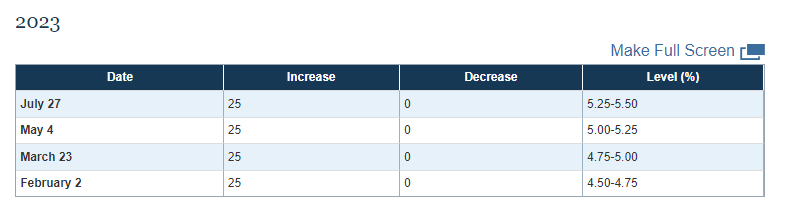

FED pivot is defined as the change in the approach of defining the upper bound of the target federal funds range, so-called 'interest rates'. The decisions on the target federal fund range are made by the Federal Open Market Committee (FOMC) meetings.

This market will resolve to "YES" if by December 31, 2023, the Federal Open Market Committee decides to decrease interest rates (over the level it was prior to the meeting), on any of its meeting.

The level and change of the target federal funds rate is published at the official website of the Federal Reserve at https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ2,586 | |

| 2 | Ṁ1,557 | |

| 3 | Ṁ235 | |

| 4 | Ṁ203 | |

| 5 | Ṁ192 |

People are also trading

Left this comment for Tyler in the other market, which is the same market: https://manifold.markets/itsTomekK/will-fed-pivot-in-2023

So Kalshi has this at 15% here: https://kalshi.com/markets/ratecut/federal-reserve-rate-cut#ratecut-23dec31

I have been watching the markets which were looking to call the FED's bluff and thought that FED would cut the rates by the end of the year, esp if the economy tanks. On June 27th, they were still at 25-30%, but now they are down to 15%ish as well.

A lot of it is because the economy has held up better than many expected. I'm expecting cuts in 2024Q1. Things may change, but leaving some alpha here.

@ozan The Fed is data dependent. If you have a view about the economy, what the Fed will do is going to resemble that.