As a creator I want to be able to tell how my markets are doing in mana terms, including spend for creation, extra answers, subsidy, boosts, etc. and also the total amount gained from trader bonuses (and other future potential reward systems). It would be even better to be able to see these on a chart, per market!

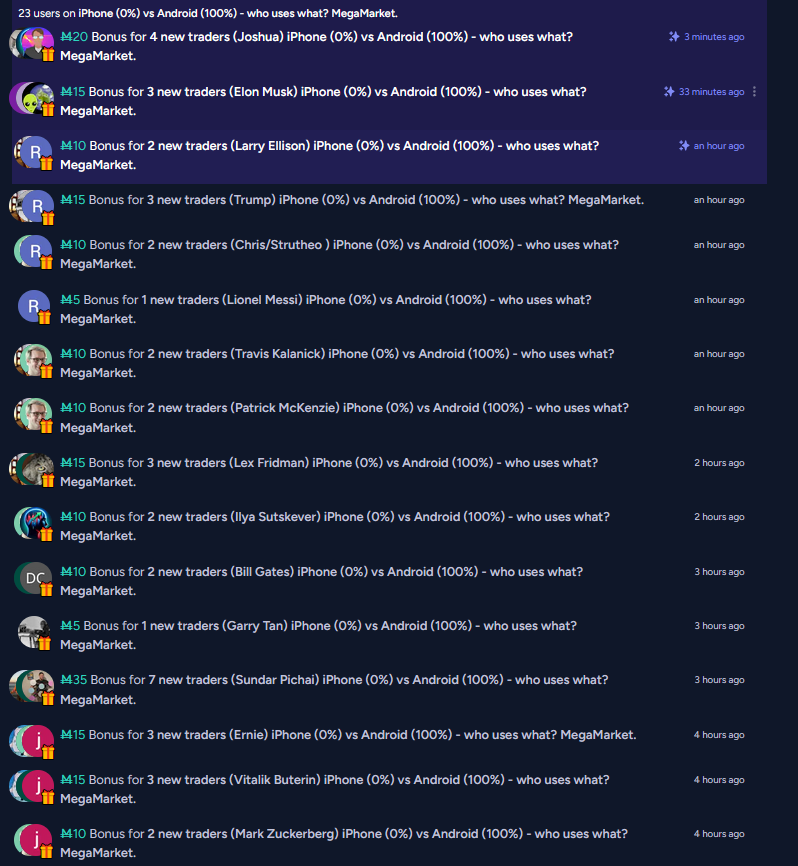

Right now it's not really possible. The data on new traders comes in in small chunks in my notifications (which are awesome! Not saying to remove that!) which isn't directly usable to determine a total. There's a log system which is great, but also would require quite a bit of manual work to roll up into a total.

I'd think this would be part of the metadata about a market? perhaps with info on the cost to create, etc.? so you could see your success rate.

Longer term, this whole "money for nothing" thing has got to go away. But even then, we'd probably offer market creators & judges a small percent of mana spent, perhaps with juicier percentages for the first 100 mana each unique user spends. This would be where that info would be stored, too.

This is what big market info looks like now:

It's fun but the market cost 2k or more to create, plus boosting etc. So I have no idea if I'm ahead now or ever. It would be useful if creators could measure and track what works for them.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ422 | |

| 2 | Ṁ238 | |

| 3 | Ṁ139 | |

| 4 | Ṁ94 | |

| 5 | Ṁ39 |

More on limit orders: imagine you are buying a house and have a budget of 1m USD

Do you go around writing formal proposals to commit to buy houses and dropping them off? Even with expiration dates? With no knowledge of which of them will be accepted? Or if whether the house has been destroyed overnight? No, that'd be crazy. And it's not about overdrawing your account; even with overdraft protection, the risk is that you can be contradicted by reality changing. That's why people make deals in ways that are as instantaneous as possible.

What you do is identify a seller to match your buy, and talk to them, and when you reach agreement you sign it. Neither does the seller go around issuing "right to buy at price X" contracts to anyone interested; the point is, open limit orders are a huge liability. And auto cancelling or short term limit orders protect you at the cost of lowering usefulness proportionally

Rather than limit orders, I envision something like:

A private UI where you enter your "actual" best estimate price. Then in almost every UI on the site for traders, you can order items not by the site's price, but by the gap between your estimate and the site price, (relative) ! And this would matter both for markets you hold (where you may want to sell to rebalance) and from those you want to buy in on (to estimate the value of the mispriced purchase option, for me.)

i.e. holding a bunch of a stock which you value at 10YES, which is actually worth 90 now - well, that's a situation I really want to know about. Even if I bought at 5, if we truly believe we aren't biased, then either we should see this either as an out of date estimate, or as a situation I should rebalance to reduce risk.

