Currently I think cryptocurrency is mostly a curiosity. It's neither evil nor particularly useful. Many people disagree with this assessment.

If my opinion remains unchanged, this market will resolve to 50%. If I'm convinced that crypto is good and I should be supporting it, it'll resolve to YES. If I'm convinced that crypto is bad and I should be opposing it, it'll resolve to NO.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ141 | |

| 2 | Ṁ43 | |

| 3 | Ṁ10 | |

| 4 | Ṁ7 | |

| 5 | Ṁ6 |

People are also trading

I have done tens of thousands of crypto transactions. Crypto is 99% garbage, filled with scams, grifts, and hucksters trying to make it rich. 1% is anything useful.

I'm struggling to think of anything that crypto can do better than the real-life (that isn't illicit activities). It makes everything it touches worse -- more complicated, costlier, and less efficient.

Think you're also too dismissive of the energy argument. The amount of energy usage is bonkers considering that the space is 99% useless.

@Domer I don't use crypto, and the summation of my interactions with the ecosystem are occasionally looking at polymarket and a single ethereum coin I bought back in like 2018 through coinbase (which is no longer on my phone).

Nevertheless, the energy arguments really do not do it for me. People are paying for that electricity on the free market because they think it has value. The same as I do not shame people for purchasing drinks in aluminum cans, or purchasing plastic toys (or metal toys, etc.) when instead they could be buying lower energy usage goods, I see no reason to shame people for paying for energy used by bitcoin. That's their right! People spend tons of money on things I disagree with; saying bitcoin is bad because I think it is overvalued is an isolated demand for rigor.

Further, ethereum as Proof of Stake is cool! Super low energy usage from my admittedly poor understanding, on a better coin, etc.

@Domer Yeah that appears to be the same terrible arguments everyone uses, not explaining why we should care more about the ~0.7% of global electricity usage that's used by crypto any more than the other 99.3%, not to mention all the non-electric uses of fossil fuels or other ways to address climate change.

@RobertCousineau Yeah ETH switched their energy usage around last year. But BTC is (and always will be) an energy hog.

To be clear, the main argument is that crypto is 99% useless. If you're in the space, the vast majority of people are there for get-rich-quick stuff. There are just so many scams and bad people. One person that I used to talk to (and advised against exploiting people) exploited people for $100m and is now in Federal prison. A lot of people still venerate this fraudster. I didn't know SBF but I was like 2 degrees from him in terms of friends. Monumental scam, waste of everyone's time and money and resources. It's a toxic space full of toxic people. There are huge hacks like once a week or so that steal millions or tens of millions of dollars. Scams are a regular occurrence. Pump and dumps are an everyday thing. People promising things, and then taking the money without delivering (and other Rugs).

It's the Wild West -- much less murder, a limitless supply of bank robbers and banks being robbed, and almost 0 sheriffs around.

As a corollary to it being 99% useless, it also uses insane amounts of electricity. Which increases demand for power, and raises the prices for everyone else doing productive work.

Isaac, I don't know what to tell you man. If you think crypto is worth than .01% of the world's electricity, then more power to you. Shrug. I didn't mention climate change. I just mentioned it being a waste of resources.

@Domer If other people want to risk getting scammed, that's up to them? They can do what they want with their own money.

@IsaacKing Alright, but you're assuming people are fully aware of the risks, which I would label extremely unlikely.

@Domer Yeah, people getting ripped off is bad, but the way to solve that seems to be better education and law enforcement. If we discovered that sellers of green towels had an extremely high scam rate, we wouldn't use that as an argument to ban green towels.

