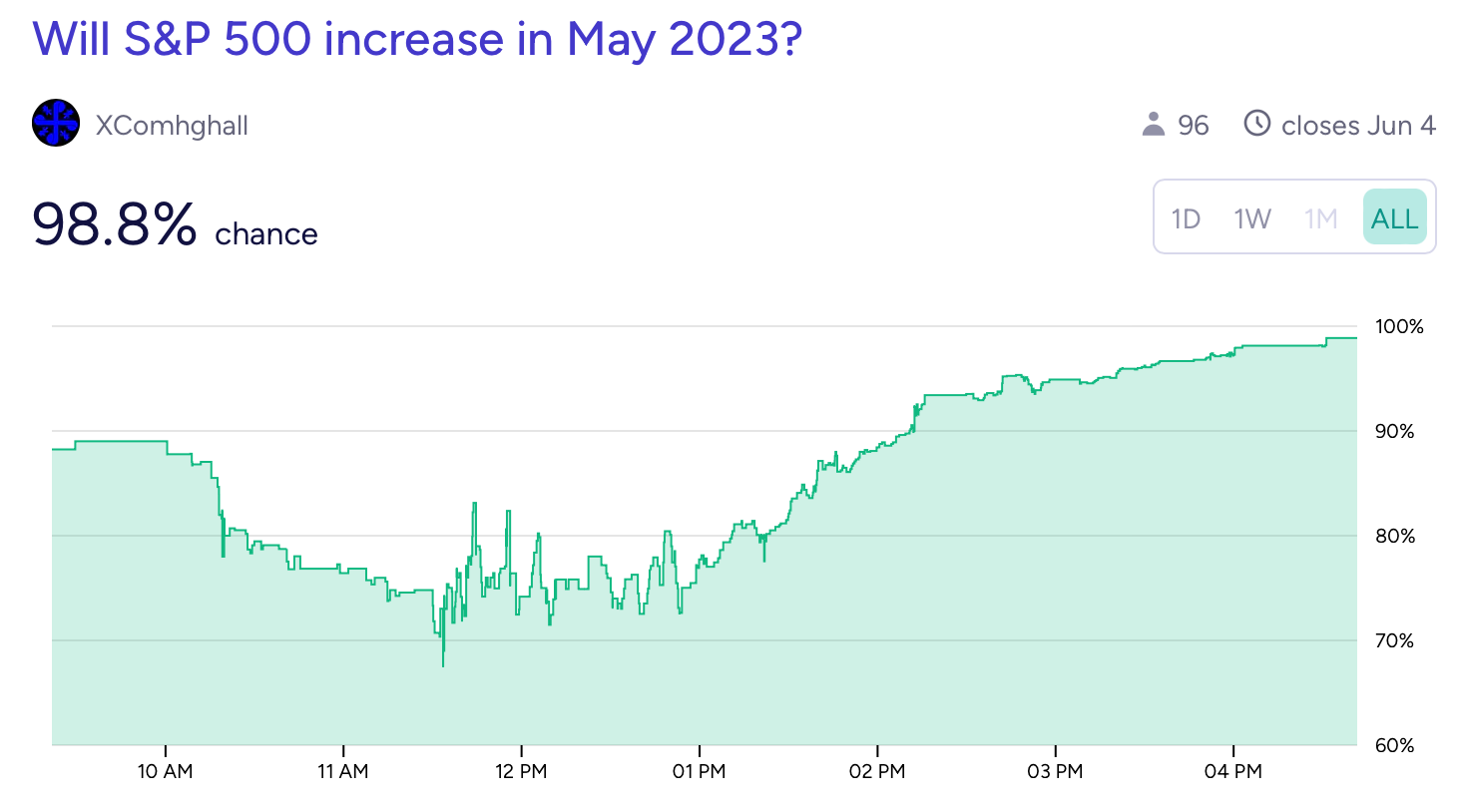

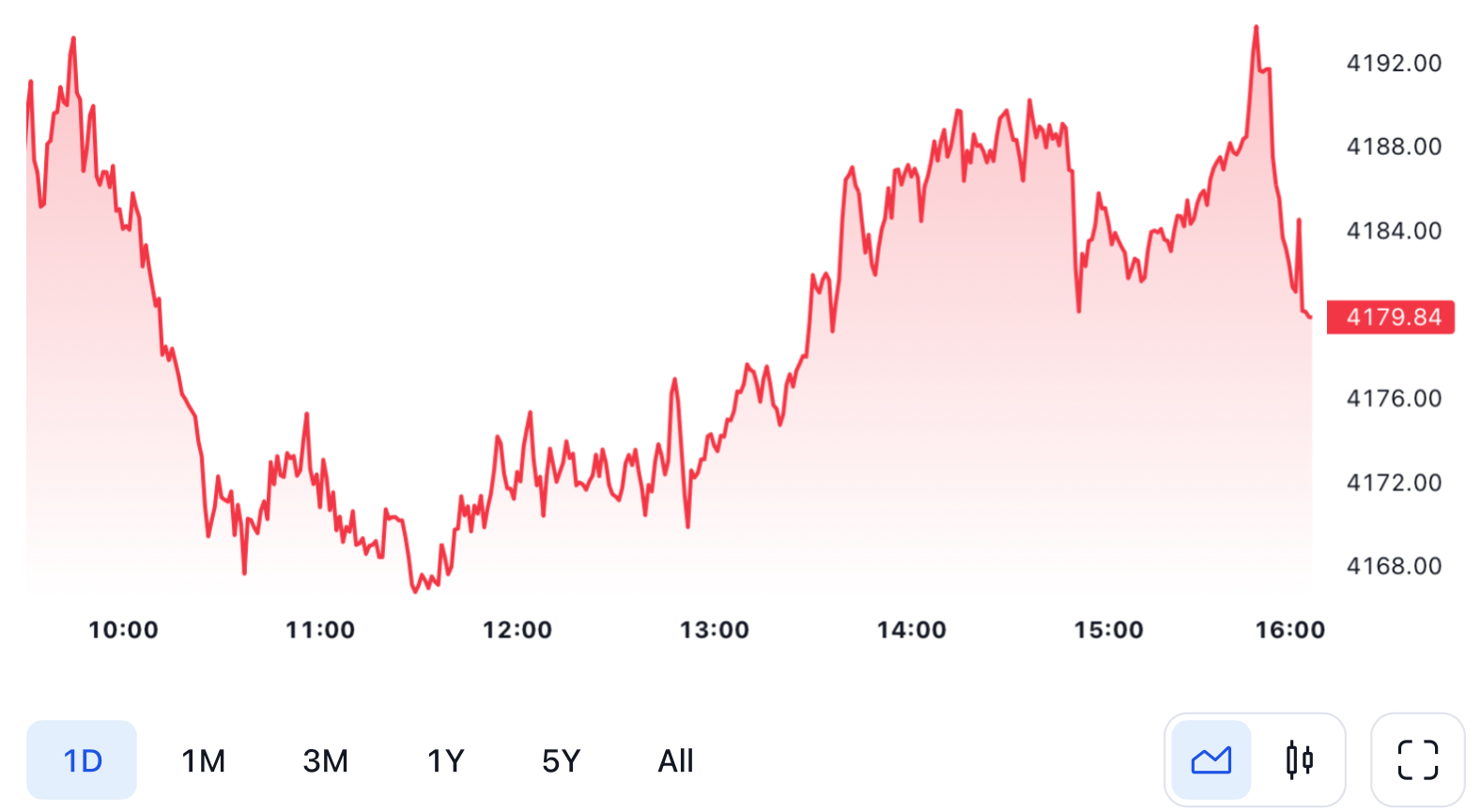

The S&P closed at 4076.60 in January, 3970.15 in February, 4109.31 in March, and 4169.48 in April. Will it increase from open on 2023-05-01 (4166.79) to close on 2023-05-31 (4179.83)?

Source: https://www.wsj.com/market-data/quotes/index/SPX/historical-prices

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ544 | |

| 2 | Ṁ443 | |

| 3 | Ṁ240 | |

| 4 | Ṁ197 | |

| 5 | Ṁ171 |

People are also trading

Closing level I am seeing is 4179.83. Waiting a day to see if it gets updated. I need to have the exact closing level for future reference, and the description cannot be edited after resolution.

@deagol I don’t care if anyone day trades, I think it’s great. Arbing with or without a bot makes sense to me as well. Were you arbing another market?

Buying and selling the same contract within a minute multiple times (with no one else trading in between) is just churn. I don’t understand why anyone would do that.

To be clear, if this is what you want to do, it’s not any of my business. I am just trying to understand.

@JimAusman I was arbing against my estimate of the probability (based on the index distance from 4167, volatility, and time left) adjusted for my position size. This market was very biased up to yesterday due to debt ceiling relief hopes, and especially today before 1-2 PM when it finally got some breathing room >0.5% from the threshold. I think this allowed me to have the best chances of capitalizing on my NO bet if the market had not turned at noon, while still being able to unwind my position most efficiently.

@deagol Thank you for the detailed explanation. I had some similar ideas but did not do as much trading as you did.

@deagol It’s a close enough analogy. I’m actively buying and selling within the same day. My bets have no predictive basis.

What is the point of this?

ok i’m done for now. One point was to get me out of my big NO position going into today without incurring a huge loss. I think I may have cut the potential loss by 70%.

@JimAusman and around noon I could’ve kept the position if the market went that way, was flat for the month at that point. I had >2k NO at that time.

@Radicalia in meaning 'within'. Suppose that it closed at 4,000 on Friday, opened at 4,100 on Monday, and decreased throughout the day to 4,001. Yes, it is up from Friday, but the movement within the time period from open to close on Monday is kind of overlooked. So I wanted to separate the effects of higher / lower opening price and movement within a month / quarter / year.