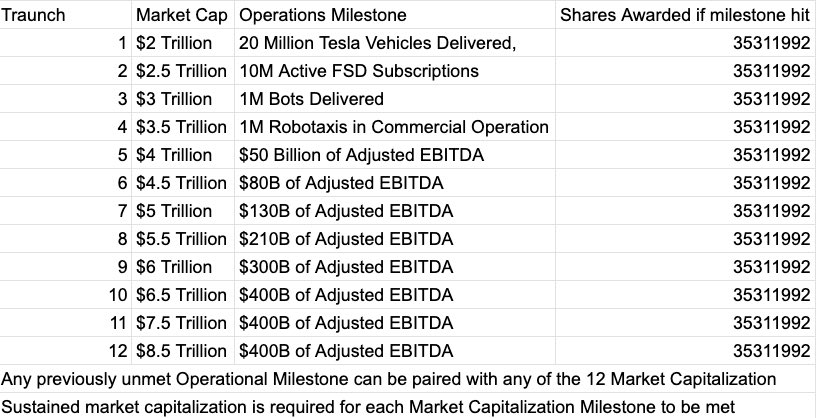

The proposed package would grant Musk 12 tranches of stock options tied to ambitious targets, including a market capitalization of $8.5 trillion and milestones in autonomous driving and robotics. (Reuters)

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ800 | |

| 2 | Ṁ470 | |

| 3 | Ṁ163 | |

| 4 | Ṁ151 | |

| 5 | Ṁ137 |

People are also trading

@ItsMe The package has up to $1 trillion in potential compensation if all performance milestones are met, but whether it makes Musk a ‘trillionaire’ is mostly irrelevant. To hit those milestones would almost certainly require Tesla’s market cap to be well above the levels that would already make Musk a trillionaire from his current stake.

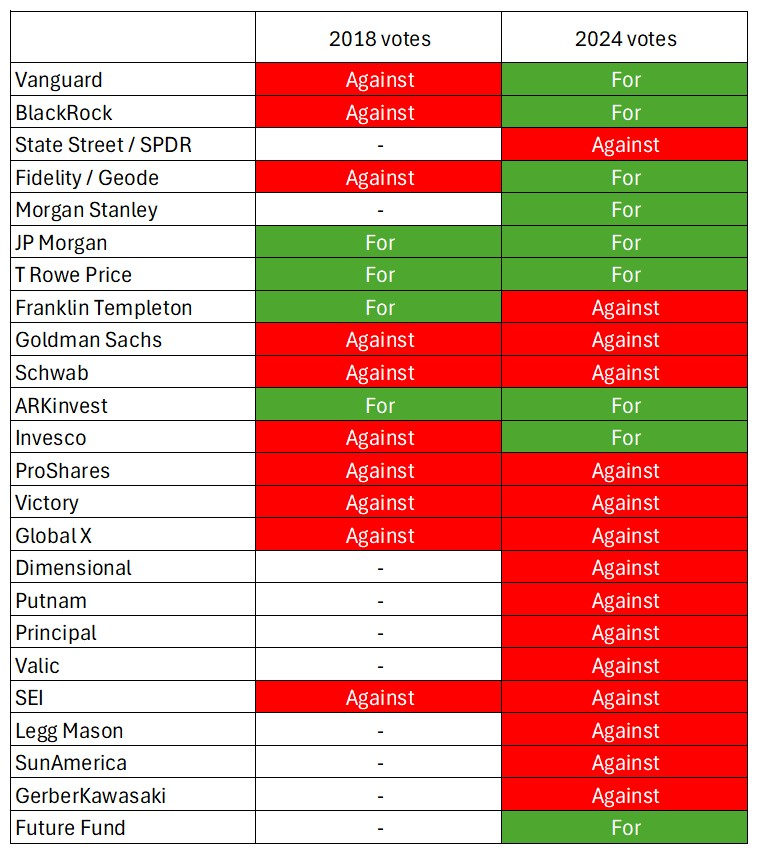

Schwab, Morgan Stanley will vote for the pay package. Thousands of Tesla investors were going to revolt and move accounts if they did not vote for the package. State street won't reveal their vote for a few months but Tesla investors have told them that if that vote ETF Tesla stock against Elon then accounts would be moved. Schwab had voted against the 2018 pay package twice. Schwab bent the knee.

