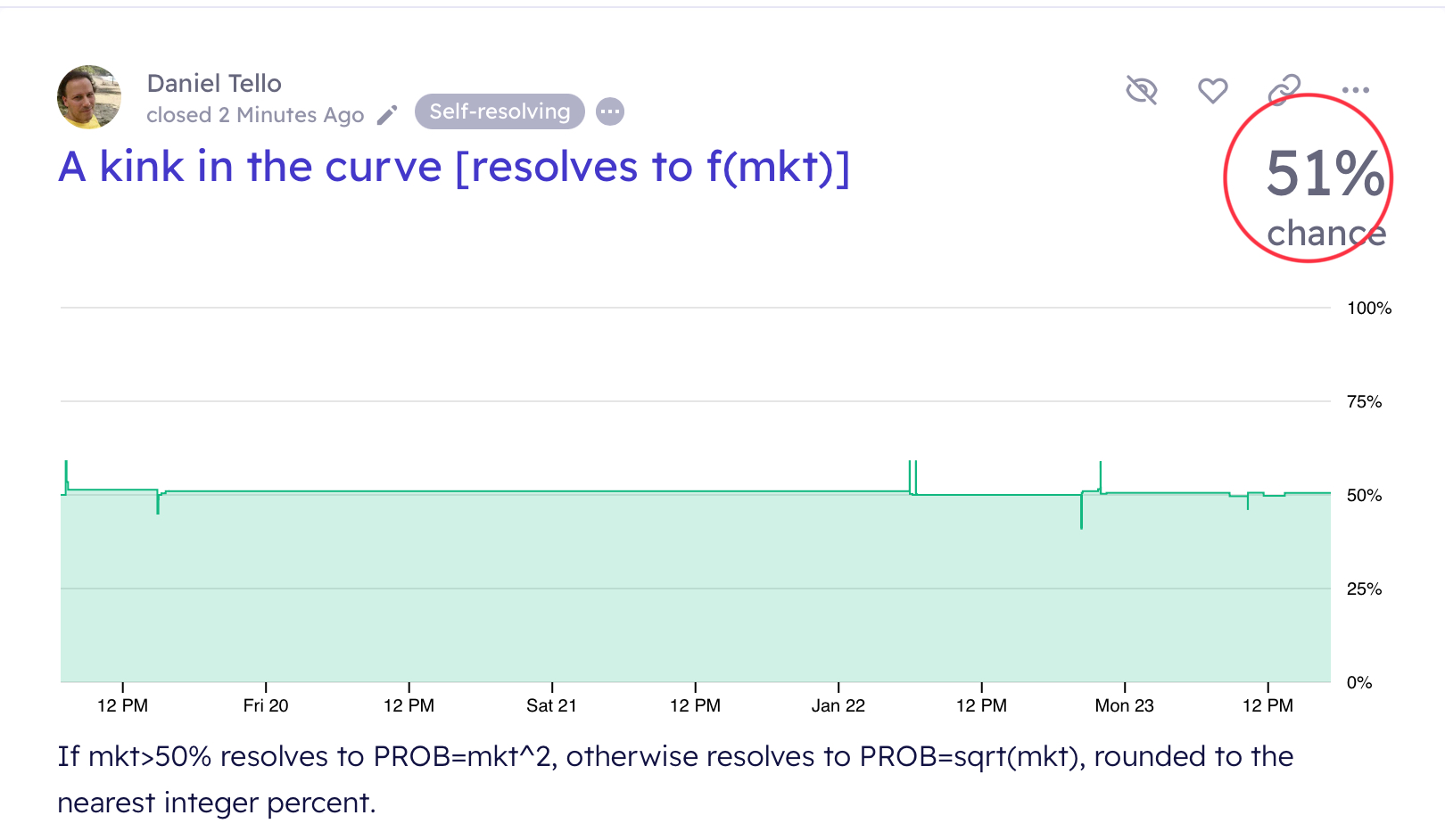

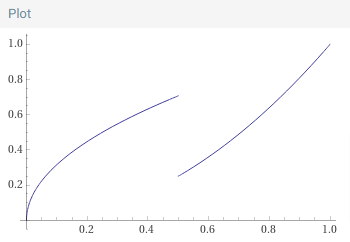

If mkt>50% resolves to PROB=mkt^2, otherwise resolves to PROB=sqrt(mkt), rounded to the nearest integer percent.

By mkt I mean the market's predicted probability or "chance" as shown by the interface at close (a 2-or-3-decimal number between zero and one). For example, if the "chance" predicted when the market closes is:

60%, resolves to PROB=(0.6)^2=0.36 =36%

1.3%, resolves to PROB=sqrt(0.013)≅0.11402 ≅11%

Market closes at some random time during Monday 1/23/23 EST unless there's trading within the latest 60 min, in which case it closes at a random time between 30 and 60 minutes later regardless of any further activity. I will not actively buy any shares past Sunday EST, but I reserve the right to set protective limit orders or liquidate all or part of a potentially losing position up to when I first check the market on Monday.

