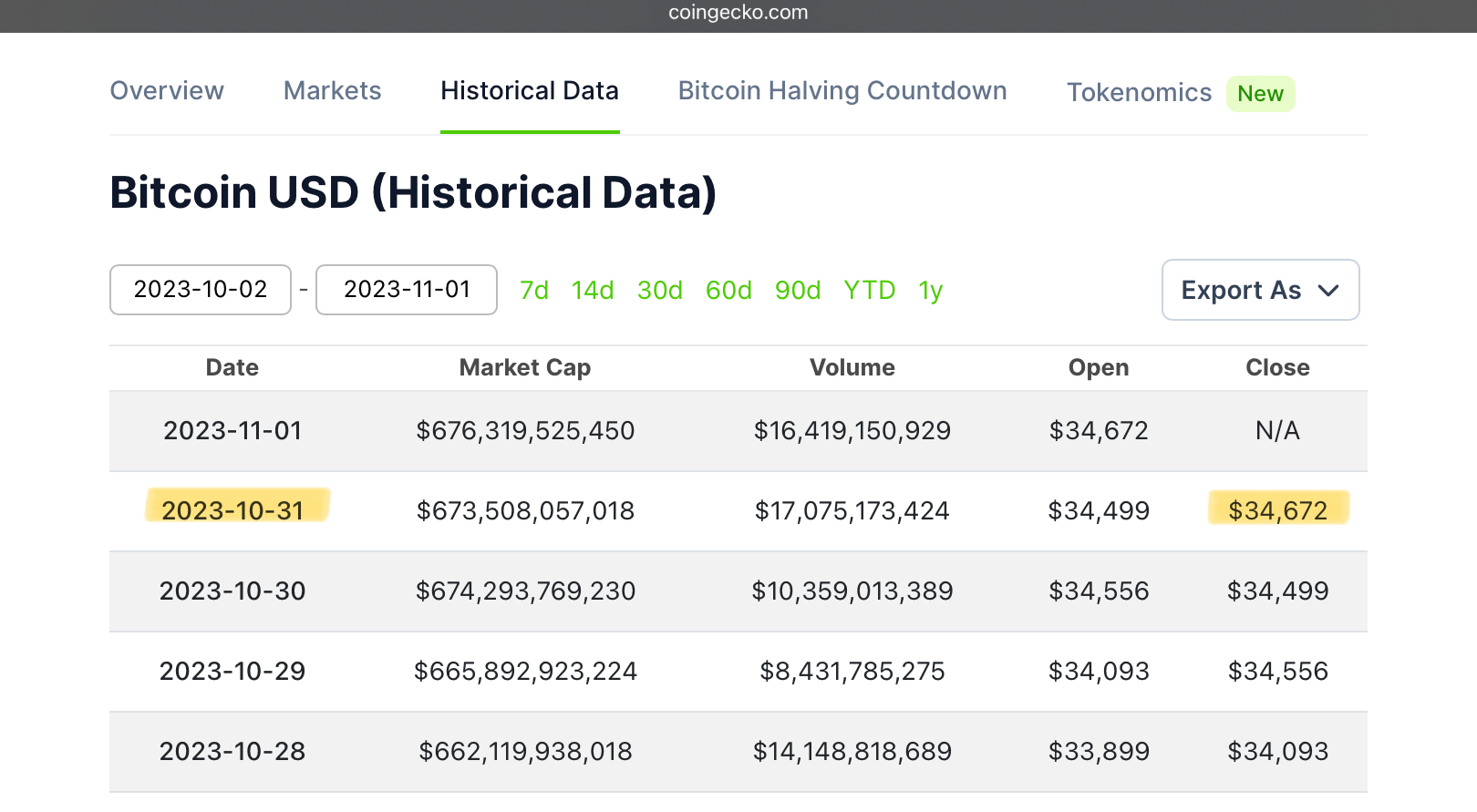

October 1st Open: $26,970

vs

October 31st Close... resolves based on Coingecko Historical Data

https://www.coingecko.com/en/coins/bitcoin/historical_data#panel

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ500 | |

| 2 | Ṁ194 | |

| 3 | Ṁ185 | |

| 4 | Ṁ169 | |

| 5 | Ṁ133 |

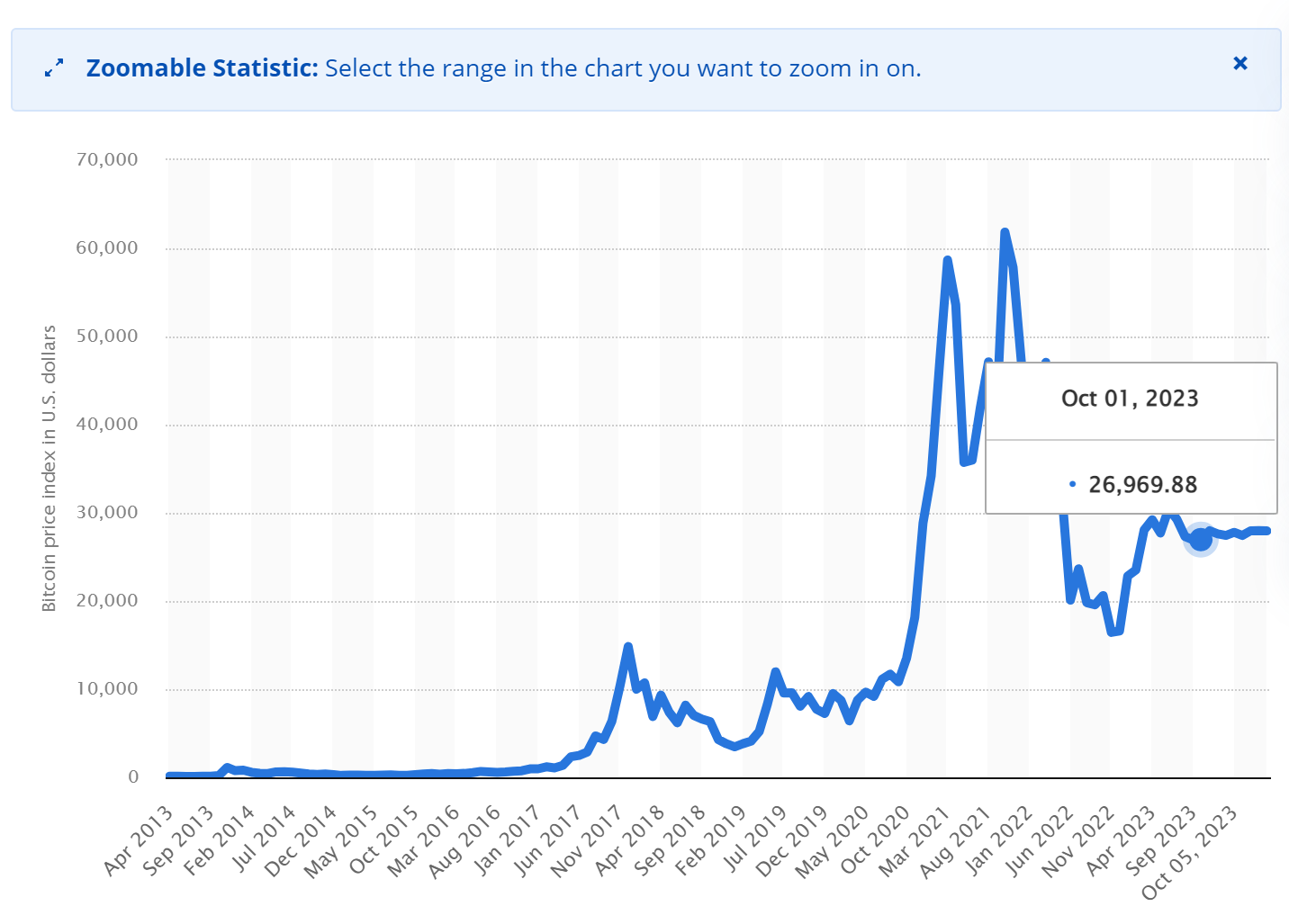

Bitcoin (BTC) will not close October higher than it opened. Bitcoin marked a big drop in the middle of August 2023 from $29 K to $26 K due to the factors that affected the demand of cryptocurrencies around the world (Coinstages, 2023). It was all caused by rising bond yields of the United States and also technical factors like competition in between the cryptocurrencies and demand and availability of them in the market (Coinstages, 2023).

The fear and greed index of bitcoin is at 52 for now while this considers to be normal however the index marked at 62 on July 2023 (Graw, 2023). The index can represent the trading volume on a particular cryptocurrency. Here is the reason why bitcoin cannot close October higher than it opened. The reason is that the breakdown hasn’t been managed to stay at its resistance level of $30,000, but ended up supporting $26,000 (Graw, 2023). Bitcoin may temporarily mark resistance level of $21,000 and $15,760 during the last quarter of 2023 (Graw, 2023).

Citation:

Coinstages. (2023, August 19). What caused the crypto market crash on August 17, 2023? Binance. https://www.binance.com/en/feed/post/993402

Graw, M. (2023, October 20). Bitcoin Price Prediction 2023, 2024, 2025, 2030. Techopedia : https://www.techopedia.com/cryptocurrency/bitcoin-price-prediction

I checked statia, Opning Bit Coin's Value is 26969. I was calulating the mean, mode,median from October 1st to 16. Considering 95% confidence range, there is no outlier. Although the number of samples is small, the changes are gradual and the mean is slightly higher than the opening price, so I have determined that the price will continue to rise at a slower rate than the opening price. Crypto have few metrices available that allow for forecasting, if only because it is