Last time 72% in favor of 2018.

In 2025, Schwab flipping to yes and Elon can vote his 15% in Texas.

30% of vanguard flipped to Investor choice. Yes has over 18+% more in favor as a starting point.

@brianwang This is a slop list with little - if any - relationship with reality

most orgs made no comments in 2018 and voted on a fund-by-fund basis. I’d love to know how the “no”s were determined here (excluding vanguard who opposed publicly)

Teslas 8th(?) biggest holder, Norges Bank, is not present on the list - they are the biggest (only?) public opposition to the new plan

You’re framing it like these orgs hate Elon and are now “bending the knee”, but most of them just vote the board recommendation and are only in doubt due to Musk’s recent court debacle (2024) where board independence was challenged. Plus, I don’t understand your math? Schwab represents a fraction of a percent and vanguard is 7.5% - how is this a +18% swing from past numbers?

Obviously of course it is still likely to pass

Maybe we should have been betting on how much it would pass by, lol

@Gen Elon Musk and Kimball Musk could not vote before. Now that the company is in Texas. Texas law allows everyone with shares to vote even if they are on the board or CEO etc... Elon and Kimball and other insiders who could not vote can now vote 15%.

Schwab and 30% of Vanguard were no before and now they will be yes. -2.5% becomes positive 2.5%. So actually a 20% swing to yes. Norges Bank has about 30 million shares. About 1%. The list I copied was more complete than anything put up by anyone else. Are you going to put up a non-slop list?

Schwab was going to vote no again and follow the current recommendations of Glass Lewis and ISS. But Tesla shareholders in the thousands threatened to move accounts if they did. The knee was bent to shareholders who got active. Otherwise people with ESG and anti-elon beliefs working at Glass Lewis and ISS would get their recommendation followed. The 2024 Delaware court ruling against the 2018 pay package voted positively twice by over 70% of shareholders was challenged by greedy lawyers and ruled an activist anti-Elon judge. The board independence argument was BS. The future overturning of the 2018 pay decision will be to stop the flow of companies leaving Delaware. Tech and other companies want a jurisdiction that has minimal rules, clear and predictable results and non-interference with the company operations.

Most asset managers are voting based on Glass Lewis and ISS by default. They are too lazy and cheap to do the work of actually determining what is in the interest of shareholders themselves.

3000-4000 people work at these Proxy advisor companies. the work of deciding upon thousands of ballots per year is outsourced. Proxy advisors like ISS and Glass Lewis exert outsized influence on how major asset managers—BlackRock ($10T+ AUM), Vanguard ($9T+ AUM), State Street, and Fidelity—vote the trillions in shares they hold on behalf of clients (retail investors in index funds). These managers must vote proxies fiduciary-style under regulations like ERISA, but the sheer volume (thousands of ballots annually) makes in-house analysis costly. There has been a intensifying movement since 2023 against Glass Lewis and ISS.

@brianwang Ah I see, the Musk brothers make up the difference. no debate there

But the rest of your argument is not based in reality. These firms generally don’t operate on emotion, Reddit sentiment, or threats from account holders. They vote fund-by-fund, follow their own stewardship policies, defer to proxy advisors (as you point out), and they almost never make public statements.

That's why it's misleading to to label 2018 votes for these managers as "against" when they follow these processes and never disclosed. Schwab specifically are not even worth mentioning as their holdings are so tiny that it is inconsequential - they follow their policies because it's a waste of time to individually assess every compensation plan.

Norges is actually relevant because they do comment publicly, disclose their votes, and are a top 10 holder. They are the only major institution that has clearly said "no" this cycle, just like Vanguard and Norges were the only ones to comment in 2018.

