🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,938 | |

| 2 | Ṁ640 | |

| 3 | Ṁ631 | |

| 4 | Ṁ439 | |

| 5 | Ṁ270 |

People are also trading

The Chicago Mercantile Exchange federal funds futures market puts 62% on a 0.25 basis point rise and 38% chance of no increase at all.

Also, from Bloomberg:

The details of the [January CPI] report showed shelter was “by far” the largest contributor to the monthly advance, accounting for almost half of the rise. Used car prices — a key driver of disinflation in recent months — fell for a seventh month. Energy prices rose for the first time in three months.

Shelter costs, which are the biggest services component and make up about a third of the overall CPI index, rose 0.7% last month. Owners’ equivalent rent and rent of primary residence increased by the same amount, while hotel stays also climbed.

Because of the way the housing metrics are calculated, there’s a significant lag between real-time price changes and the government statistics.

I know CPI was higher than usual, which presumably makes people expect the Fed to plough on with hikes despite SVB, but I don't think it's as big of a deal as the headlines imply: these shelter costs are lagging indicator and, anyway, are Fed rates really going to bring down rent spending? It seems like a housing supply issue (and demand's always going to be fairly inelastic).

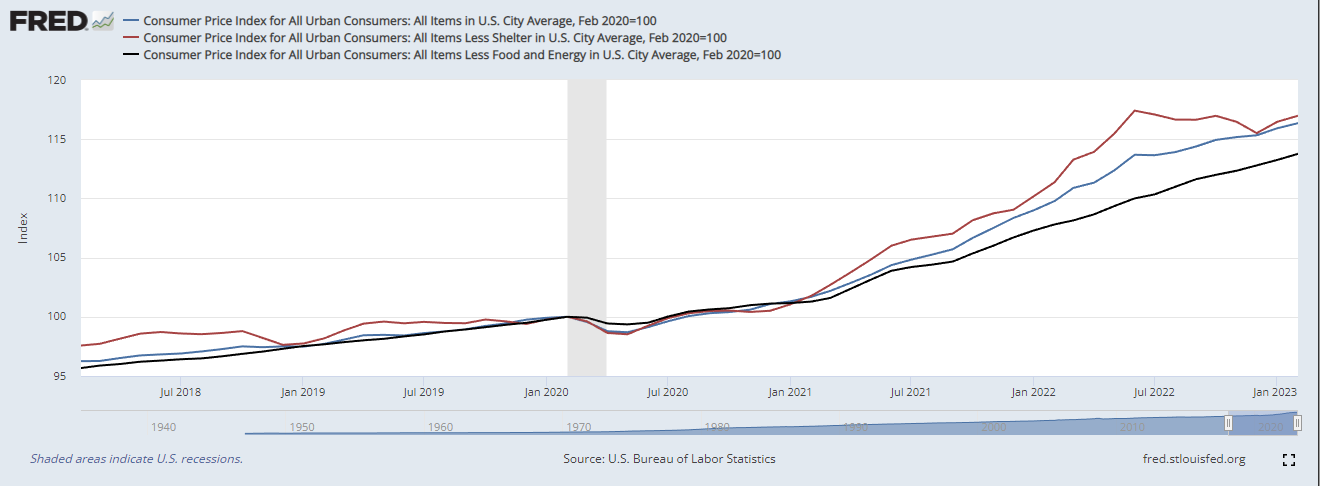

The prices for everything-but-shelter have been flat since June, it seems:

(I'm genuinely asking whether people expect interest rates to affect shelter costs by the way, I don't know much about macro...)