This question resolves Yes if, on December 31, 2025, it is no longer possible to purchase a new electric vehicle (EV) and receive a $7,500 federal tax credit or to purchase a used EV and to receive a $4,00 federal tax credit. If either of those credits is available to some buyers in the US on that date, this question resolves No. If the EV tax credits are substantially reformulated or there are serious ambiguities, I'll try to resolve them in the comments. If that discussion leads to no clear resolution, I'll resolve N/A.

Update 2025-05-24 (PST) (AI summary of creator comment): If the EV tax credit is continued by law through December 31, 2025 (and repealed thereafter), it will be considered available on December 31, 2025. In such a scenario, the market will resolve No.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ5,706 | |

| 2 | Ṁ494 | |

| 3 | Ṁ344 | |

| 4 | Ṁ340 | |

| 5 | Ṁ237 |

People are also trading

@MikhailTal It was an honor to bet against your 5 mana NO bets that you placed every hour for many months on a market that was guaranteed to resolve YES. Sadly the day of reckoning has come. I don't know what the person who operates your account was even trying to do here but thank you for the 5000 mana.

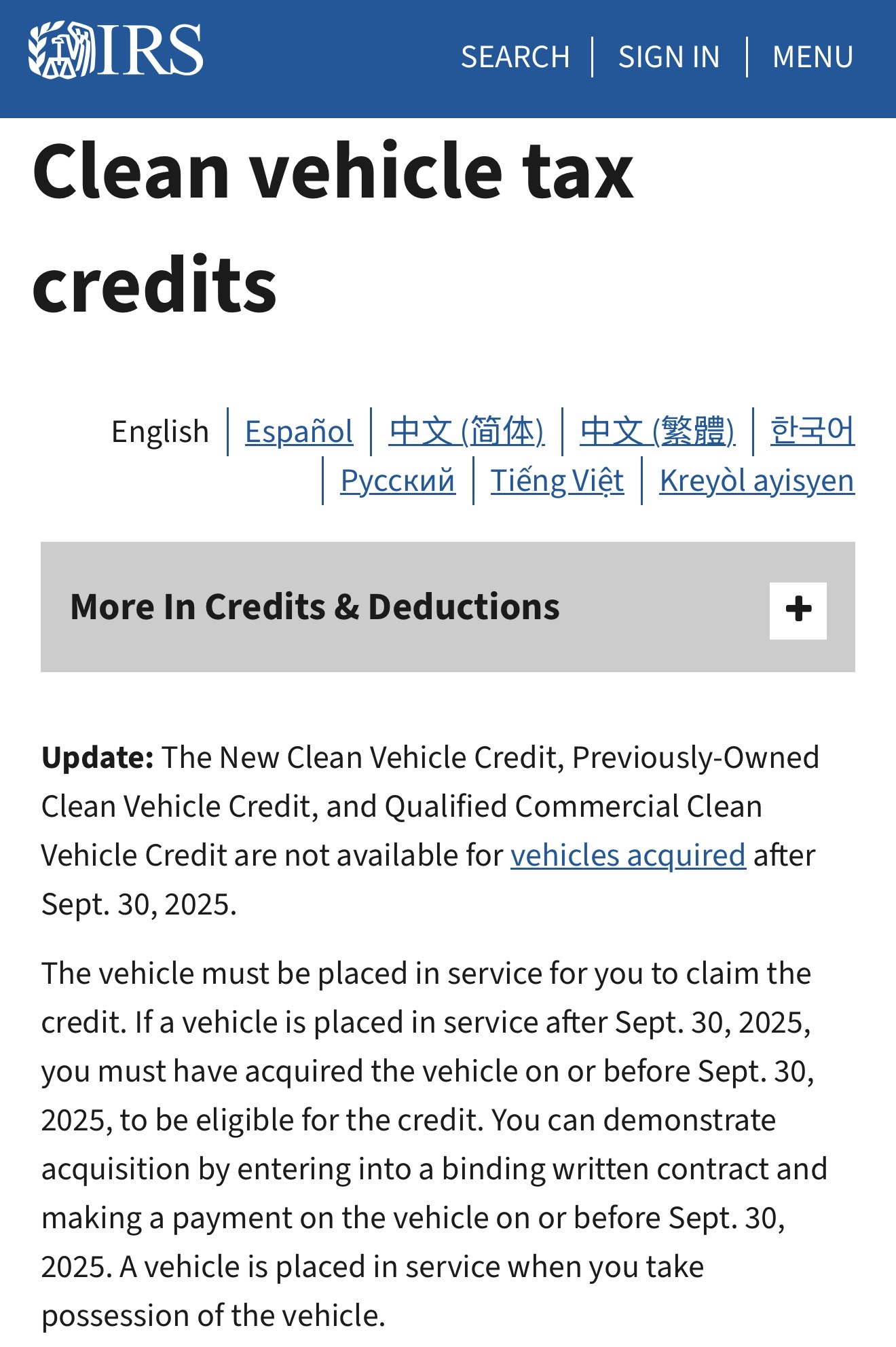

@mndrix as it is December 31 and it is no longer possible to purchase an EV and receive the federal credit, this can resolve NO. See, for example, https://www.irs.gov/clean-vehicle-tax-credits

i don't know why people are buying NO, this has been repealed already, and the last date you could buy an EV and claim the tax deduction was september 30, not december 31

https://www.congress.gov/bill/119th-congress/house-bill/1/text

SEC. 70501. TERMINATION OF PREVIOUSLY-OWNED CLEAN VEHICLE CREDIT. Section 25E(g) is amended by striking “December 31, 2032” and inserting “September 30, 2025”.

SEC. 70502. TERMINATION OF CLEAN VEHICLE CREDIT.(a) In General.—Section 30D(h) is amended by striking “placed in service after December 31, 2032” and inserting “acquired after September 30, 2025”.

@SaviorofPlant yeah, the friendly IRS webpage is also very clear

https://www.irs.gov/clean-vehicle-tax-credits

The New Clean Vehicle Credit, Previously-Owned Clean Vehicle Credit, and Qualified Commercial Clean Vehicle Credit are not available for vehicles acquired after Sept. 30, 2025.

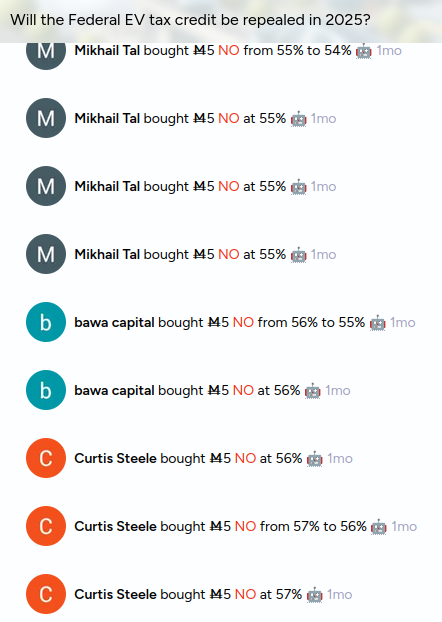

@SimonWestlake the reason this market isn't at 99% is because there's a bot which automatically places a 5 mana NO bet every hour. i have been farming it for a while now

Updating slightly downward because if the EV credit is repealed, there's a decent chance it won't take effect until January 2026 (the next tax year). Roughly half of the Inflation Reduction Act's tax credit changes took effect immediately, while the other half took effect in January 1 of the next year.

No new info as far as I can tell, but for reference: "Trump's transition team aims to kill Biden EV tax credit"