tldr

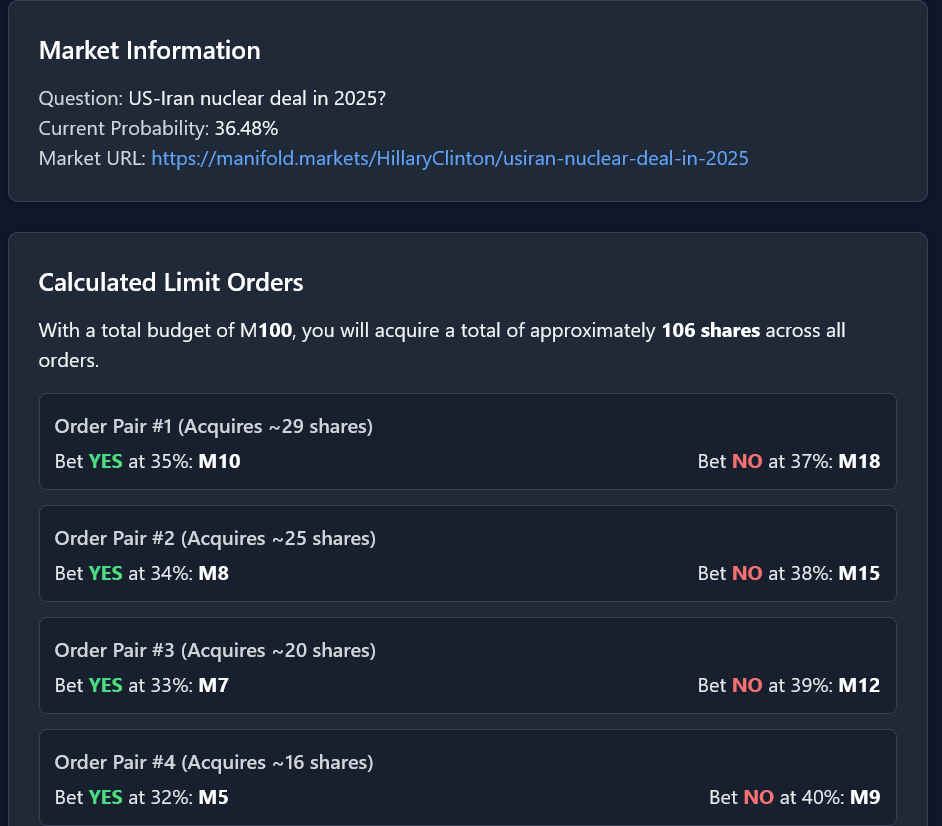

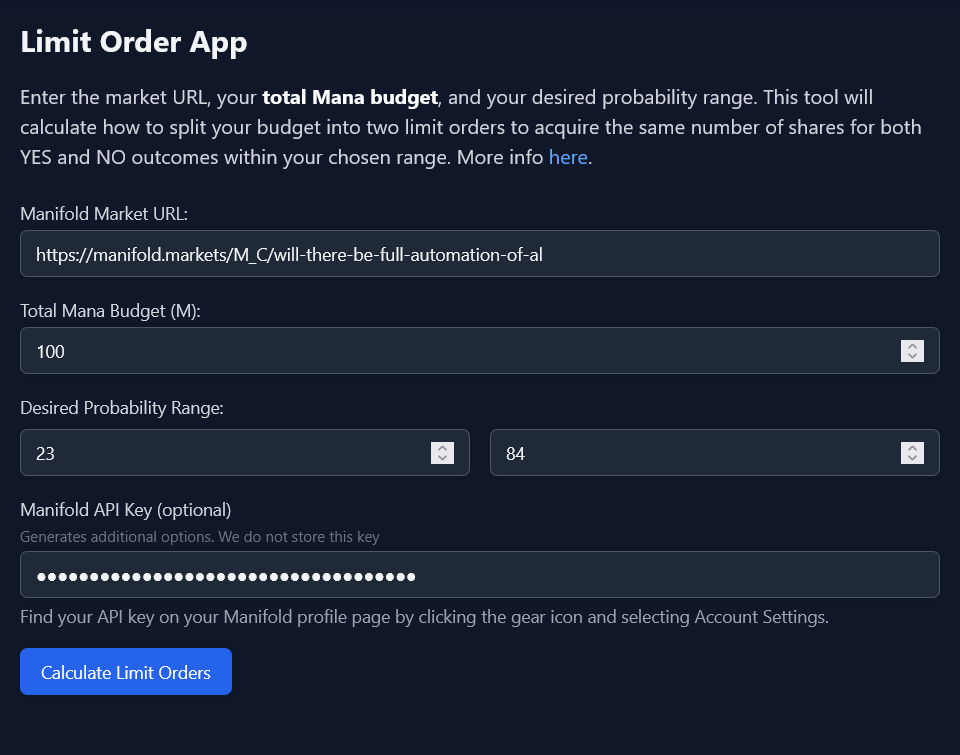

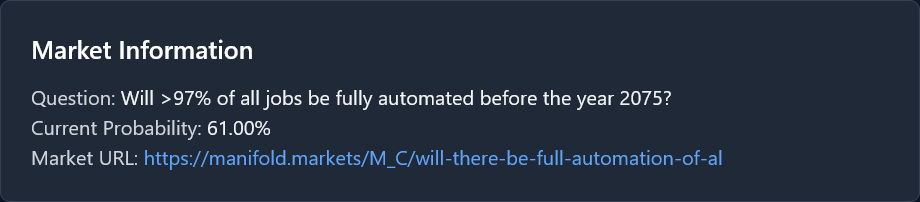

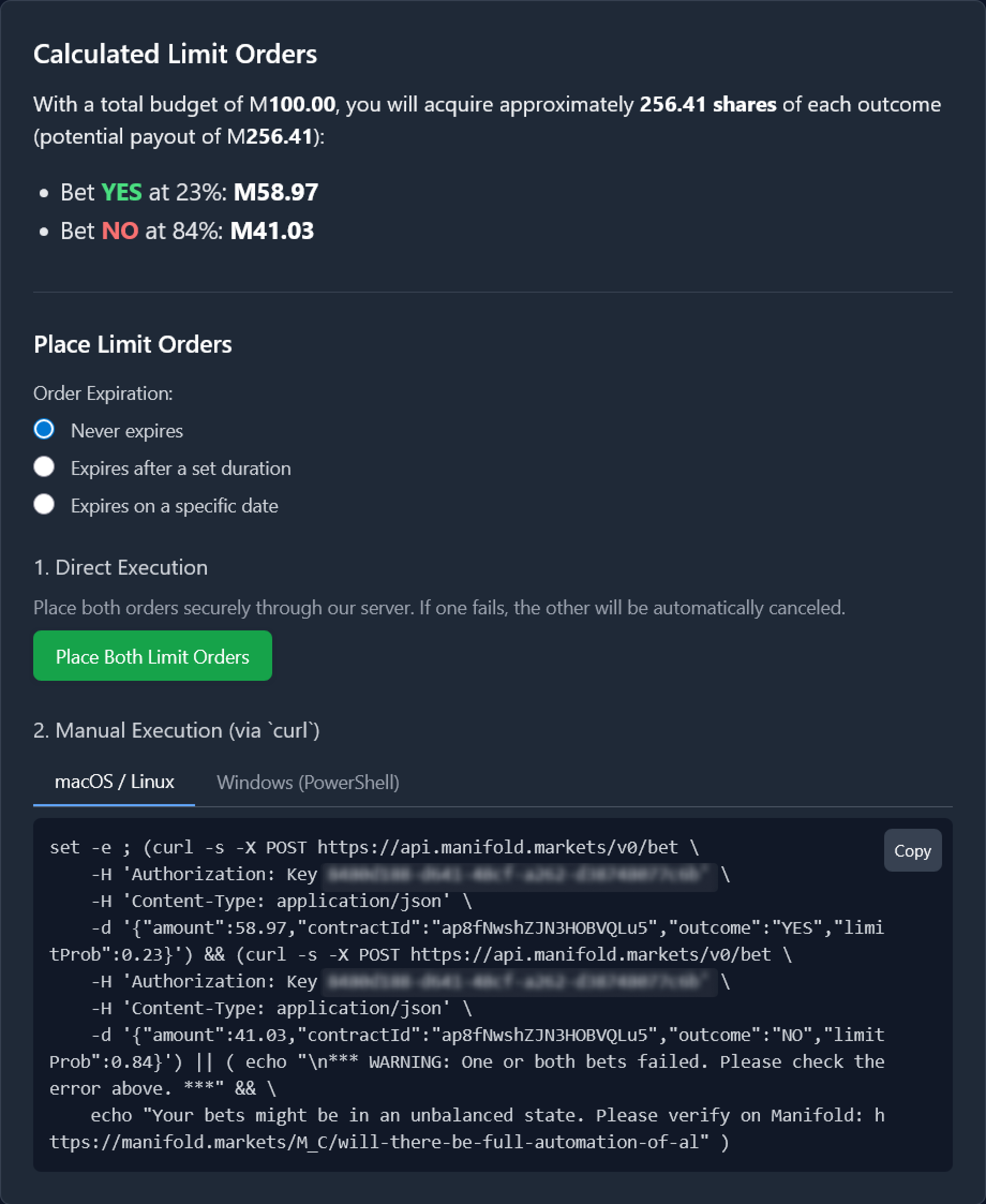

I added a limit order app to the website here: https://risk.markets/limits. It was inspired by this section of the FAQ. Give it a whirl.

