State-level markets = boring, played out. Manifold deserves to speculate on midwestern counties they haven't the first clue about.

For reference:

https://www.nytimes.com/elections/2016/results/pennsylvania

https://www.nytimes.com/interactive/2020/11/03/us/elections/results-pennsylvania.html

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ35,288 | |

| 2 | Ṁ1,057 | |

| 3 | Ṁ668 | |

| 4 | Ṁ251 | |

| 5 | Ṁ205 |

People are also trading

I found a lot of good information on this page:

https://vote.phila.gov/resources-data/commissioner-meetings/commissioner-meetings/

In the 2024-11-19 meeting, the board certified a particular set of numbers, but then on the 2024-11-25 meeting (watch the video here, it is only 6 minutes long), there were an additional 895 countable provisional ballots added and they re-certified the final results.

Based on watching this meeting, I would really like to see the actual thing they signed with the computed results, but the lady who reported the new totals was very specific that this info would be on the website. And the 2169 write-in votes were definitely included in the 2024-11-19 numbers (you can find the transcript at the link).

NOT counting the write-in votes feels like a weird thing to do since these folks certified those as real votes. But every data export and chart I can find on the PA-wide site omits all write-in votes for every county. Like the Delaware County report I found in a different comment here said 'official' on it, but the PA.gov website did not include that county's write-in votes.

@Eliza Aha, I finally found the actual report of the write-in votes for Philadelphia!

https://vote.phila.gov/media/write-in_24G.pdf

So this report says that Anthony Fauci got one write-in vote for President and Vice-President, but the PA-wide election results page does not seem to list that specific vote anywhere. Hmm.

@Eliza From the 2024-11-19 meeting:

These figures are 869 short of the total votes now reported on the website, so presumably 869 of the 895 ballots added in the 2024-11-25 meeting included a vote for President, and the other 26 did not.

@polymathematic Do you now agree with Eliza that the resolution should be NO? Or do you still think there is a case for N/A or YES?

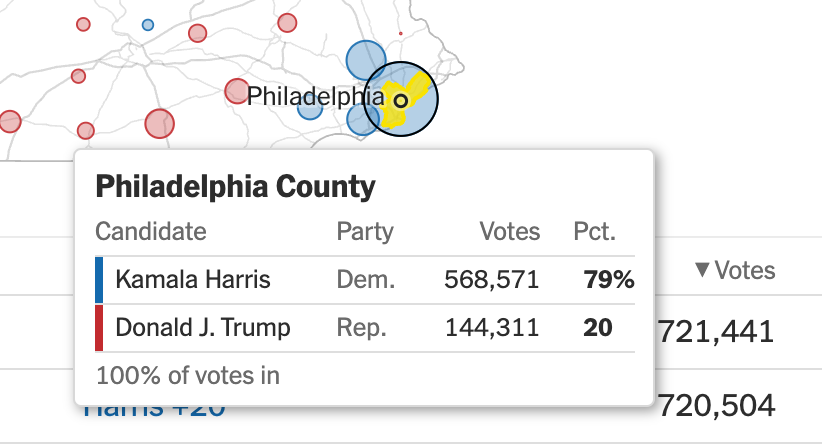

@mods @traders @creator I strongly object to this resolution. First of all, it's not clear to me why no one has checked in with @dlin007 as to his original intent in how to resolve the market. In absence of that, all we have to go on are the links in the description. The analogous link for 2024 is here, and it has Trump at 144311 out of 721441 (pictured below for reference), which is ever so slightly above 20% (20.003%).

If the links in the description aren't sufficient to resolve, then surely the next best thing are the official results, which match the NY Times numbers precisely. Why would we be going with the unofficial results instead? To be sure, I have no idea what makes them unofficial or why there's a discrepancy, but in light of the only information referenced in the description and the way the official results are computed, I can't see why this market would resolve NO. At worst, it should N/A.

@polymathematic Because Pennsylvania simply doesn't include write-in votes in the official results, but does in the unofficial results. This is the only discrepancy.

This just comes down to, do votes for invalid write-in candidates count as votes? I think so. I believe that a NO resolution is appropriate (full disclosure: I don't hold any shares here, but I hold shares on meta-markets that would benefit from a NO resolution here)

@Robincvgr It's not clear to me if the market creator is allowed to resolve the mana one however they wish, but if it was my market I would be furious if I didn't get to.

@Robincvgr see this report from another county that is specifically labeled "official" and includes the write in votes, while the statewide site omits them and has a different percentage:

https://delcopa.gov/vote/pdf/2024/Write-InCumulativeResults-11-22-2024_03-17-32PM.pdf

@Robincvgr it's not clear to me how we're supposed to know pennsylvania doesn't include write-in votes in its official results. surely they would if a write-in candidate had won! from a brief search, it seems like different counties have different procedures for how voters should make write-in choices. couldn't it be that these votes weren't simply invalidated 'cause they didn't follow philadelphia county rules, whatever they happen to be? (i couldn't find such rules specifically for philadelphia county.)

bigger picture, this kind of parsing is exactly the problem with relying on an unofficial count that the creator never referenced. the only source the creator referenced would lead to this market resolving YES. in absence of clearly dispositive evidence otherwise, i think that's what should happen.

i said in a different comment that i had no opinion on the sweeps side. my only interest here is the mana side, and while i'd prefer to be up 3k than down 3k, it's just pretend money. but if i DID have actual money on the line here, i think it'd be pretty upset to see the sweeps market unresolved and then resolved NO against the official count and the only referenced material from the description.