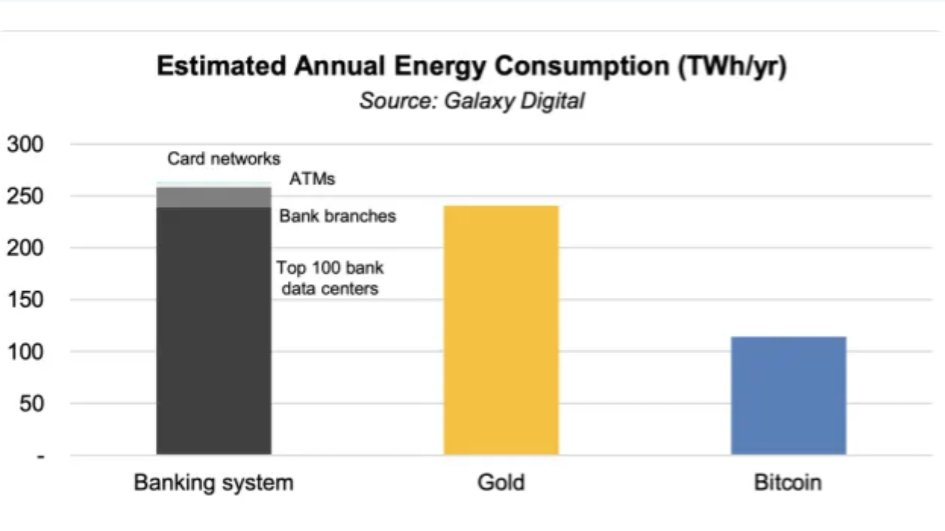

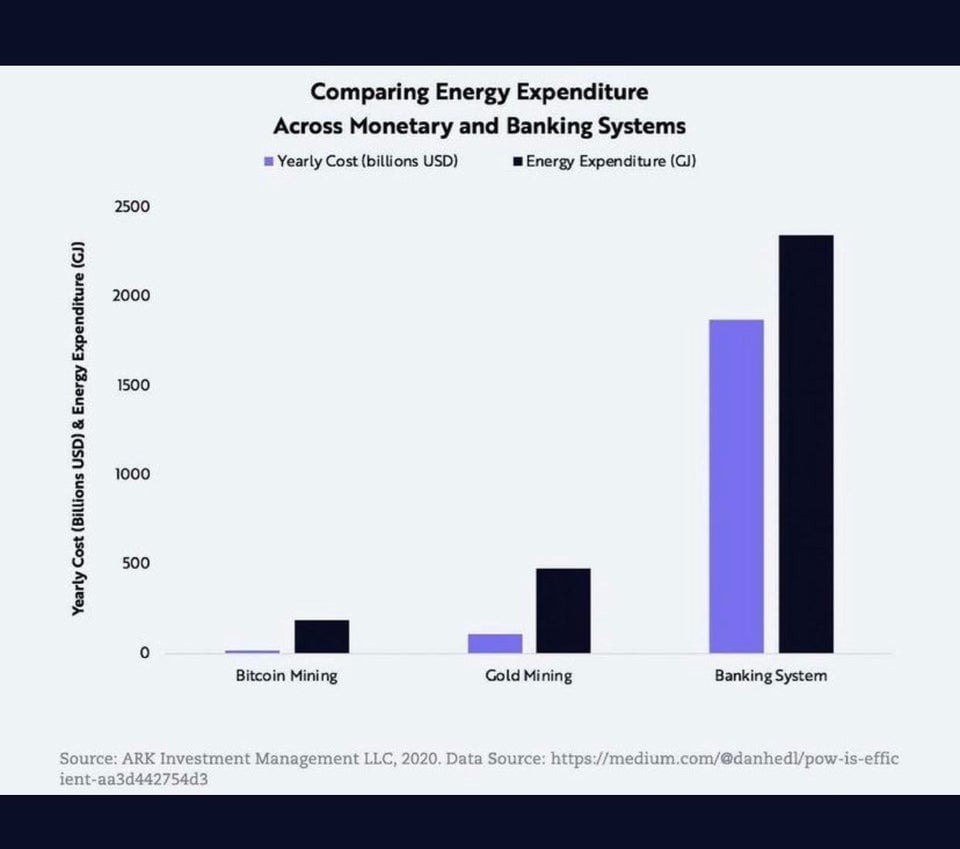

@Domer bitcoin uses way less energy than the current banking system, but maybe you aren’t ready for that yet

@IsaacKing I don’t have it handy, but it exists.

plus, most of the FUD about bitcoin’s energy usage is linked to a single debunked article

@mistersplice Bitcoin, an extremely niche product that is involved in hardly any legitimate financial transactions, uses less energy than the global banking system that serves billions of people and trillions of annual financial transactions? Wow, that is some scoop, man.

