Marcus has requested a short-term, six-figure loan so that their fund can complete a profitable deal with another crypto platform. If Manifund chooses to lend them a bunch of money, will we be repaid without incident?

About the loan

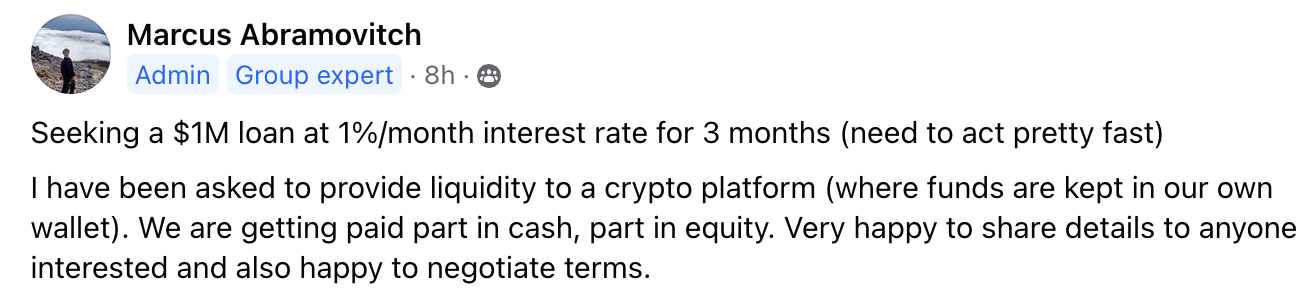

Marcus also posted about this opportunity in the FB group "Highly Speculative EA Capital Accumulation":

This is highly time-sensitive, which is why they're hitting up nontraditional sources like Manifund who can move quickly

Manifund has previously issued a $300k loan to Lightcone, which was paid back promptly

That loan was collateralized against Oli's personal ETH; for this loan, Marcus is checking to see what kind of collateral they can offer.

The altruistic case for making this loan is much weaker (this would be to a for-profit org, albeit one that is for earning-to-give; while Lightcone is a nonprofit that we would have been reasonably happy to fund)

But the returns are better (1% per mo instead of per 2 mo)

Reasons to do this:

I trust Marcus highly, based on his track record as a Manifund regrantor, his engagement with Manifold, and his presence in the EA community

$2.5-$4k of return for not that much work, would be nice

I like the idea of Manifund moving fast and doing offbeat things to help others in the community (see: previous loan to Lightcone)

Reasons to maybe not do this:

It ties up our funds for a while

I think that Manifund operationally won't miss $400k of money loaned out for 1 month (>90%), though I need to spend ~30m checking how our funds are currently committed

It looks weird or crazy to potential future donors

It's actually very risky?

I heard a lot of warnings against making the Lightcone loan, and just because it worked out, doesn't mean it was a good idea

(At least this time I'm checking the prediction markets first!)

Resolution criteria

Roughly, the goal of this market is to capture "how likely are we to regret making this loan":

Resolves YES if we're repaid at the end of 1 month

Resolves YES if we mutually agree to extend the loan to 2 or 3 months, and are repaid on time for those

Resolves YES if they end up eg handing over pledged collateral in place of a cash

Resolves NO if they end up defaulting, or have to issue some kind of IOU to us that we're unsatisfied with

Resolves N/A if the loan ends up not happening

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ6,819 | |

| 2 | Ṁ1,579 | |

| 3 | Ṁ533 | |

| 4 | Ṁ352 | |

| 5 | Ṁ197 |

People are also trading

@Austin, i think this is worth saying publicly, now that the loan has been repaid.

1. I think Manifund doing loans, especially to aligned organizations, is a good idea and makes a lot of sense. Too many people in EA like convention too much and are very risk-averse. I think Manifund should continue to do this (provided they have the money). I think this can be a helpful way of funding things and with a little bit of your/Rachel/someone else at Manifund's work, you can make good returns and also help out an org/project. A win-win.

2. That said, the amount of diligence needs to be increased a little bit. I looked back on this and saw many assurances I could have and should have given you that you... just didn't get. I don't think this would have taken long to collect either

A) That the company actually exists (Idk, i could have shown you some docs or something or a certificate of incorporation)

B) What we were doing with the money, why it works and why we needed the loan quickly (it's odd to be willing to pay 1.25%/month on a line of credit for trading). We were copying prices from one source to another. I don't think you needed to run a code audit or anything like that but I agree with others that "off-shore Panamanian company trading crypto options in Defi" should set off red flags.

C) When we agreed to back the loan with the management company, would have been good for you to confirm that our management company... had enough money. We do. We have about $600k in there but I don't think you knew that. There could have been 10k for all you knew.

