Last price: 2023-10-31 $170.77

(will try to update major moves or every Friday after Nasdaq close)

Resolves YES if AAPL trades >= $200 during any regular Nasdaq trading session (09:30-16:00 ET) up to October 31, 2023, and NO if that hasn't happened by then.

Reference is publicly-quoted intraday high price, adjusted for any future stock splits. For example, if it splits 2:1 at $180 then quoted prices next day would be $90 but reference price for this market would be x2. Alternatively, I might update the title and resolution criteria to use the post-split price corresponding to the current $200, so would change from $200 to $100 in the 2:1 example (I'd appreciate suggestions in comments regarding these two alternatives, likely most relevant for longer-term markets).

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ1,118 | |

| 2 | Ṁ342 | |

| 3 | Ṁ340 | |

| 4 | Ṁ207 | |

| 5 | Ṁ189 |

People are also trading

Apple’s current stock is at $172.88, which is over 2% lower than the previous day. Apple would need about a 15.69% increase to reach $200 by the end of October. Even though Apple is one of the most successful companies, it is at a current slow growth, in fact, shares have been down about 10% since august. Based on Apple’s current performance and their slow growth in stock, I do not see a possibility where they could reach $200 in stock by the end of this month.

Percentage increase calculation = (($200-$172.88)/$172.88)*100 = 15.69%

Reference:

https://www.fool.com/investing/2023/08/28/apple-stock-might-not-reach-250-in-2023/ (https://www.fool.com/investing/2023/08/28/apple-stock-might-not-reach-250-in-2023/)

https://finance.yahoo.com/quote/AAPL?p=AAPL (https://finance.yahoo.com/quote/AAPL?p=AAPL)

Reasons for "NO"

1. The considered events by Oct 31, which can lead to 200.00 USD, are a significant decrease in the U.S. treasury's 10-year bond yield or an announcement of a new product. But their probability is supposed to be low.

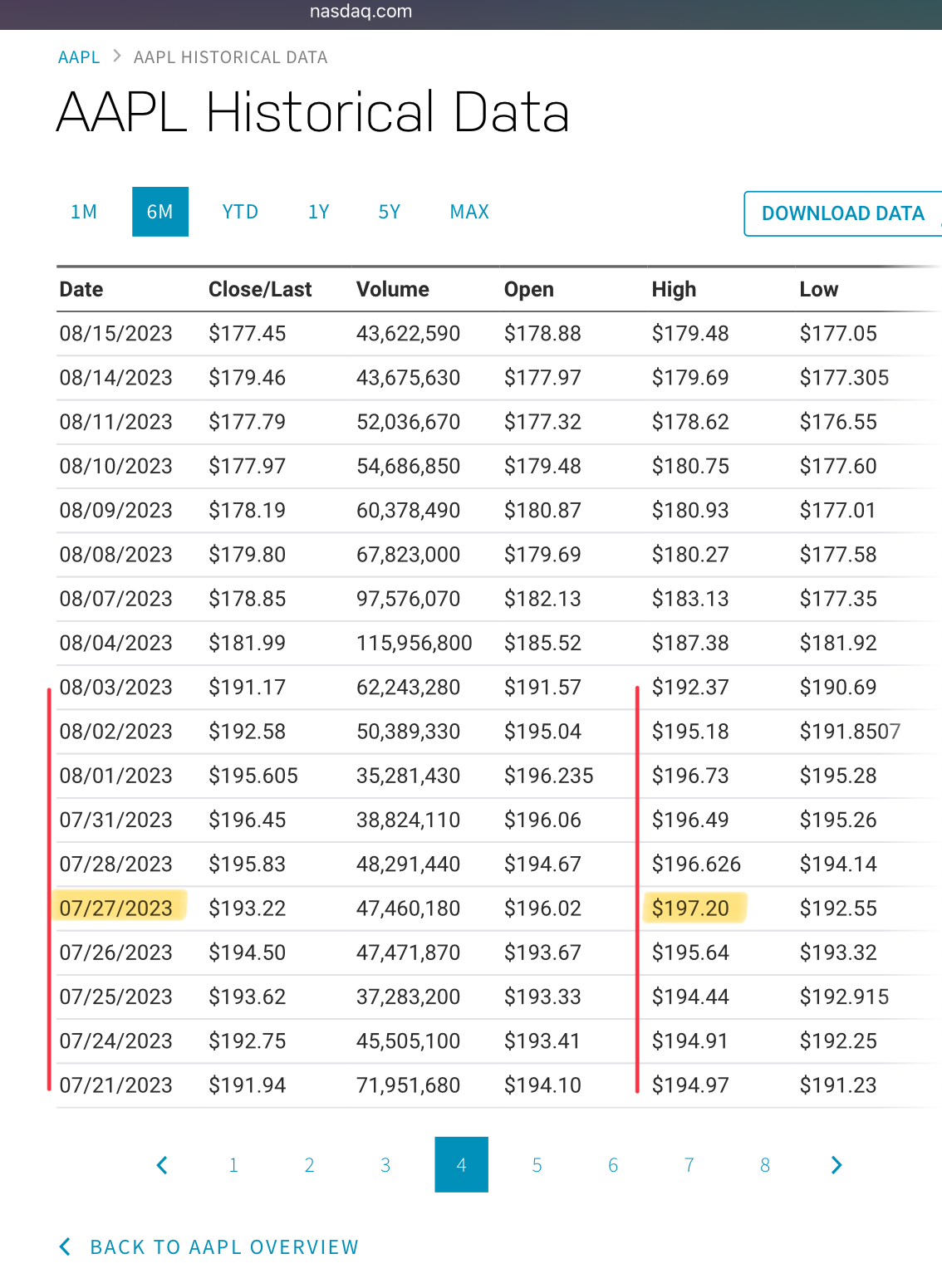

2. We can see a descending triangle starting this August on the stock chart, representing even lower in the future.

3. An even higher confidence bound price on Oct 31 is predicted at 169.90 USD on the forecast sheet in Excel, which is lower than the price of 200.00 USD.

@YoheiMaekawa thanks! looks cool but what is it based on? also, the stock bottomed and rallied off 170 yesterday so you may wanna update the forecast, not that it would affect this market at all, but perhaps for this: /deagol/will-apple-stock-aapl-fully-break-1-846f9490f46

@deagol Thank you for sharing the new movement of the closed price!

The forecast sheet is based on the historical closed prices between June 20 (the closest date to the starting date of the post)and Oct 20 on Yahoo Finance.

Does it resolve YES if anyone sells their share for $200? 🤔

We need a whale to manipulate the market 😏

Apple's stock price was valued at 129.93$. As of today, Oct 3rd, the stock price of AAPL was 172.40$.

Meaning that the price has been increased by 32.68%. Assuming that no life-changing events will happen in the near future, it is unlikely that AAPL will hit 200$ by the 31st.

It is also worth mentioning that the stock price had reached a local maximum of 189.70$ around September first, with the launch of new iPhone and Watch models. And it has been decreasing ever since. As a result, since Apple will not announce the release of any other products this year, we can assume that the stock price will not pass the local maximum of 189.70$.