Background

Manifold is implementing a new plan for greater liquidity revolving around bots, known as the Yunaplan after the bot account @Yuna.

Basically, when a user tries to place a market order, they place a ~1-5 second limit order instead, to give the chance for bots to fill the order.

Personally, I'm not sure how good of a plan this is. There aren't really many bots trading on Manifold right now, and the only scenario this seems to work is for sports games where it's easy to find a good source of probabilities. It also makes it less intuitive for users given that if your limit order is unfilled you don't actually buy as much shares as you inputted. Also, this plan allows bots like @Yuna to take money directly from the AMM again, which is known to be not ideal.

Resolution

This market resolves based on my opinion of how well this plan is working at around the closing date of this market. If the answer is already very clear before so I may resolve early, and if I need more time I may extend. If the plan doesn't get implemented this resolves N/A.

I am against this plan, but I will try to resolve this as neutrally as possible. I won't bet here.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ257 | |

| 2 | Ṁ176 | |

| 3 | Ṁ160 | |

| 4 | Ṁ143 | |

| 5 | Ṁ63 |

@traders I have resolved the market to No.

A central part of the pitch was that users would not notice the misleading UI because bots would quickly fill the limit orders set up by the user, which has not been happening at all.

I considered resolving N/A but I think that the changes made and in particular the addition of an opt out adds more evidence to show that this didn't work.

.

@traders The implementation of the Yunaplan has been changing, and sweepstakes were shut down.

I could resolve N/A, evaluate based on the initial implementation, or evaluate it based on how well it is working at the closing date of the market.

Thoughts?

@bagelfan I am obviously biased, being a YES holder, but I think this is either a N/A or a NO. N/A because sweepstakes are dead (as far as I understand it was first and foremost aimed at sweepstakes) and the implementation was changing; NO because theoretically we should have seen a bot or two doing this on mana markets aswell, but I havent seen any besides acc.

@bagelfan I'm also biased, as a NO holder. IMO none of the iterations worked as hoped, but then again I'm not too clear on what the goal was, what results would achieve success here? I never understood what problem they were trying to solve.

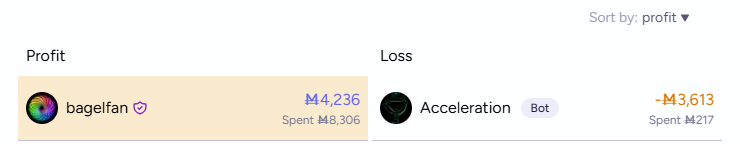

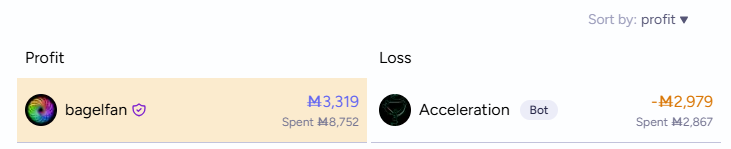

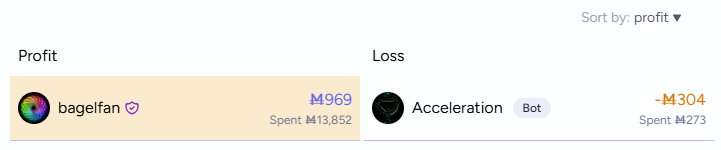

In terms of allowing bots try and "catch" such casual and presumably overextended traders and profit while supplying that liquidity, afaict none other than acc did it, and acc's profit graph speaks for itself.

As for sweepstakes shutting down, wouldn't that be additional evidence that the plan failed? Sweepstakes might have been doomed no matter what, but the constant radical changes in interface and market mechanics due to this plan could not have helped.

@bagelfan I guess the bot is providing liquidity (and getting destroyed on newstrades), but doubt this was the plan.

@bagelfan it falls beautifully for pump-and-dump ruse, and someone figured it out to top their league. 🤣

Since I'm mentioned here, a few comments:

You wrote '~5 second[s]' while the plan says '1-5 seconds'. In my conversation with them I argued for as fast as Manifold can update the odds in the API. Technically 1s is possible and targeted by them afaik.

Also, as I understand it, the website and Manifold app won't change substantially. So everyone would have the choice using the new Mani or whatever it will be called app with default limit orders, or the old way. I might be wrong about that though, or they changed their mind.