Bitcoin does less transactions in a year than banking does in one hour. And if we're talking legit transactions that are actually productive, guessing we're talking about roughly half a second worth of banking transactions for every year of Bitcoin.

@IsaacKing Like reading about the protocol itself and its extensions. Watching videos by Antonopoulos or similar stuff.

@mariopasquato No, knowing how it's implemented on a technical level doesn't seem relevant.

@IsaacKing Imo lightning VS on-chain transactions is an important topic to judge overall impact (it affects energy consumption and possibly the amount of adoption). Knowing this kind of technical background could be helpful.

Betting no, 50% strikes me as basically accurate given your current stance. My only real argument is that "cryptocurrency" as a whole, the entire emergent phenomenon, consists mostly of frauds, including a few catastrophic frauds (and the potential for more). Regardless of the underlying technology and the marginal use cases, the forest is dark and the healthy trees tend to wither.

I wouldn't give this a very high chance of changing your mind (mostly because I think you've probably considered it already), but skimming the comments I'm surprised no one has made the "proof of work is bad" argument.

If someone asked you, without any other context, if it would be good for a civilization to spend non-negligible amount of their resources (energy, maintenance, etc) doing meaningless mathematics instead of serving literally any other purpose, what would your answer be? The opportunity cost of mining is staggering, it's a high bar to clear even if there is some utility to it as a currency.

I recognize that a thousand different arguments have been made to muddy the waters here ("it's just waste energy", "it incentivizes more energy production") but ultimately what we're talking about is humanity spending a lot of time and resources producing chips that are just burning energy on hashes that produce no value beyond propping up a currency. Surely even if there is some Moloch-ian induced side benefit to it at the moment we can recognize there is something deeply wrong with this approach in the long term.

The energy used also produces as much co2 emissions as the country of Greece, which seems bad if we want a stable temperature on this planet.

Proof of work isn't the only way to do cryptocurrency, but it seems to be the dominant one and likely would play a significant role in a world where crypto became the most common currency. A world where it is the dominant currency would also require proportionately more compute.

If you think proof of stake can (and is likely to) do it all, feel free to just ignore this comment.

@DanMan314 Energy wastage becomes a significant problem in the far future, but I don't think it's particularly relevant right now. People getting mad about emissions from the energy usage of crypto is an isolated demand for rigor; plenty of other industries use similar amounts of energy and we don't see complaints about those. (How much electricity do all the world's video gaming servers use?)

@IsaacKing Video games are fun and have obvious utility. If crypto is just a curiosity with a large resource black hole attached, seems bad. I don't think it's isolated, just an argument specifically for the negative part of the utility.

@DanMan314 Plenty of people don't play video games, and plenty of people do get some utility out of crypto. Personally I think video games have benefitted my life more than crypto has, but I could see a cryptography nerd feeling differently.

My point is that the amount of energy used by crypto mining is well within the range of "normal industries that are not vital to human survival". A degrowther could take a principled stance against all of those industries, but I have yet to see a cogent reason why crypto is more of a concern than the others.

Irrespective of whether crypto is useful enough to / should use as much energy as it does, I have always found the comparison to the energy usage of countries (Greece, Switzerland, Norway etc.) to be a bit misleading. How much energy do other industries use? Does the typical person reading that even know how many people live in those countries?

A better comparison, for me, would be to see what the energy usage is per user. In fact, let me investigate this now.

Bitcoin uses 127TWh/yr. Averaged over every human on earth, this is 1.8 W / person, but this is unfair, since not everyone uses Bitcoin. This report estimates 80 million Bitcoin users, which is 181 W / user, about the equivalent of 3 lightbulbs being run continuously.

I suppose whether this is wasteful or not depends on your sensitivity to that sort of thing. You could criticize the 180 W number by saying that some users are not actively transacting and shouldn't count. A bitcoin maxi would counter that even for people that are "hodling", the value of their bitcoins is still being protected by the security of the network. 🤷