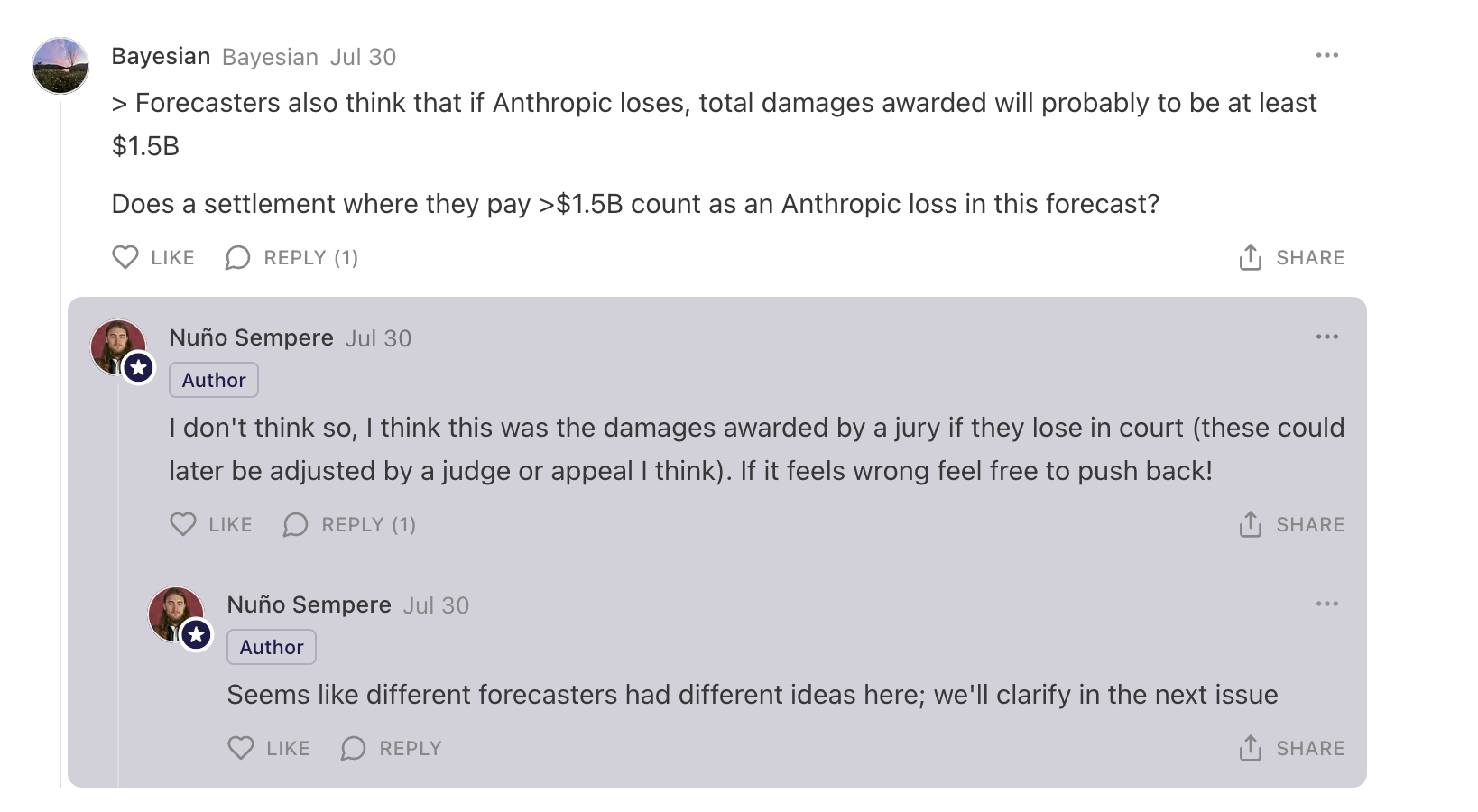

Update 2025-07-28 (PST) (AI summary of creator comment): In response to a question about how a settlement would be treated, the creator clarified that the intent is to mirror whatever Sentinel was predicting.

Update 2025-07-29 (PST) (AI summary of creator comment): The creator has stated that a clarification on the resolution criteria is due. To resolve ambiguity around outcomes like a settlement, the creator will seek to determine what Sentinel (the source this market is mirroring) intended. If necessary, the creator will ask Sentinel directly on Twitter for this clarification.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ171 | |

| 2 | Ṁ93 | |

| 3 | Ṁ85 | |

| 4 | Ṁ15 | |

| 5 | Ṁ13 |

People are also trading

I guess this was on me since the resolution criteria to mirror Sentinel was explicit, but I was expecting all the “If Anthropic loses, …” options to N/A (or even resolve YES, as in formal logic) in the event that Anthropic didn’t actually lose.

As an aside / for posterity: I think that prediction market questions like this one and Sentinel's expert forecaster survey questions on this topic produced a lot of noise and very little signal in this instance, doing more harm than good to the information environment.

