Just for fun:

This resolves to the number of these 95 Theses that Zvi more agrees than disagrees with, as per the post on 5/9 or alternatively by his self-report.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ34 | |

| 2 | Ṁ16 | |

| 3 | Ṁ12 | |

| 4 | Ṁ7 | |

| 5 | Ṁ4 |

I thought it was overconfident, but then I went through the list and got 61 myself when the predicted value was exactly 60.98 so I only adjusted it a bit

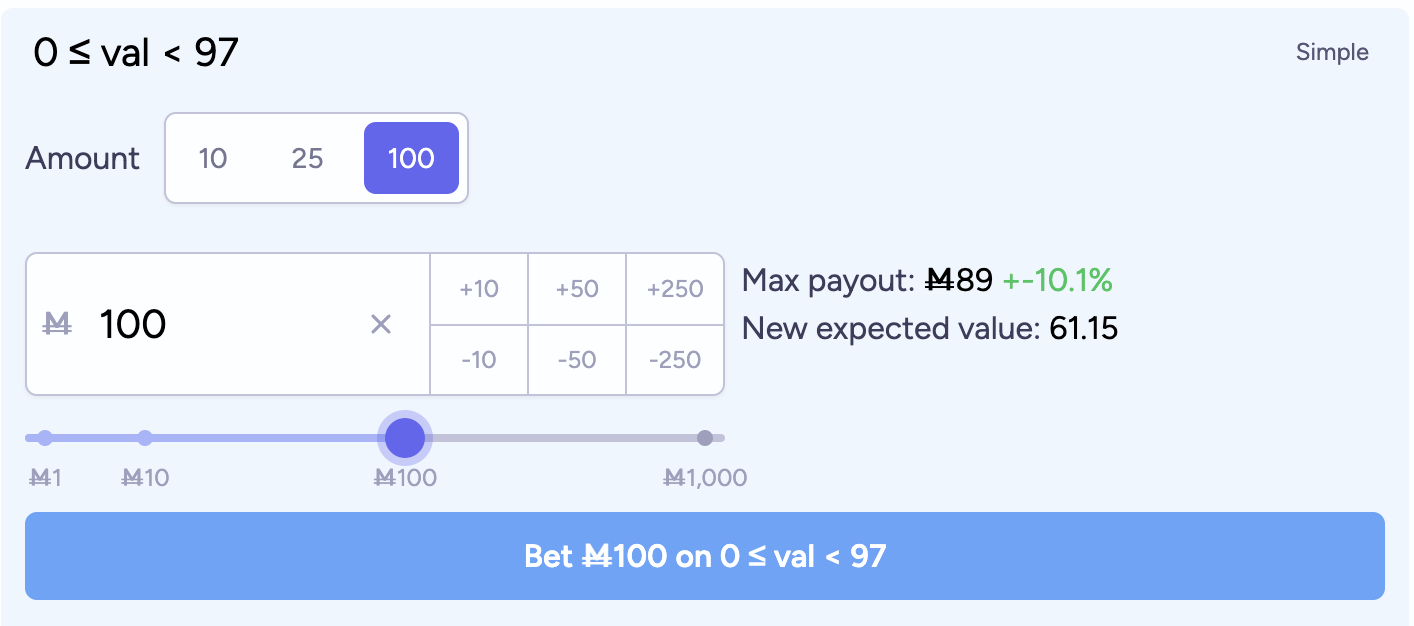

I wish there were a way to buy "about right, but higher variance". Buying a wide range is apparently guaranteed negative payout:

and I just tried to broaden the range by buying above and below the current range, but that just created a bimodal distribution even though I only bought a relatively small number of shares?

I'm not sure if this is a problem with the market format or I just suck at this.

if you buy a range that makes up 99% of the prob mass, but each option is below 10%, fees at 10% are ~5% of M spent, so u pay 5%+ in fees but can only earn 1% when betting on a range with 99% prob mass, so guaranteed losses of ~4%. For now I recommend betting on smaller ranges, but works poorly when markets have low liquidity, which they do by default. More at

https://discord.com/channels/915138780216823849/915138780653051910/1238007611027357697