What it says on the tin. Closes September 5; anyone can add answers.

EDIT TO CLARIFY: The amount someone bet can be seen by looking at the total number of shares they are shown to have spent on all options in the "Holders" tab, as of the closing of the market. This only includes what they spent on shares they did not eventually sell.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,189 | |

| 2 | Ṁ320 | |

| 3 | Ṁ227 | |

| 4 | Ṁ99 | |

| 5 | Ṁ32 |

People are also trading

Due to unforeseen behaviour with buying NO shares of Other, Qoiuoiuoiu and NielS look like they've spent less than they really have. I will manually add the disappeared 160 and 405 shares, respectively, to their totals.

I will not do the same if this happens again, so nobody buy NO shares on Other. Sorry for the inconvenience.

With less than two days to go, the current totals are Bayesian at M2725, NielS at M1100+M405=M1505, and Qoiuoiuoiu at M865+M160=M1025.

@Qoiuoiuoiu ah, fuck. I completely forgot about that little Manifold feature, and its special interaction with this market.

Suppose the market has A, B, C, and Other. You buy 100 shares of NO on Other. Someone adds a new option, D. Manifold doesn't exactly have the functionality to give you 100 shares of NO on (Other | D), so they have to give you some other set of shares of something, that are guaranteed to be equal in value. They can't give you, for example, 50 shares of NO on Other and 50 shares of NO on D. That would be strictly more valuable than your original investment, because you would still get M50 even if D or Other did happen.

There's only one set of shares that's equivalent to what you originally bought - one set of shares that's guaranteed to pay off M100 if neither Other nor D happens, and guaranteed to pay off 0 if one of them happens. That set of shares is 100 shares of YES on A, 100 shares of YES on B, and 100 shares of YES on C. That way, as long as it's something other than D, Other, or anything that ends up getting split out of it later, you'll get your M100.

So you now lost your 184 NO shares of Other, and gained 184 YES shares of every option except Other and the option that was last split out of it (your own name). And unfortunately, Manifold no longer displays you as having spent anything on Other, because you no longer have the shares you bought that way.

Unsure how to handle situations like this:

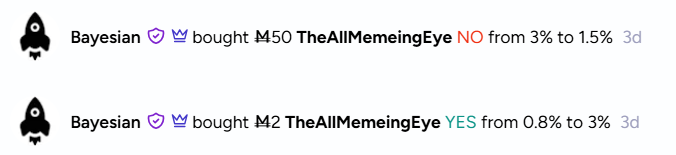

Bayesian spent M2 buying YES shares, and then spent M50 buying NO shares, which presumably meant that some of the YESes and NOs cancelled out to refund Bayesian some of their initial investment. But it's not clear just from this how much Bayesian got from the YESes and NOs cancelling out - it could have been anywhere up to M2, afaict.

There are more examples like this, where it's even more complicated due to other people trading the option up and down in between the first and second trade.

Anyway does it really matter? I doubt anyone's even close enough to @Bayesian for it to matter

@Bayesian the problem is, that doesn't take into account shares that someone acquired via trading on Other

@ZaneMiller I think it does? Someone spends 1000M on other. It splits off into A. UI marks it as: you spent 0 on A, but 1000M on Other.

@Bayesian the problem is, suppose someone buys shares of Other, which splits into a bunch of options, and then sells all their shares of Other

@ZaneMiller I mean technically you haven't spent anything on the split-off options, so those don't count. Just as it's marked in the UI anyway.

@Bayesian It allows you to get a lot of shares without it counting as you buying anything.

But I suppose it's not an enormous problem. I guess I'll count it that way.

docs.google.com/spreadsheets/d/1wsDgGNhy4FrNzYo38KeYLAP0Kw2quzuKTZ0j6eZS4yU

Current standings: Bayesian at M2767, NielS at M1230, everyone else below M100. Some people are negative because they have made mana on net from trading on this market.