In general, just more visibility into this information - the possible contradictions between your own views and the current price, would improve discoverability right now. I have positions in 100+ markets and there is no way to find out the mispricings besides me keeping a parallel, duplicate spreadsheet holding my manifold portfolios and my own estimates, and then periodically importing the actual prices in and using that as the UI.

But seriously, in a world with people holding even just 50-100 markets, how does MANIFOLD think people should adjust their holdings, and buy more or less over time? There's no UI for it.

Think about the real world - for price discovery in small markets (say, for antique cars) there are NOT constantly running, full open commitment auctions. Instead, there are periodic publicly announced gatherings where people meet and arrange deals. This facilitates deal discovery. And my example doesn't show the full level of need - because really we are betting on things which can 100x in value in 1 second at any time. I don't think it makes sense to believe that big buyers will ever want to expose themselves to limit order risk. Instead, they'd be much better off in a discord, during an "off" time of the market, where real world info is not likely to leak out (if possible), so that they have a few hours to discuss, without commitment, approaching a real deal, then commit, then execute immediately.

It's not June 30th yet, but given the current available UI, I (personally) think this should resolve NO (it's @Ernie 's market, so his opinion is obvs the only thing that actually matters for resolution, just laying out my own personal case).

Including the Mana earned from fees is helpful, but in practice it's still often impossible to tell using the current UI if a market is profitable (without more laborious API computations).

Example: in this market, I let others submit their own options, and I will close the market before the debate, to recoup liquidity. However, in the current UI:

(1). It's impossible to tell how much of the liquidity I paid for. There's currently 39k total, and I can manually count up the options I added, but that isn't immediately displayed in the UI, let alone cases where e.g. others add overall subsidies. (There are old markets where people have steadily added liquidity boosts over time—AFAIK the only way to tally who contributed the liquidity is via the API).

(2). More importantly, I have no idea how much liquidity will be returned to me. It's hard to tell that based on current market probabilities, and once it resolves it will be pretty laborious to check how much liquidity was returned to me (since in the balance log, AFAIK my profit from betting will be mixed with the liquidity returned?). (Note that this isn't simply about the market probability for each option, which would be complicated enough. AFAIK, it's sensitive to the market probability when the liquidity drizzled in. If e.g. I repriced an option to 80%, and then the liquidity drizzles in, and then the market closes at 80%, AFAIK I shouldn't actually lose mana on that extra liquidity, because the market price didn't move further. But again this is impossible to tell from the UI.)

In total I have no idea how much mana that market will cost me. I spent roughly ~20k on liquidity, and some of the options will close near 50% (so I should receive most of that liquidity back) & some will close at e.g. 20% and I might lose most of that liquidity (or maybe I'll gain mana if it resolve the other way). It's not a huge deal, but for the purposes of this market, I don't think it's easy to tell whether a market is profitable in very common circumstances like these.

Oh yeah we're not close to yes

YES would give me a spreadsheet with all transactions in and out, with amount, date etc. afaict we have nothing like that.

I think it may come sometime, though.

Take a look at the way creator new trader notifs work - they're designed because the old creator motivation was to make markets which get wide participation, along with the new trader bonus. Yet, the bonus is gone now and we are rewarded for volume... But we have no way to be notified of volume, or to match up people who want to do huge buys with those who want huge sells. So previously creators were motifated to create popular markers; now we aren't.

What would we need to do a good job of creating volume? Well, buyers and sellers must be matched. But we have no way to do it

They keep saying limit orders... And the answer always is, nobody sensible would ever set a large open limit order in a market which would quick resolve. Then they say we should use small limit orders as a notification system.

That implies there could just be a purpose built notification system! It would be a way for traders to privately track how much markets violate their personal estimates. Then in their UI they could sort by "markets I've investigated, whose current price violates my expectations the most" and at least go and move the price

Or things like chat rooms for likely traders to informally set up deals to immediately execute

The overall idea here is that we should think about what we want traders and creators to do, realistically, and give them tools and motivation to do it

Rt now, as a creator I'm mana incentivized to generate volume.... Yet there are no volume notifs, and it's hard to see volume history in a market. The limit order execution log syntax is incomprehensible etc

So yeah, if the idea that volume will help manifold grow (rather than market reach, admittedly an unintuitive idea) then it'd help to think through what creators would need to do that and have fun too, and work towards it now

I don't work towards generating volume cause volume I generate is invisible to me