved until next quarter.

Manifold has been more lax about these kinds of technicalities in the past, but we're trying to take everything more seriously as the site intends to introduce cash prizes soon and Mana needs to be treated more seriously.

/end speech

So, because of all this, we'd like to re-open this market and have it not resolve until the ETF approval process is finalized according to the proper definition. I would expect to see a new wave of headlines announcing that the ETF is /actually/ approved in a few weeks when the S-1 filings are fully processed.

As mods we're open to hearing more opinions on this, though. Is there anything that we might have missed about the facts of the matter?

Will Ethereum ETF be confirmed before the January 1st, 2025?

Hi! Here there is a related market for you :)