Close date updated to 2023-01-23 11:59 pm EST

Close date updated to 2023-01-23 4:15 pm EST

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ1 | |

| 2 | Ṁ0 |

Yesterday I generated 2 random numbers (0-1 fractions) defining 2 times: time1 (based on rand1) for initial market check/close attempt, and time2 30-60 minutes later (based on rand2) in case there was trading activity in the 60 minutes prior to time1. These were the values:

rand1=.677 -> time1=4:15 pm

rand2=.421 -> time2=4:58 pm

The first is simply the rand1 fraction of the day, and the second is time2=rand1+(1+rand2)/48, both expressed in HH:MM (rounded to the nearest minute).

Verification string for MD5 hash as posted yesterday (remove quotes): "rand1=.677 time1=4:15 pm rand2=.421 time2=4:58 pm"

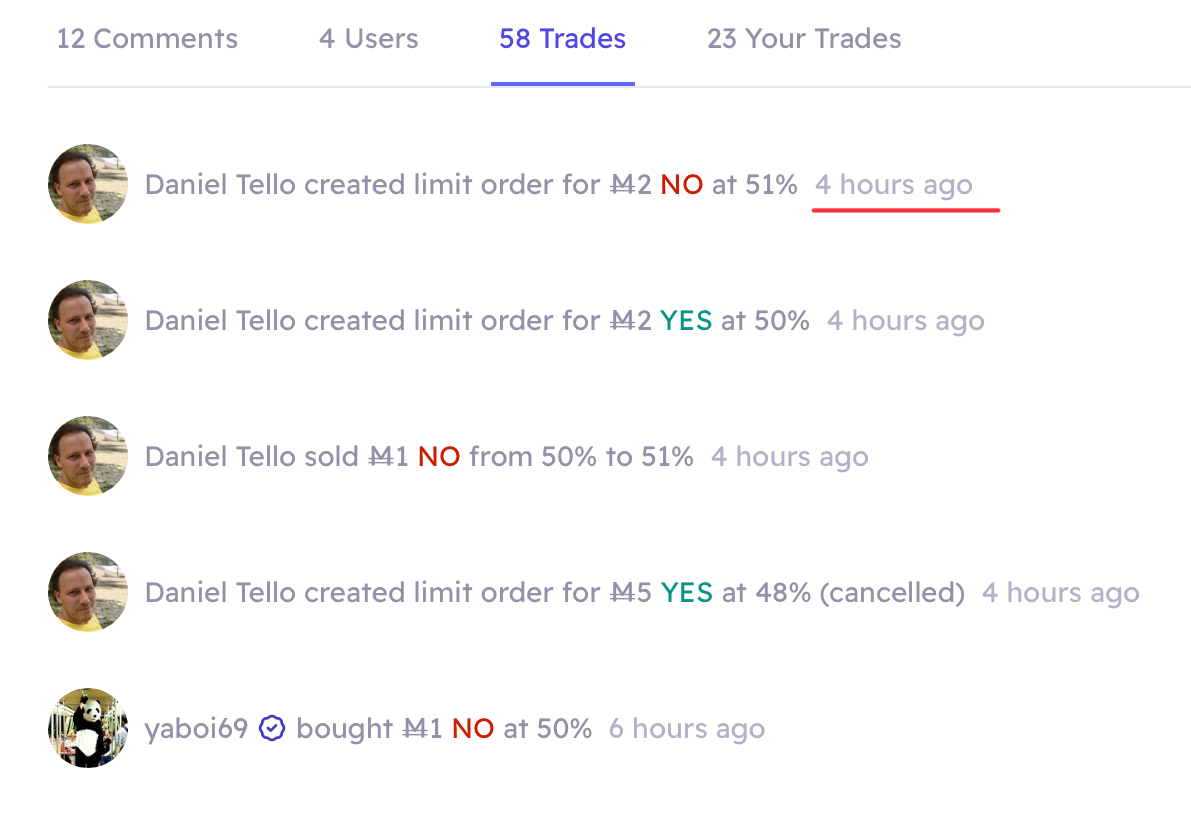

@yaboi69 As stated in the description, I won’t buy any shares beyond today, and I think these are of the “last player wins” kind. I do reserve the right to sell off part or all of my position tomorrow, or set protective limit orders (i.e. not price-moving at the time they’re placed). I’ll probably end up with very few shares at midnight just for for kicks. Good luck!

@deagol Also implied from the description, it’ll remain open for at least half an hour after my last sell/limit order, if any.

I wish to advance the close to an earlier date (due to lack of incentives for anyone taking a stance on it), as well as adjust the closing mechanics to be an arbitrary time within the 24 hours before the new close date (to prevent last minute shenanigans). At this time only one trader remains (myself) with a profit of Ṁ1 and a (currently mostly losing) position of 1 Yes share.

Would it be ok to proceed with this planned change of closing date if there’s objections in replies to this comment, say in the next 24 hours? This is my very first market and I sure don’t want to do anything that could be interpreted as shady.

@deagol ok here’s the plan: at some random time on Monday EST I’ll check the market and if there’s no trades in the previous hour I’ll close and resolve it. If there are trades then I’ll wait 30 minutes and at some random time within an additional 30 minutes will close and resolve regardless of any further activity. I will not actively buy any shares past Sunday EST, but I reserve the right to set limit orders or liquidate any potentially losing position up to when I first check the market on Monday.