D) I put $150k of my money into this, unsecured, at 1.5%/month (the general rate we did for all unsecured loans for this to make up the 1M). I didn't think about this until now but that should drastically decrease the perceived risk to your board for example.

I purposely put point #1 first since I think most people don't see the value in this. Having nimble orgs like Manifund is super important for the EA funding ecosystem. I agree a bit more diligence might be necessary, but this is what I like about Manifold/Manifund. A lot of the time, these types of things get shut down because one person will find them to be too risky and thus it won't happen.

I think everyone agrees with 2.

@MarcusAbramovitch haha, I appreciate the feedback and think everything you said in 2 is pretty reasonable if Manifund were to go deeper into the loans business with parties we trusted less. (though I also don't think doing that will be super core to Manifund's ops).

In this particular case, I placed significant trust in you personally as not intending to deceive me, based on ample interactions and observations of your behavior on Manifold and Manifund. For a large but not existential amount of money, this felt about right to me.

@Austin fair enough. I suppose I will say that I think loans might actually be a small but needed space in EA/non-profit space. I can imagine something like MATS being promised $ from startup founders or VCs that is pending a closing or something and thus needing some type of bridge financing. Or another FTXFF situation where now some orgs were left stranded uncertain and w/o funding and loans could prop up certain orgs that are overwhelmingly likely to receive funding.

I'm still against grants to for-profits (I think they should be investments and there is nothing wrong with making an investment that you expect also has social purpose and improves the world. In fact, that is all of my investments.) but less so than before since Im uncertain a scenario could pop up and it make sense

@MarcusAbramovitch Im not up in arms per se about the loan and in retrospect it was safer than I anticipated.

But I think that if you made 100 loans of this type, gambler’s ruin would catch up. If there’s a niche for loans like this one, I’m really uncertain that Manufold/fund is the best occupier of the niche.

@Austin fair enough. I suppose I will say that I think loans might actually be a small but needed space in EA/non-profit space. I can imagine something like MATS being promised $ from startup founders or VCs that is pending a closing or something and thus needing some type of bridge financing. Or another FTXFF situation where now some orgs were left stranded uncertain and w/o funding and loans could prop up certain orgs that are overwhelmingly likely to receive funding.

I'm still against grants to for-profits (I think they should be investments and there is nothing wrong with making an investment that you expect also has social purpose and improves the world. In fact, that is all of my investments. There is also impact investing and the like. I can't figure out why for-profit investors would get equity but people being more altruistic don't get equity) but less so than before since Im uncertain a scenario could pop up and it make sense.

@JohnSmithb9be I think if he starts to make 100 loans of this type, he can afford for a couple to default. I don't see why Manifund isn't a great occupier for this niche actually. Currently, they have the strongest track record of doing it and who would be better? There is always this kind of thought of "I'm not the person most able to do it". I think that thinking is good for public and highly sought-after roles. I don't think that's the case for things that don't exist yet.

@MarcusAbramovitch I had a long response and Manifold ate it. Short version, I don’t think they’re financially literate/thorough enough to do this and have it pay off. They took a shortcut by loaning to people they trust but frankly that’s got its own risks, as Benjamin Franklin might warn you.

Is the loan collateralized?

@Anthem we have promised to pay out of the management company if the loan goes badly. I suppose the management company could go bankrupt in which case Manifund would have a claim.

Manifund does not hold any collateral.

@colorednoise FWIW Marcus provided me some screenshots of their ongoing positions on the crypto platform, as well as a link to the etherscan transaction of payment from the platform. (I haven't spent any time verifying these myself, as I trust him at his word)

@Austin when you say “extend the loan another month”, is there a specific date by which the loan is currently set to be paid back?

@mattyb We agreed that if he were to give us 5 days notice of needing it, we would give it back but we agreed for "another month" meaning Dec 26th.

The total time we need this money for is until January 26th. I'd give good odds, maybe 80% that the loan gets extended until then but we would have no need for the money beyond that so that would be a firm cutoff date.

@JoshuaWilkes to give some colour on what we are doing, we have mainly been selling crypto options with it (predominantly calls because that is what customers want)

.

@colorednoise Can't testify to Michael's reasoning, but I find it easy to explain. An analogy: I think drunk driving is 100% bad and nobody should do it. Yet, I'd bet 98%+ to markets like "If I get 3 beers and drive, will I get home safely?".

@colorednoise Marcus seems competent and trustworthy. The base rate on funds repaying loans has to be high for them to stay in business. But if I'd read this Zvi quote beforehand, in which he explicitly tells me not to place the bet, it would in fact have given me pause.

@MichaelWheatley Then why are you doubling down so hard? I don't even see how this would be a worthwhile bet at 98% even if you are very very confident, there are multiple markets stuck at 4% which are certain NO that you could invest in instead