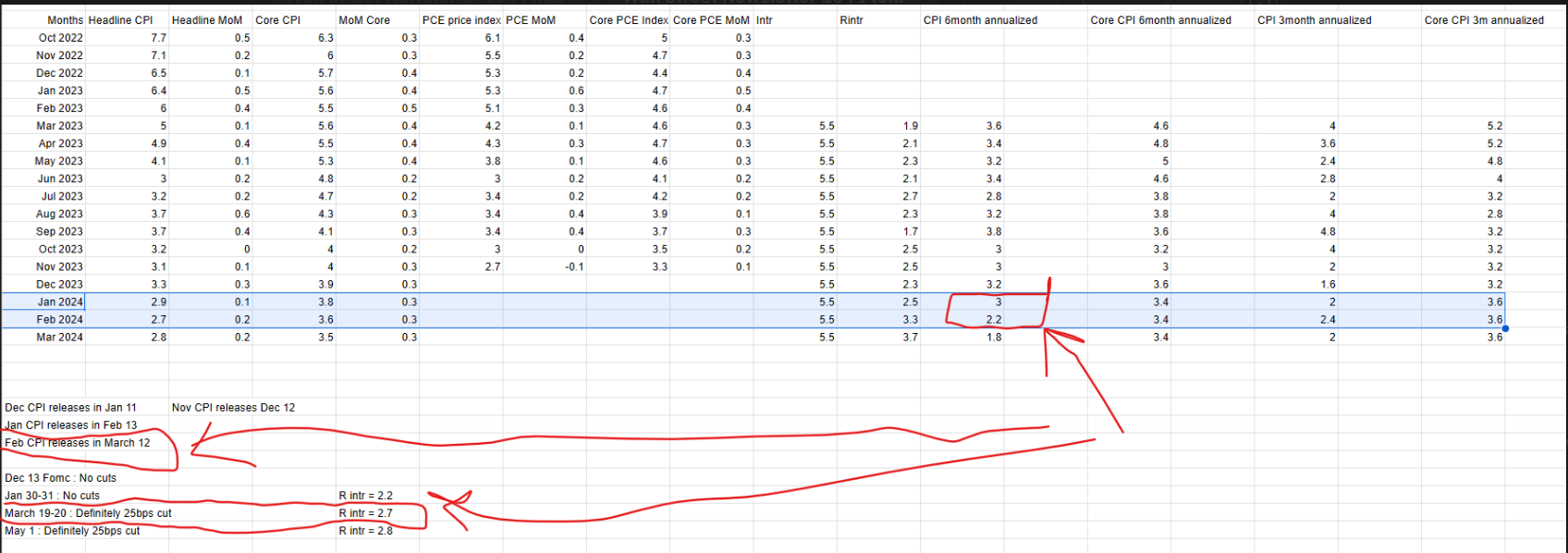

FED pivot is defined as the change in the approach of defining the upper bound of the target federal funds range, so-called 'interest rates'. The decisions on the target federal fund range are made by the Federal Open Market Committee (FOMC) meetings.

This market will resolve to "YES" if in mentioned in the title scheduled meeting, the Federal Open Market Committee decides to decrease interest rates (over the level it was prior to the meeting), on any of its meetings.

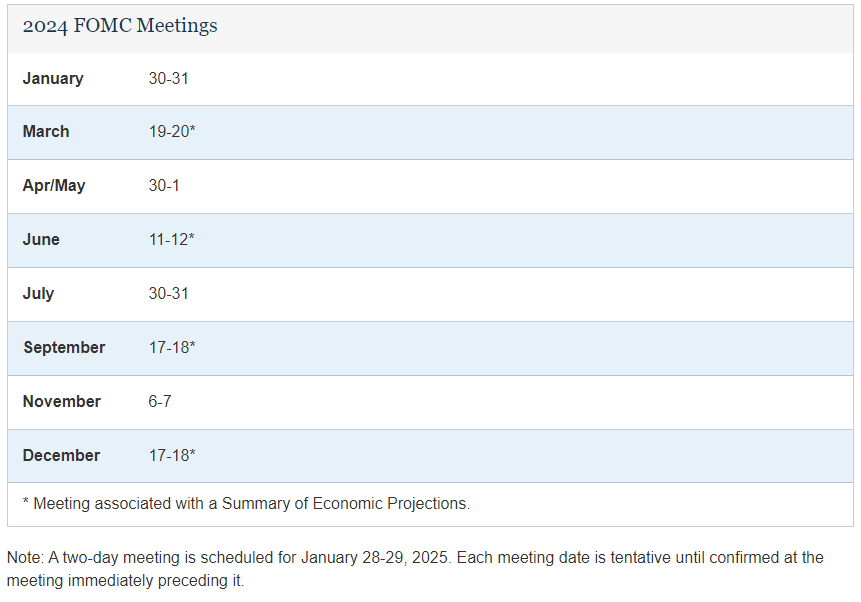

calendar of meetings

📅 FIND SUCH MARKET FOR OTHER DATES HERE

The level and change of the target federal funds rate is published at the official website of the Federal Reserve at https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,797 | |

| 2 | Ṁ1,675 | |

| 3 | Ṁ1,068 | |

| 4 | Ṁ538 | |

| 5 | Ṁ464 |

People are also trading

@riverwalk3 I think one thing a lot of people don't appreciate about e.g. the CME Fedwatch data is that the volume on those futures is very low even a few months out; imo it's unsurprising for a >3 month Fedwatch prediction to be "wrong" (in the sense of - giving a plurality of the probability mass to the wrong option)

@draaglom Inflation surprised to the upside and unemployment also surprised to the downside. GDP was much hotter than expected.