context: Polymarket | Ethereum ETF approved by May 31?

This market resolves YES if that market resolves YES and the ETH ETF has only the 19b-4 SEC approval and NOT and S-1 SEC approval by May31.

If that market hasn't resolved by May31, this will wait for the resolution -- but any approvals which occur AFTER May31 will be discounted.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ8,713 | |

| 2 | Ṁ5,733 | |

| 3 | Ṁ4,863 | |

| 4 | Ṁ2,989 | |

| 5 | Ṁ273 |

People are also trading

@Gen Happy to provide clarity by spending all my mana on NO.

Sorting Polymarket comments on likes as an indicator of popular opinion shows there's pretty much only one convincing interpretation.

@ErikBjareholt I just went down a lengthy rabbit hole reading about both forms, which turned out to be a bad idea because I could honestly see a viable argument for either at this point. my inclination is no; although it seems like the ETF is approved in principle with form 19b-4, it is just not available for the shares to be listed on the exchange until S-1 is accepted. is that your understanding as well?

@shankypanky I guess an interesting question would be, how often do they issue 19b-4 and not a S-1, where both are necessary?

@Gen sure I don't think it's a matter of not issuing S-1, it just seems like the submitted forms needed a number of changes. if both are required for any approval, why wouldn't they hold out until all are received with amendments?

I mean my initial bet was No and there's a strong case for "approved" meaning that it has all required sign offs for trading obviously. but I think there's also a case for "approved" meaning the ETF is approved in principle and then just the formalities need to be confirmed so people can access it on the exchange.

@shankypanky I agree with your assessment, but "approved in principle only awaiting S-1" implies not really approved in practice. Final approval after 19b-4 might be a foregone conclusion, but it's nonetheless not sufficient.

The market specifies SEC as the resolution source, and it's unlikely they will use loose language in this regard. If they approved 19b-4, but not the S-1, and said the equivalent of "ETH ETF approved" (and not more specific language indicating remaining steps), that'd be crazy.

But we'll see soon enough.

@ErikBjareholt yeah I'm in the same camp as you there as well (tbc I'm just exploring a little as devil's advocate for the sake of curiosity - and I could give it another angle but it's not that important). resolving to communication from the SEC means to a release that will likely say 19b-4 was approved, or "first step," etc? I do think news sites could call it approved but the SEC would be more granular.