More generally, a lot of the people who at the moment fight over the $50 liquidity in sports markets, and that includes me as a person, are different from regular sports bettors. Regular sports bettors by revealed preferences (based on their activity with bookmakers) pay for making a sports match more entertaining by having a decent position on it. If the underlying odds are 50%, they are happy to bet $1, $10 or $100 at 55%. But on a Manifold sports market without bots, 2 people bet $10 at 50%, the price will be at 70% or whatever, 2 more it's 80%, even though the underlying is still at 50%. If you have 100 people active on a market, 80 will bet in the same direction if something happens on TV (which can have a 10s delay btw). So the odds would swing from 99% to 1% all the time without much happening in the game, and most people would get super shitty odds because they bet $10 at 90% when the chances were 50%. So they expected to win $8-10 instead of $1.

Right now, $50 liquidity makes about 5-10 regular Manifolders (who are not like regular sports bettors) happy. So let's say $5 per person per match. That's not sustainable. Manifold needs to eventually be profitable to exist (I think 😅).

@Yuna I don't mind the idea of default/mandatory limit orders, it's been proposed before, but I don't think it's likely to do much to increase activity on those markets. And if those markets ever become very active, the order book will fill up anyway (see polymarket).

I agree with you about the AMM subsidy. It doesn't attract the right kind of trader for sports markets. The AMM can be a good way to "pay for a forecast", but that's not what they're trying to do with sports markets.

@travis I mostly agree except that the order book won’t fill up in live sports. Or at least people will learn their lesson fast, because people with a decent feed let alone people at the match can clean up those limit orders when something important happens. Which is why bookmakers suspend their markets during critical events. With this system Manifold might be a rare or unique place for uninterrupted betting.

@Yuna I'm seeing a pretty deep order book on polymarket right now for live NBA, with a pretty narrow spread too. I'm not sure what it's like for soccer, that seems like it would present more of the challenges you're talking about.

@travis Interesting. Yeah, soccer or football would not work for sure. I’m curious how NBA behaves on Polymarket when it’s a close game in the last minute. Will check it out.

@Yuna Even soccer should be workable with enough "natural" trading activity. The depth and spread of profitable orders is limited by the probability of a "good fill". If trading activity is high enough, you'll make enough on your good fills to offset the cost of the occasional bad fill. For instance if your spread and depth give you an exposure of 20 and an EV of 1 per good fill, then at worst you need 20 good fills for every bad fill.

@travis I looked at NHL on Polymarket yesterday. Hockey is similar to soccer but the higher number of average goals makes each less impactful. Still even there during the critical events I saw spreads went up to 30-40%. That's better than I thought. For moments like that though I actually think Manifold's AMM/orderbook hybrid might be better suited.

The problem with the one bad fill in soccer is that it's so atrociously bad EV (it's like betting against someone with foresight) that I wouldn't know how to make up for that with a lot of small percentage +EV bets. If you know how to do that you can become very rich 😅 🍀

@Yuna Well you can always keep your depth low so you never get burned too badly. Then just keep re-upping your orders as they get filled.

Sorry, I misremembered the length of time for the limit order. I have updated the description.

The doc they released was light on details about how the plan will be implemented, so I am not quite sure if it will be on the new app or on both. But judging from the Discord thread it looks like they are implementing it on both.

Right now, $50 liquidity makes about 5-10 regular Manifolders (who are not like regular sports bettors) happy. So let's say $5 per person per match. That's not sustainable.

That's just not true. From my observation it's more like 35$ for you and 10$ split between everyone else (due to the 99% cap only 90% of AMM subsidy is taken).

I didn't think the desc for this market was the right place for laying out in detail my concerns about this plan, but since you commented here they are:

I don't get why Manifold is trying these sorts of things when basic features aren't down yet. Options on the super bowl market can't resolve even if a team is already eliminated. The sports dashboard is missing many key features, and the markets take quite long to resolve. Questions with Other (i) or unlinked multichoice by creators who aren't @Manifold can't be sweepified.

Manifold is making a change that seems only workable on individual sports games and doing it for the whole site. They are planning on rebooting @acc to trade sweepstakes, which seems like a bad idea.

