I will initially bet ᛗ50 on YES, then every day for 50 days, I'll bet the ᛗ1 from the daily 2% margin loan, also on YES. I will never sell, nor buy NO.

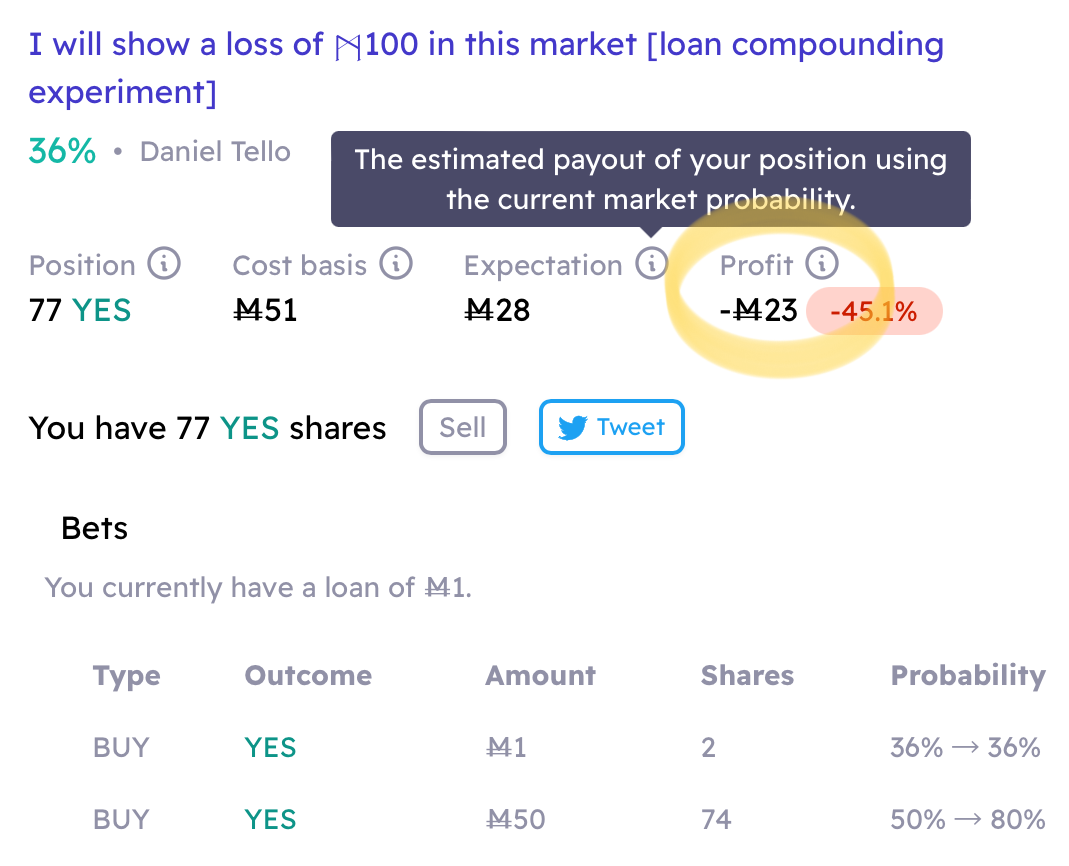

Resolves to PROB matching my total loss as shown by the interface at close (which assumes a payout based on the market probability by then, e.g. see screenshot below would resolve to PROB=23%). If it shows a profit or breakeven, it resolves NO.

Mar 4, 2:10pm: I will show a loss of ᛗ100 in this market [loan compounding experiment] → How much of my ᛗ100 bet on YES will it show as a loss at close? [loan compounding experiment]

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ39 | |

| 2 | Ṁ12 | |

| 3 | Ṁ0 | |

| 4 | Ṁ0 |

People are also trading

A toy example just to check I understand: suppose you buy YES shares at an average of 50%. You end the experiment with 200 YES shares that you spent 100M on.

If on the last day, somebody bought NO to 33%, your shares would be worth just 66M and you would show a profit of -34M. In this case, you would resolve the market to 34%?

If, on the other hand, somebody bought NO to 10%, your 200 YES shares would be worth just 20M and so your profit would be -80M and you would resolve to 80%? (So the person who bought all that NO to drive it to 10% would have made a big error.)

Have I understood your resolution criteria correctly?

@Fion @deagol It is a self correcting system, assuming everyone bets with their best self interest in mind, but there are always those "agents of chaos" that would be willing to take a personal loss just to upset the system.

I think the optimal solution is 30% and that Fion will out perform everyone else.

@deagol I don't think this is free money. If the price goes close to 100%, you will show profits, and it will resolve at 0%. If the price goes close to 0%, you will show losses, and it will resolve at close to 100%. Is that what you intended?

@jack I think NO could still profit down to 30% but must prevent me from buying cheaper than 29%.

@deagol Sorry, where I said “must prevent me from buying cheaper than 29%” I meant the opposite, must force me to buy below 30% as NO wants me to make profits or lose small.

@deagol so say a NO buyer drives the price to 5% right now and limits it there. My daily mana then buys 20 YES 49 times = 980 added to the 77 I already have, then to ensure a <5% resolution thus my profit >-5, needs the last price p such that 1057p-100>-5, or p>9% requires selling some (around 110 shares if there’s no limits to push through) of the NO before close to make a profit. I think there’s similarly profitable last-minute counter strategies for YES (forcing me to buy high but leaving a low price at close thus ensuring I show a big loss).

@deagol what are the extremes unlimited whales could achieve?

For a NO whale, drive it to 1% now and put a huge limit there. I buy 49x100 end up with 4977 YES shares, then whale must ensure market closes >2%. Easy?

For a YES whale, say they cut in front of my 49 remaining YES buys, forcing me to buy at >40%, I’d get <122.5 shares added to my 77, and YES wants me to lose more than 40 (to resolve >40%), 199.5p-100<-40 gives p<30%, but ideally much lower. Seems opposition whales’ limit orders could stop it? I don’t know.

@deagol @jack So I think an unlimited NO whale could in fact squeeze “unlimited” profits by setting the price as low as they want (and defending it which I guess is the hard part), say 0.1%, then I’d buy 1000 Y shares 49 times, and then make sure I don’t lose (resolves N), so for the close just sell a few N to leave the market higher than p:

49077p-100=0 => p=0.2%

@deagol “unlimited” ok more like —how was it they call it? Something like, monotonically increasing but bounded, I think.

@deagol @jack Right now only 3k on NO drives it to 0.1% and would profit 80, and then 1k every day for 49 days counters my buys (but I’m sure there’d be speculators to fend off) would profit some more. Any extra Y fighting it adds more potential profit. Last day sell a few, showing me at no loss, resolves NO. All YES speculators can do is dump last minute, but you’d dump back realizing those bits of profit (last player who dumps gets those bits). You’d always get at least the 80 plus my 49 (since I can’t dump). How does this fail?