PREDICTED: NO

AAPL has demonstrated remarkable price growth throughout the year. The stock's price has risen from $124.17 to $198.23 by July, signaling significant growth.

Return to Growth

Apple is actively seeking to return to a growth phase after experiencing three consecutive quarters of declining sales. This underscores the company's focus on reviving sales and growth.

Q4 Results and iPhone 15 Sales

The results for the fourth quarter, set to be revealed on November 2, are pivotal in assessing whether the company is indeed returning to robust growth. This quarter includes the initial sales of the iPhone 15, and analysts will be eager to scrutinize the figures.

Analyst Insights on Demand

Analysts often gauge demand by monitoring shipping times, which indicate how long it will take to deliver a new iPhone. Currently, these shipping times are shorter compared to the previous year, particularly in China. Recent analyst notes from UBS, JPMorgan, and Bank of America suggest that these reduced wait times primarily reflect improved supply rather than diminishing demand.

Differing Views on Supply

However, opinions vary among analysts regarding the issue of limited supply. Some sources suggest that shorter shipping times reflect improved supply, while others believe that supply constraints might push some iPhone sales into the first quarter of 2024. Morgan Stanley analyst Erik Woodring falls into the latter category and has revised down estimates for the December quarter.

Diversification of Products

Investor concerns also stem from the fact that Apple's products beyond the iPhone, including the Mac and iPad lineups, have not seen significant updates this year. The introduction of new models typically spurs demand, and the minor update to the Chinese iPad has left some speculating about the potential impact on MacBook sales.

Singles' Day in China

A crucial event to gauge Apple's performance in China is "Singles' Day" on November 11, a major shopping holiday where iPhones are likely to receive slight discounts to boost sales. The outcome of this event could serve as a valuable indicator of what Q4 will look like in China, a key market for Apple.

Conclusion

In summary, while there are signs of a potential recovery, concerns persist regarding iPhone supply and the lack of substantial updates to non-iPhone products. The situation in China, a critical market for Apple, will be closely monitored.

Forecasts of AAPL's growth beyond $200 by the end of 2023 may be influenced by how the company addresses these challenges and the results of the upcoming quarters. Investments in stocks inherently carry a degree of uncertainty, and decisions should be based on thorough analysis and individual financial circumstances.

In conclusion, in the last year (2022), AAPL experienced a negative period in November-December, with a noticeable price decline. Considering the lackluster performance of the iPhone 15 and sluggish sales of MacBooks, surpassing the peak price of this year (July, $198.23) might pose a challenge. That’s why I bet : NO.

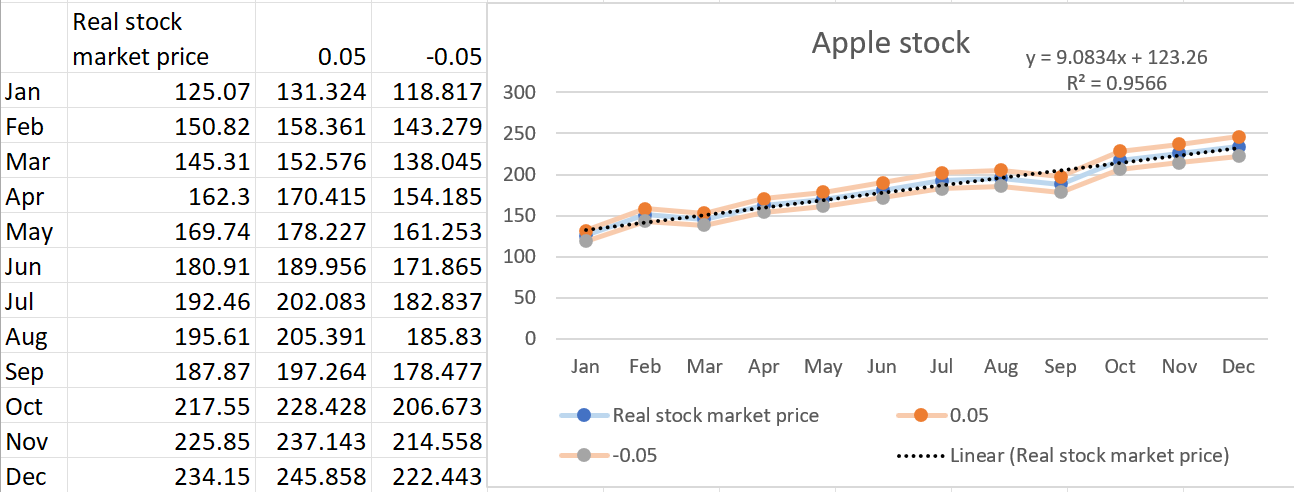

Apple, one of the brands that is topping Google and Amazon in the global BrandZ ranking. During the year the distribution of the range of the stock price goes from $124.17 to $198.23 in July. Despite being the company's slowest sales period, June marked a significant milestone for the organization. It achieved a market valuation of over $3 trillion, becoming the first corporation to surpass this threshold. According to Nasdaq data, the stock of Apple has shown an average monthly rate of 9% this year. Taking in count that in september they also do the debut of the new Iphone it will definetel impact the stock value in a positive way for the end of this year. In the grafic we can notice a consistent upward trend and adding a confidence interval of 5% even loosing 5% during the two last months of the year the price will still stay above $200.

@barbaranicollearangomiron what is “real stock market price”? I can’t recreate that series from market data, seems made up.

The Q4 results, extending beyond iPhone 15 sales, emphasize the growth in Apple's customer base and the flourishing Services segment, indicating a robust ecosystem that could fuel further stock appreciation. Analysts' consensus reflects a Moderate Buy rating with an average stock forecast of $207.69, indicating a 16.1% upside potential. These projections, alongside positive market reactions to Apple's innovative ventures, the Vision Pro for instance, make a strong case for AAPL to reach or surpass the $200 mark by year-end.