There only seems to be one non acc bot interested in this (You).

Part of this plan allows you to bot trade against the AMM again. I don't see how this at all helps anyone besides you.

Having the limit orders in the order book already there is much better for traders because there is no uncertainty over whether you will fill them or not. I don't agree with your argument that it is impossible to do it this way without losing money from quick traders. As @travis pointed out above that is how Polymarket functions. If Manifold has enough sports bettors then the volatility will earn you more than enough to offset the potential downside from a quick trade against you (also, you're a bot and I think you can cancel the limit order faster than someone can take it).

This mismatch between the UI and reality could cause confusion and doesn't seem ideal. If an event already happened I don't care about slippage and just want to bet it to 99%, instead I would have to do something awkward like bet over and over.

But the main thing is, how come you're trading against the AMM again?

Easy wins on sports markets gave me a lot of profit as a new user. If you had taken those opportunities I don’t know if I would be on the site still.

@bagelfan I totally agree that a lot of basic features should be in place before doing any kind of mass appeal marketing. But they need to start somewhere and they need to see a way forward that ends up somewhere profitable. They need users who are willing to pay for the value and/or entertainment they get out of Manifold. My '5-10 Manifolders made happy by $50' was referring to the markets where bots weren't allowed. Either way, you made my point: it took $10 (per match) to keep you happy, otherwise you might not be on the site anymore. That's not customer acquisition costs, that's customer retention costs. I'm sure you can see how a startup can't survive on that unless you somehow spend more than $10 per match for something else here.

It's obviously true that right now I'm the one benefiting the most monetarily from the sports markets. But that won't be for long I predict. Other bots will come. And that's good for Manifold. You seem to know how to make a profitable bot with long-lived limit orders. Then you're smarter than me. Why don't you build something easier, namely something that automates what you do manually, which seems to work well. Then we both can battle with the many more bots to come and provide liquidity to the hopeful onslaught of punters who want to bet big at decent odds without moving them to 99% or 1%.

I said:

Easy wins on sports markets gave me a lot of profit as a new user. If you had taken those opportunities I don’t know if I would be on the site still.

You said:

it took $10 (per match) to keep you happy, otherwise you might not be on the site anymore

I don't at all see how this follows. I was referring to how I was able to collect some (Mana) profit when I was new, before I had a decent predicting ability. Nowadays, I can collect profit by making good predictions (on my own without looking at external odds) against other people. I'm not quite sure where you got $10 per match, I never approached those levels of profitability on the markets.

That's not customer acquisition costs, that's customer retention costs. I'm sure you can see how a startup can't survive on that unless you somehow spend more than $10 per match for something else here.

You imply that I don't care about Manifold's future and only about myself. That is not at all true,

Every day I spend a decent amount of my free time to go through the mod queue to resolve markets for people

I have suggesting over and over to have a thinner AMM on the NBA games and other sports markets, directly against my self-interest. I did this because I was concerned over how much it was costing for Manifold.

There was a bug in redeeming shares so I was sent 20 sweepcash. When it was clear that the bug didn't actually cost me anything (it made my balance go wild but it settled after I bought shares in different directions) I offered for it to be taken back.

I know the type of person you're referring to: people who cheer tax cuts/handouts but don't see the bigger picture of gaping government deficits. That could not be farther from the truth here. I would appreciate if you don't falsely accuse me again, thanks

@bagelfan I didn't and probably couldn't know that you were talking about Mana profits. As far as I know, nothing will change about them. My bot hasn't bet on mana markets in over a year, I think.

Sorry about assuming that you needed $10 to be kept happy. That was indeed hasty reading maybe similar to your misreading of '1-5 seconds' to '~5 second'[s]. Both would have supported our points. Although, I never thought and thus couldn't have implied that you don't care about Manifold. I have great respect for mods putting in the work to help resolve tricky markets. I think critics of the plan possibly misunderstand how it's supposed to work and help Manifold entertain more users. I'm just trying to explain how I think it could work. I easily can be wrong and a lot depends on execution as well.

I don't even blame people who like some free liquidity. I'm just trying to make the point that it's not a sustainable set up for Manifold. So please don't accuse me of accusing you 😅. I'm just trying to explain stuff. I never thought you said anything worthy of accusation.