My main disagreement is the narritivising to frame this as a mass-conversion from "no" to "yes" because of some twitter posts(?) and no actual evidence.

What do you think the vote % will be? maybe we can bet on that before it's too late

@TheAllMemeingEye “don’t worry guys I won’t spend it” - Elon Musk, 2 years after he purchased Twitter for $44b

@TheAllMemeingEye first money to him happens after he finish raising Tesla to $2 trillion. Zero if he does not do that and hit an operational goal like making 1 million true Robotaxi. Predictors here do not think those are certain by 2030. That would provide $650 billion in shareholder value and give Elon the right to pay $7 Billion to buy $14 billion. He would pay the price of the shares two months ago when the package was drawn up. Mary Barra of GM never doubled the value of GM in the 11 years she has been CEO from the time she started. $300 million to go sideways or down. So a bit over 1% on completing a double and holding it. To get all 12 done it becomes a r times the EBITDA or profit of nvidia and holds it for 36 months which likely increases the value to $20 trillion or finishing a 20x and about is a 13x from here. Almost no predictors here are saying that will happen and it more value and profit than any company in history. Then he will pay about $84 billion to acquire the options at the price when the plan was created shareholders get say $100k turned into $1.3 million or $1 million turned into $13 million. If they were holding those amounts two months ago they go to &2 million or $20 million. Robotaxi and teslabots have to be assured at over a million units each. Elon gets about a 5-7% tip. Until he makes almost all current shareholders millionaires or multi millionaires and done what predictors here say is impossible. If you think it is easy for Elon to get the trillion by completing all 12 tranches did you have a better investment that will get you over 13x returns. This was the deal for 2018 as well. Do things that take a $50 billion company to $1 trillion and get $55 billion. Gm was a $55 billion company in 2014. All Gm shareholders are sitting about the same. 2018 Tesla shareholders got a 20X.

@brianwang so? This doesn’t make it reasonable. Many companies have 10-20x’d, none of the CEOs were given a “6-7% tip”

It has literally never happened, and there is no basis to suggest that offering $1 Trillion in additional compensation is any more motivating than the $1.1 Trillion his 13% would be worth if he achieved an $8.5T valuation without the package

@Gen to be fair, I wouldn’t even care so much about the pay package if they pegged it to CPI or an SPX benchmark or something

But there is nothing but downside (imo) to shareholders approving this package when I foresee no possible way of achieving it without inflation or other market conditions independent of “Elon tries harder”

@Gen There is no downside to shareholders. Inflation does not increase share price and market value. The operational milestones have to be hit or none of the market cap increases matter. You could say it is easy to get in 5-8 years to 20 million cars deployed. 10 million FSD does not just happen. We are at less than 1 million FSD on 8 million cars in the world. EBITDA increasing to $50 billion is half of the ebitda of Nvidia and a 5X increase from today.

10-20X only happens very, very rarely and it has never happened for a company that is already over $1 trillion in valuation. No company has ever gone beyond where Nvidia is now at $5 trillion.

If finding companies that 10X is easy then you can buy shares in those companies now.

Those who have shares already in Tesla are voting to have their shares 10-20X again.

This would be exceptional service where he is making wealth increase by 10X and is the most value I have ever gotten and wealth worth paying only after it happens.

1 million robotaxi would be 500X more than Waymo today.

Nvidia wants to work with all other robotaxi players to try to get to 100,000 Robotaxi starting in 2027. But there is only Lidar for 1000 robotaxi per year now, regular driver assist Lidar is not good enough.

