Resolution criteria

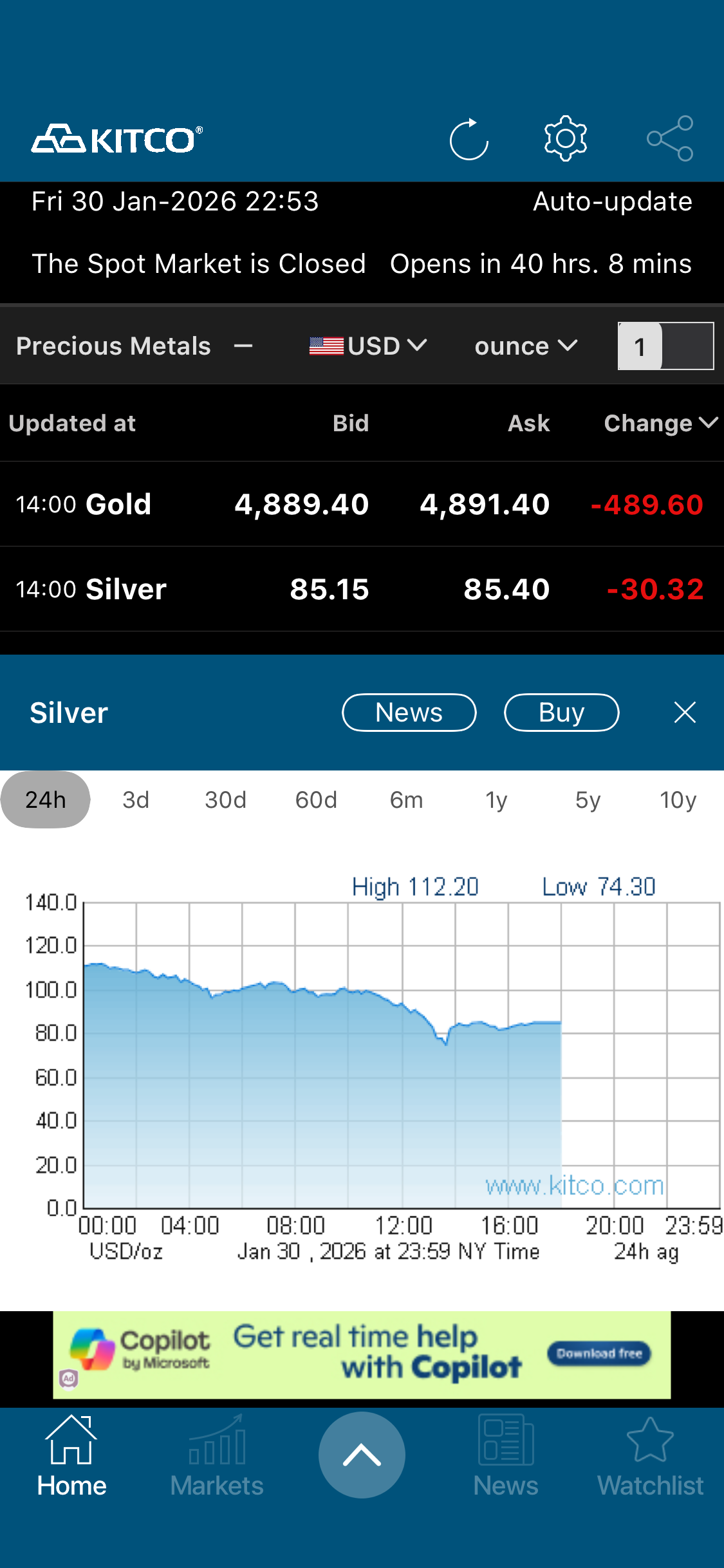

This market resolves based on the spot price of silver (XAG/USD) at the close of trading on January 31, 2026. The resolution will use the official closing price from COMEX futures or a major commodities exchange.

Background

Silver recently touched an all-time high of $84.01 in late December 2025, though it dropped more than 5% to $72 per ounce on Wednesday, retreating from the record high as investors locked in year-end profits. As of January 2, 2026, silver was trading at approximately $74.10 per ounce. The precious metal surged 148% last year, supported by its designation as a critical US mineral, tight supply conditions, low stockpiles, and strengthening industrial and investment demand.

Considerations

More than $5 billion of silver holdings will have to be sold in the five-day roll period starting in early January due to index rebalancing, which could create near-term downward pressure. However, the price of silver is widely expected to increase in 2026, according to precious metals investing experts. One forecast model projects a January high of $94.27 and an end-of-month price of $89.31, though such predictions vary widely. Trend-line analysis shows silver seeing a setback in early 2026, before resuming its ascent.

Update 2026-01-06 (PST) (AI summary of creator comment): The market will resolve based on the closing price on January 31, 2026, not the highest price reached during the month.

Update 2026-01-06 (PST) (AI summary of creator comment): If the closing price on January 31, 2026 does not match any of the specific price tier options listed, the market will resolve to Other.

Update 2026-01-30 (PST) (AI summary of creator comment): If the spot price at close on January 31, 2026 is above $90, the market will resolve to the "hit $90" option (not to "Other").

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ466 | |

| 2 | Ṁ7 | |

| 3 | Ṁ7 | |

| 4 | Ṁ5 | |

| 5 | Ṁ2 |

People are also trading

@web3nafee If the spot price at close is above $90, will this resolve to the “hit $90” option?

@ChadCotty Silver trades around the clock. It’s not clear which market the creator will use.

@web3nafee Only one answer can resolve YES—the highest price tier that silver reaches during the month

@Jack1 The market will resolve based on the spot price of silver (XAG/USD) at the close of trading on January 31, 2026. If the price is not among the options, it will resolve to Other.