@polymathematic I think there is/was still time to find out more info before resolving and that's why I was trying to ask questions like this in the comment section. Whoever decided to resolve it apparently had different ideas.

My next line of research was going to be looking for the actual official results and not just the summary style page shown on the statewide site to see if there is more info somewhere.

@polymathematic Bro wasn't worried when the market resolved 99% yes. Lol. All of a sudden we're talking "you can't just presume..." 😆 Just take the L on this one, you'll recoup it somewhere else no problem. Resolution is pretty clear, cut and dry on this one my man.

@Predictor to make sure I have no undue bias here, I'm happy to donate the 3k mana to you if/when the market resolves correctly. tis the season!

@polymathematic We weren't using any random unofficial results, it was from the official website of Philadelphia, and there's reason to believe that even though it says "unofficial" results (i.e. not final results), the results are actually final.

It's bad that the PA and Philadelphia results don't match up with the write ins, but clearly PA is omitting reporting write ins for each county rather than Philadelphia just making up the votes.

@bagelfan i certainly see how that could be the case, but i don't see how it's clear that is the case. no one has cited any particular document about how philadelphia county specifically or pennsylvania counties in general handle write-in votes. the only thing we have is an unofficial page that has write-in votes and an official page that doesn't (and the NY Times page, which matches and is presumably following the official results). like i said above, i'd certainly rather have 3k mana than not, but more than that I'd like to know when i can expect an unnamed mod to take over my market or a market i'm betting on and change the resolution without any explanation over and against whatever is available from the description. (to be clear, this criticism is not directed at @Eliza, who has been transparent and helpful.)

@Robincvgr i have no reason to chime in since Manifold mods have taken over resolution of both markets and I mentioned somewhere down below i would simply mirror what they did with the sweepcash market (which I can't do anyway since they resolved both markets)

but if i DID have actual money on the line here, i think it'd be pretty upset to see the sweeps market unresolved and then resolved NO against the official count and the only referenced material from the description.

Thanks, that's me. I currently have a -138.84 sweep cash balance due to this market being resolved NO currently. Allow me to occupy the role of being pretty upset that "the sweeps market unresolved and then resolved NO against the official count and the only referenced material from the description".

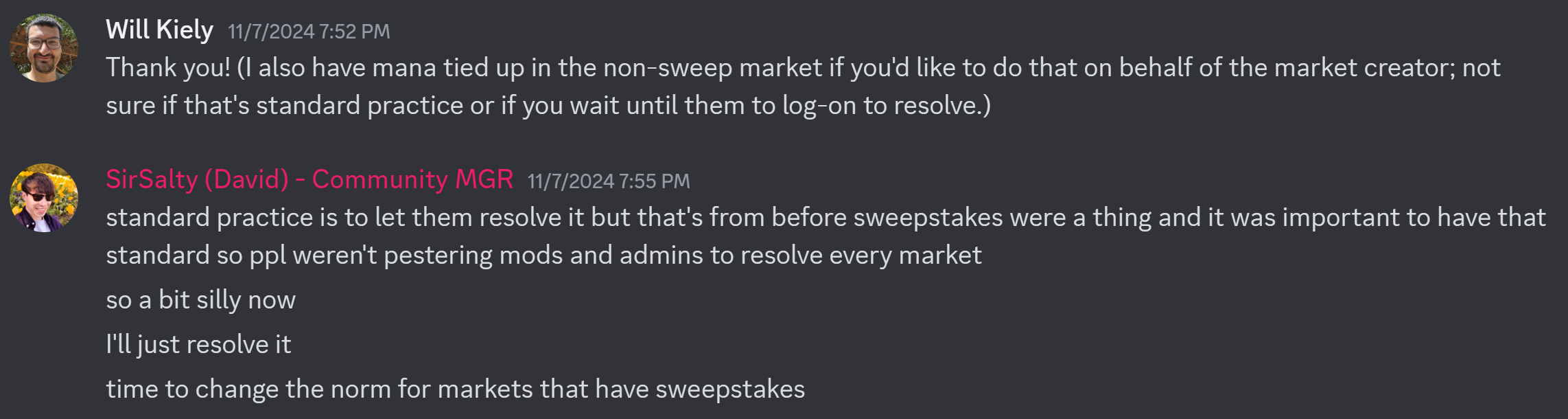

@dlin007 Re your "i have no reason to chime in since Manifold mods have taken over resolution of both markets", note that on Discord when I originally asked the mods to resolve the market YES the mod's given reason for taking over resolution of the mana market was convenience, not because you shouldn't have a say:

As such, I think your original intent about how to measure the percentage of votes for Trump (official count, unofficial counts, etc) does matter. I think you chiming in does make sense.

@WilliamKiely Link to Discord screenshot image: https://discord.com/channels/915138780216823849/1304237980956753951/1304247231175721022

@WilliamKiely the market creator is not supposed to have control over sweepstakes markets, only manifold staff controls them

@bagelfan I know. My replies were about why the market creator's intention for how the mana market should resolve still matters.