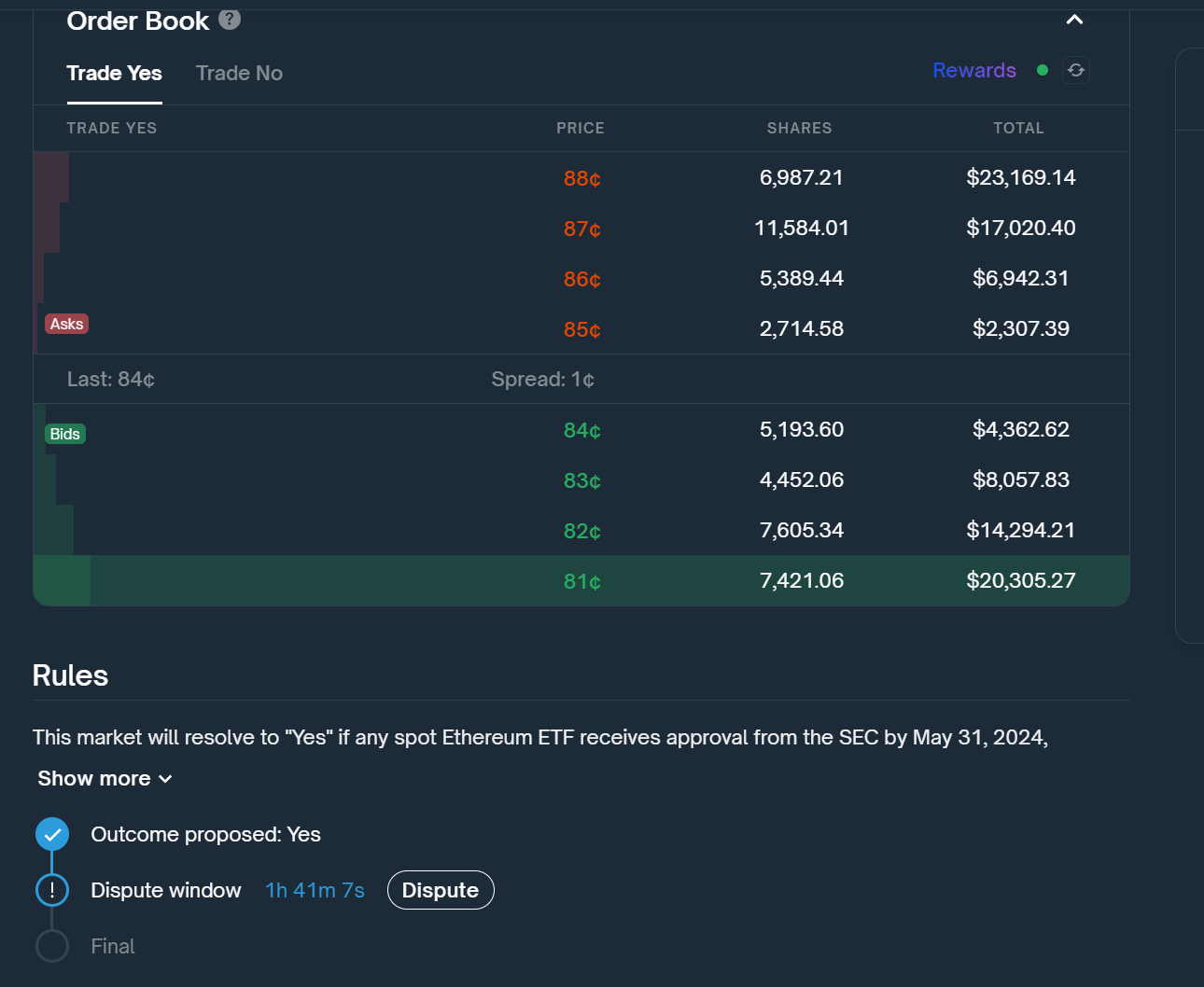

@jacksonpolack You are correct. A bond has been posted that Yes is the correct outcome: https://oracle.uma.xyz/?project=Polymarket&transactionHash=0x0acf86d5bd83f19834bcb7cb366dcd4341c1a19fdce5f2d55526ee5a038906db&eventIndex=11

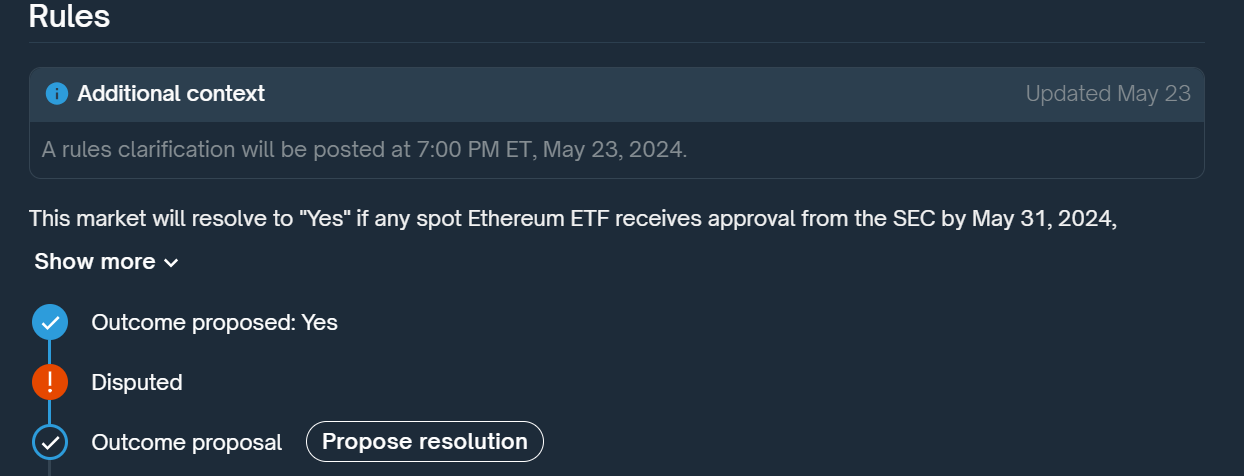

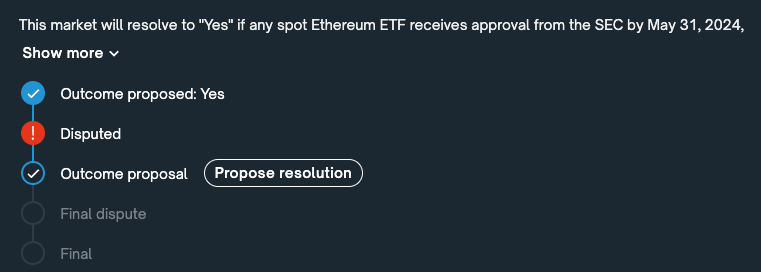

@ErikBjareholt I proposed all 3 ETF markets. Polymarket said they will clarify at 7PM ET (32 minutes from now). Someone unaware must have disputed, and it was of course, re-proposed to Yes again afterwards.

Polymarket now makes decisions for contentious disputes, not UMA.