@brianwang ok you stated a bunch of facts again but the only part of your comment that is in dispute is

there is no downside to shareholders

Your accompanying factsheet does not have anything to do with this claim. The downsides are obvious: massive ownership dilution for shareholders is the main one

the key thing you’re missing is that while you claim every Musk company is going to 5-10-20x or whatever; you can’t explain why Tesla specifically will not get there without this pay package

@Velaris his $400b is primarily in equity for that company, I think their incentives are pretty aligned already

@Gen his spacex and xai equity is more than his Tesla equity. He does not get paid anything until he first doubles the stock from where this was first proposed and getting the last three tranches means holding EBiTDA (sustainable profits) at over $400 billion. Which is four times more than nvidia. And grow profits by about 40 times from today. This would make stock worth $20 trillion. He would be getting a 10% tip.

@brianwang you’re trying to make it sound reasonable, but excluding Elon the single biggest CEO pay package was $200m for a whopping 0.02% of that company

It’s simply unnecessary, and imo it’s unreasonable to assume Elons incentives are misaligned without this pay package.

This pay package, if anything, incentivises Elon to wield Twitter to influence further political instability. The only way he’s getting that payout is if the USD inflates significantly - there is zero chance Tesla achieves those numbers otherwise.

I see the pay package as totally non determinative to Tesla’s outcomes

@Gen @brianwang I'd see it as more likely to hit the target if he were still friendly with the US gov and the govt could arm twist India into lowering tariffs for Tesla specifically. Other than that it seems unlikely that there's a market big enough to let Tesla reach the target.

But reminder that whether the pay package targets will be hit is not the question here. It's whether Musk has enough control to get the pay package passed.

@Velaris doesn't that create a feedback loop since he would then have even more power? Isn't that equivalent to a hacker saying "I have blackmail material on you, give me even more blackmail material or I'll release what I have"? Surely the strategic response is to not negotiate with terrorists, right? If he was primarily giving them something positive in return then it would be different, but if it's just the threat of him doing bad stuff to them then it doesn't make sense to me

@Gen the 2018 pay package was the same increase the value of the company by over ten times. And he did it in 4 years. Tesla was valued at less than GM and he started it when the package was written. If Elon cannot hit the new first goals of doubling from the value two months ago of $1 trillion he does not get the right to pay for options at that price. Mary Barra Gets $30 million per year and $300 million per ten years and GM stock can go sideways or down. Apple can go sideways from here and time cook would get over a billion over ten years. First tranche. Double the price and hit an operational goal. Four goals on involve quadrupling the value of Tesla and either five times the profit EBiTDA and 1 million real Robotaxi and 1 million bots etc. 4x shares and he gets to pay $28 billion to buy 2.8% more. As a shareholder. It was a great value from 2018-2022. And if he does it again I am happy for him to get the 7% tip

@brianwang I agree that those statements are all facts, but it does not mean this pay package is a good idea

Apple could offer Tim Cook this same package, it wouldn’t incentivise anything except risk taking. His incentives are already aligned.

I maintain that it is unreasonable to assume this pay package will be outcome determinative to Tesla’s future. I would say, even retroactively, that the previous pay package was likely not outcome determinative (he owned 20% of the stock, how much more aligned do you need to be?)

CEO mega grants are statistically uncorrelated with future performance, and there are studies showing negative correlation (higher paid CEOs in SPX = worse performance)

Tesla is no exception. Elon is one guy, you could argue that he’ll divide his time less, but if he thinks it has $8T potential he’ll target that anyway. Twitter isn’t going to grow that much, nor is spaceX

Elon's buddy Jared Isaacman is back. Nominated for NASA Admin. Elon and Trump are buddies again.

The pay package will pass.

SpaceX will go to over $20 trillion by 2030. XAI will go to many trillions and I think over $10 trillion by 2030.

https://x.com/SawyerMerritt/status/1985843193431089183

Tesla, SpaceX and XAI will significantly fuse together around 2035 with AI data centers in space that are larger and more inexpensive than the ones on Earth. Elon can control how that pie is divided.

Elon will again prove that he is the most exceptional person ever.

@brianwang let’s bet, I edited the market after I made it & lowered the bar for you from 30T to 20T combined: /Gen/spacex-and-xai-worth-combined-30-tr