View the full v2.1.4 release notes here. RISK is open source. Create an issue if you find bugs.

Scroll down to see screenshots.

Have a nice day.

And enjoy this picture of RICK the RISK raccoon relaxing after a long session of coding important internet tools.

Very cool!

If you want more ideas - here's 2 that I want.

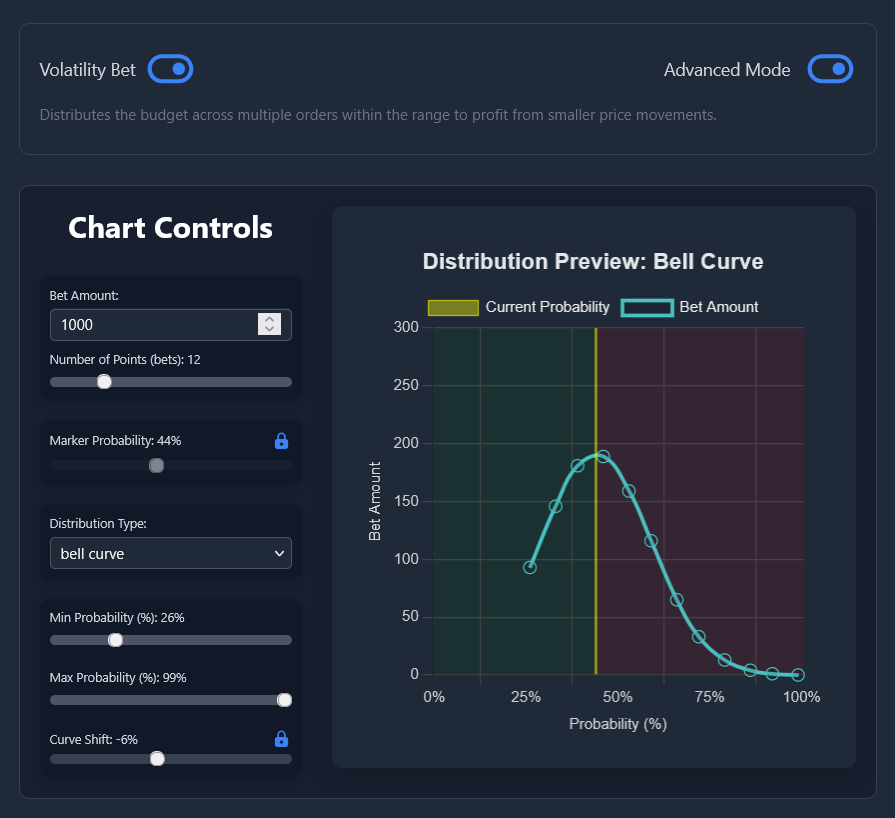

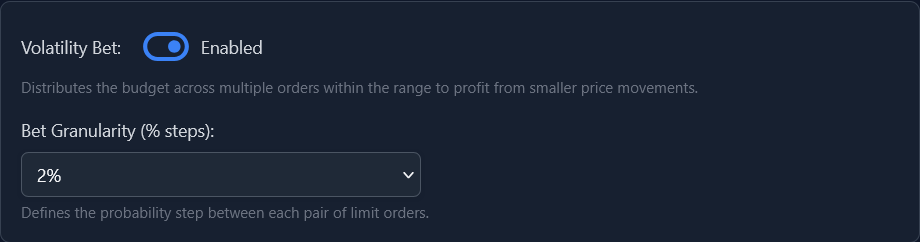

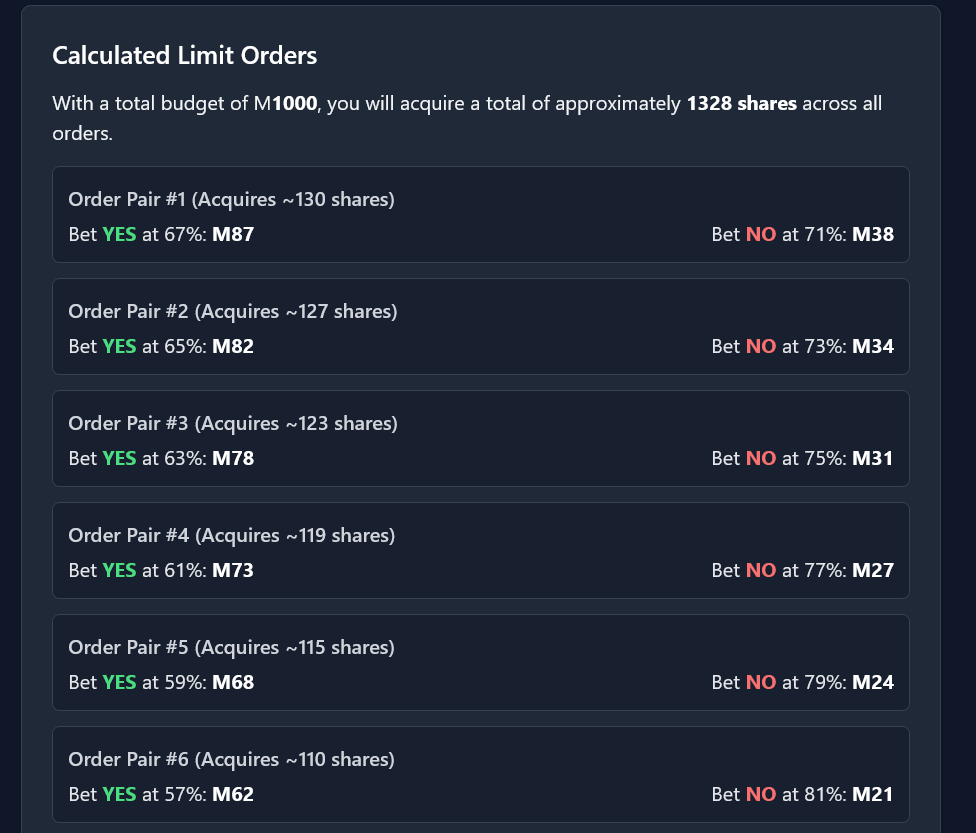

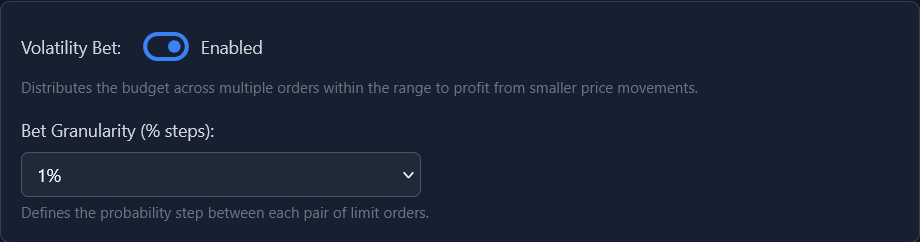

1) What limit orders to place for volatility trading (i.e. a market that continuously fluctuates between 35 - 45)

2) Arbitrage helper (user would input 2 markets that they believe should resolve the same or inversely. A more advanced version would be 3 markets that are correlated e.g. A resolves to the difference between B & C

Volatility Trading: To accomplish this, would it be good to do something like: place YES/NO at 39/41, 38/42, 37/43, 36/44, 35/45?

Arbitrage Helper: User would enter two (or more) URLs and the app should do what exactly?

Isn't there a question, how much to put at each end? if 3/10, yes on 3 makes a lot more than no on 10

I don't know bec every time I attempt arbitrage I lose on both - no idea how. :( It should say how much to put on each direction on each question taking slippage into account I guess?

I'm not sure I understand what you are saying. It sounds like you're acknowledging that betting YES on a market at say 30% will make a lot more mana than betting YES on a market at 60%, so long as the resolution is YES. Or in the case of a range, (say 35% to 45%), then to profit on the volatility, you will make the most mana by betting on the widest range (35% to 45% rather than 39% to 41%), however if betting on a range, you are also assuming that the market will in fact be volatile enough to fill those orders. So in order to make profits more likely, I'm saying that a set of bets could be placed throughout that range: So in the case of my previous example, you could be a large amount on 39/41, smaller bet on 38/42, smaller bet 37/43, smaller bet 36/44, smallest bet on 35/45. This way, if the market is less volatile than you imagined, you can still profit on smaller fluctuations. This seems doable and reasonable to me and I might just try and built it :)

I'll put some thought into it...

That makes sense...

I've never really thought about either, I don't do much "day trading" or technical trading but I've recently wondered about it

ⓂMANA would like to purchase your app for 10% shares of MANA. We will keep the app free but allow donations, of which you will get 75%

@100Anonymous ❤️ Not for sale but the code is open source with MIT license. I see you DM'd me as well, I'll continue the conversation there.