Sentinel's panel of forecasters clearly did not have any idea what they were talking about (nothing against them personally, of course). Their estimate of a 68% chance of a jury trial was wildly off, to the point where it's clear that they either got bad information from somewhere or were just making guesses based on nothing. Less than 1% of class action lawsuits ever see a jury trial, and this case was particularly unlikely to go to trial because there were no real disagreements between the parties about any factual issues. Any halfway sensible lawyer who'd read or skimmed the class cert and summary judgment opinions could have told you that a settlement was overwhelmingly likely, and even in the absence of insight into the specifics of this case the base rate for class action jury trials is super low.

I'm sure there are situations in which forecasters can outperform subject matter experts, but this was clearly not one of those situations. For the survey to have any predictive value, the forecasters would have either had to have some basic level of legal expertise or access to input from a knowledgeable lawyer.

As for this market, I believe it also showed something like 50+% chances of the case going to trial for a while (hard to tell because either the website's graph function is not working properly or I don't know how to work it), and then towards the end it was around 27%. That was also way too high, but more importantly, it appears to have been based on approximately nothing -- the market was highly illiquid, only a few small play-money bets from random people. But to anyone looking in from the outside, it would have been hard to figure that out; all they would've seen was the top line number, 27%. Also, no one involved in the market was quite sure what the questions even meant, because the resolution criteria weren't well defined and were going to be decided by asking the Sentinel people what they meant after the fact.

So, in my opinion, anyone who followed the forecasting efforts here would've gotten no useful information, but might have been misled into believing they did have some idea of what was going to happen. In order to figure out that they were getting a bunch of noise and no signal a casual observer would've had to dig into the market definition, the market's volume, the specifics of Sentinel's survey methodology, etc. It's not reasonable to expect anyone casually trying to get a bit of useful information to do that amount of work.

Not trying to call anyone out, just thought I'd post this in case it's a useful data point for anyone who's forming an opinion about the value of this kind of forecasting effort. I'm sure there are situations where this kind of thing would have a lot of informational/predictive value, I'm just observing that this wasn't one of those situations.

@Exegete good feedback! the main argument isn't that the market is inefficient, bc yeah markets are bound to be inefficient when ppl put little effort into betting on them and they are very thin and so on, it's rather that it might give a misleading appearance of having a sensible price, to onlookers, when it doesn't? fair tbh. I wonder what, like, general behaviour change i should do to make this issue less bad

@Bayesian I don't think you were the main problem, but I would suggest in the future only making a market if you have the time/inclination/ability to specify good, precise resolution criteria. This one felt a bit undercooked to me (we weren't going to find out what we were betting on until after it resolved and you asked Sentinel). Not trying to hate, I know you had good intentions.

And then the bigger issue in my view, which you have no control over (I assume) is that Manifold doesn't signal to observers/visitors that a given market is "very thin" etc. and not a reliable signal of anything. I think some kind of easy-to-spot disclaimer like "hey btw this market is very small (X mana wagered) and involves only a few bettors (X number) so don't assume that it communicates reliable information" would be a good addition. As it is it's pretty hard to discern that information and people default to assuming that the number is meaningful.

https://news.bloomberglaw.com/class-action/anthropic-settles-major-ai-copyright-suit-brought-by-authors

Case is being settled, so it won't go to trial. A settlement does not involve an "award" of "damages," and Anthropic has not "lost" (a settlement is not a "loss") so as soon as the settlement is officially entered I believe all five markets can close "No."

Unless we want to say that a settlement for X amount counts as a damages award for X amount and that settling counts as Anthropic "losing." Either way, all five should be able to close once settlement terms become public.

@Bayesian It will probably be five no's either way, because it's unlikely that the settlement amount will be >1.5b. But we'll know for sure once the settlement terms are announced.

@MaxE Looking at the sentinel blog post, it seems like you may be right. They cite odds of certain damages awards "conditional on Anthropic losing at trial." I only bet on the "will it go to trial" question (which seems like a safe "no" at this point) so I have no dog in the fight either way.

All the markets on this:

- https://manifold.markets/GauravYadav/will-anthropic-lose-the-authors-cop

- https://manifold.markets/Bayesian/the-potentially-businessending-anth

- https://manifold.markets/CharlesFoster/will-anthropic-be-ordered-to-pay-1b

- https://manifold.markets/Nu%C3%B1oSempere/will-anthropic-go-bankrupt-or-be-di

@Mactuary The intent is to mirror whatever Sentinel was predicting, I don’t know what would seem most reasonable, hmmmmm

@Bayesian I feel like a settlement here is as likely as not, especially if there's the potential for a company ending award. I think using the value of the settlement is closest to "correct", though on a technicality you might call that not going through a jury trial.

As one piece of weak evidence, the tobacco case, referenced in a retweet, was settled.