rumored that only few cryptocurrency holders own a large portion of available supply. And, most people who use crypto worldwide are retail clients rather than institutional investors. This means outlooks on whether Bitcoin prices will fall or grow are difficult to measure, as movements from one large whale already having a significant impact on this market.

@YayoiTaniguchi I agree with your overall prediction, but I think the methodology is wrong: You are not taking into account many determining factors of Btc price. These are: strong correlation with NASDAQ, the recent news regarding Spot ETF filed from many Asset Managers, moving average and overall trend. The bet would be a YES since, considering all these variables I just mentioned. But just yesterday it tried to break the ceiling of 30.000$,twice, with no success, and usually when this happen it can signal a bearish trend. It would mean a 10% decrease in price to reach back to <27.000$. The factor you are not taking into account is the MA 15 indicator which signals a much higher trading price in the last 3 days, and for the rule of mean regression there is the danger that BTC will fall to re-test specifically that level, with the risk of big players of rapidly shorting the token down to 26.500$ and with the purpose of eating all the retail investors with stop-loss at 26900$. So, even though the chances are in favor of BTC NOT falling below 26969$ before October, I would still be careful in the analysis done.

@MichelePittarello Thank you, I learned a lot. 👍 Where can I find out about "strong correlation with NASDAQ, recent news about spot ETFs submitted by many asset managers, moving averages and overall trends''? Even if they exist, I don't think it is statistically predictable.

@YayoiTaniguchi You can find everything in tradingview or yahoo finance and download the datapoints. Moving average gives a big predictability when paired with price patterns, because the overall market trends to follow the rule of mean regression. News about ETFs are all over the place, just check in your favorite newspaper (times, wsj, Bloomberg, economist) or YouTube channels about finance.