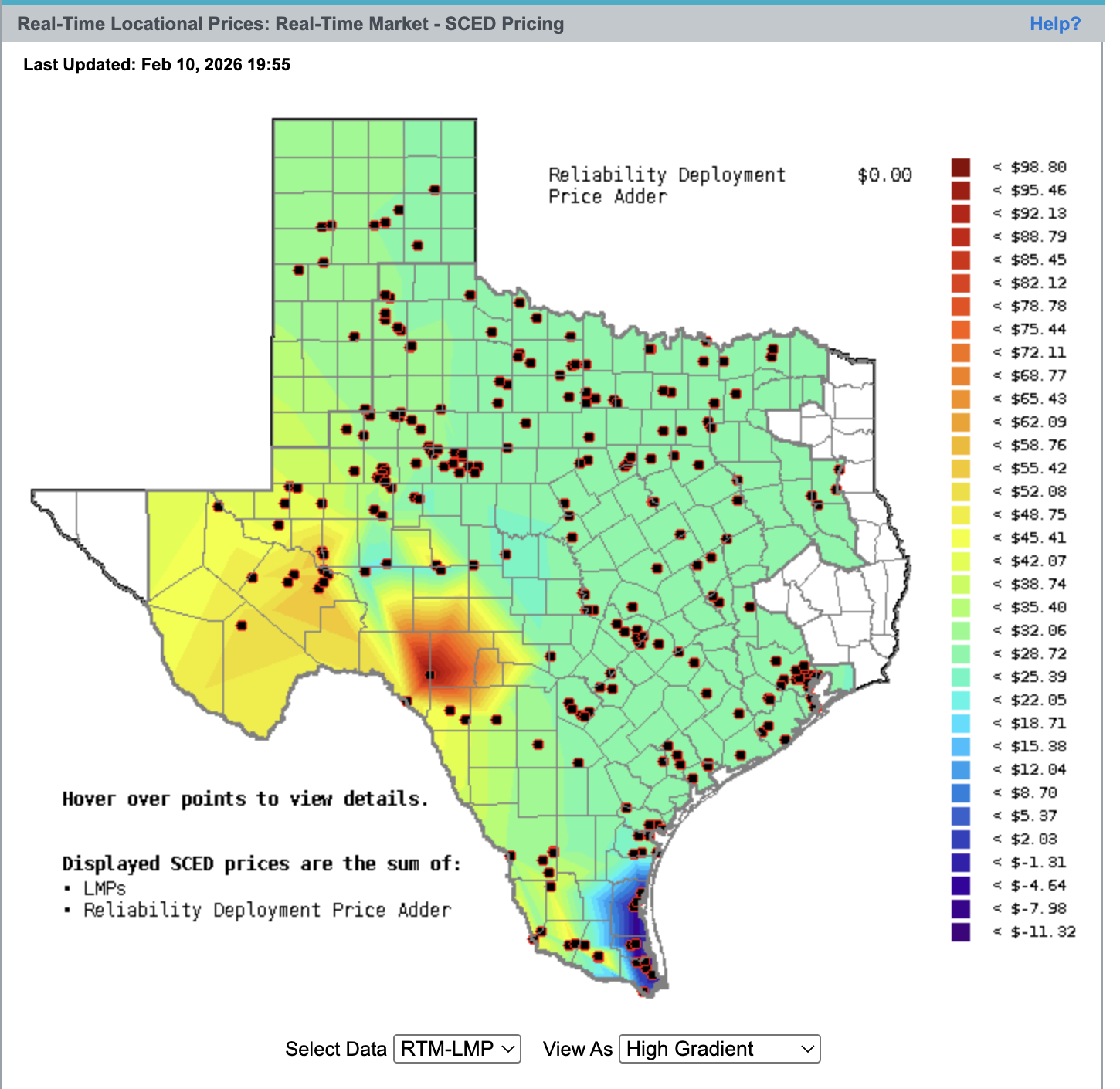

The Situation: January 2026 set a high bar for the ERCOT grid, with a mean settlement price of $77.83/MWh. But as WattDoc, I’m looking at the diagnostic charts, and February is currently flatlining at an average of $23.54.

To win, February needs a "heart-attack" price spike. We’re talking about a multi-day cold snap or a massive solar-ramp failure that pushes prices toward the $5,000 cap.

The Bet: Will the average of all ERCOT Hubs and Load Zones in February beat the January "Boss Level" of $77.83?

The Scoreboard (Live as of Feb 7):

January Mean (Final): $77.83

February Mean (MTD): $23.54

Gap to Close: ~$54.29

Why You Should Trade:

The Bears (No): Relying on a "Texas Spring" and mild late-Feb weather to keep prices in the basement.

The Bulls (Yes): Betting on the next "Winter Storm" anomaly or a sudden gas supply crunch to send the average to the moon.

Resolution Source: ERCOT NP4-180-ER Report. Average of all Hubs and Load Zones.

Come prove your grid knowledge. Is the February discount a trap or a gift?