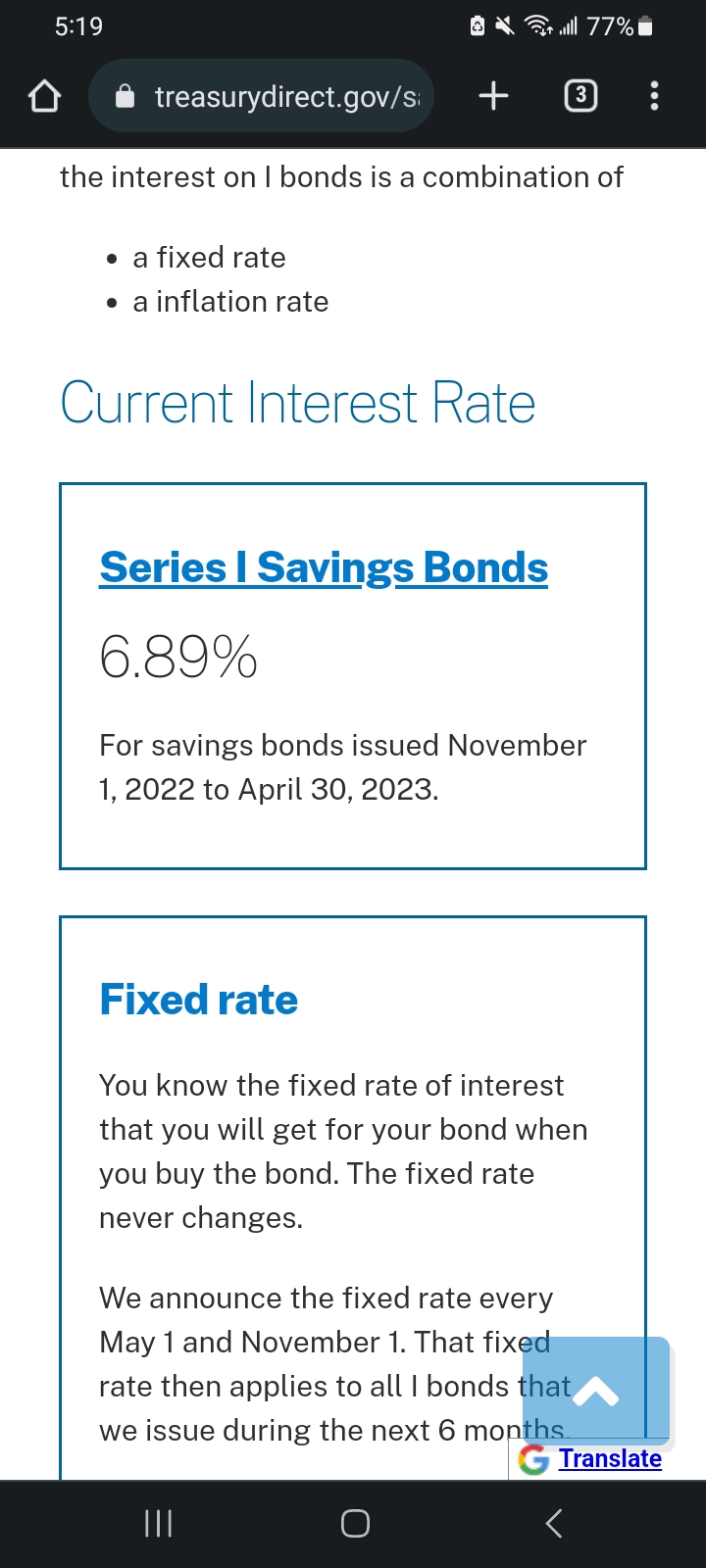

Based on treasury.gov published rate.

My first try on a # prediction market so hopefully I didn't fudge it up...

To clarify - we are talking about the rate for I-bonds issued in May, not the current rate for bonds issued through April 30th.

This will also include whatever the base rate is for bonds issued in May.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ31 | |

| 2 | Ṁ9 | |

| 3 | Ṁ2 |

@MarkIngraham I hope you are right but the math doesn't seem to support it.

What makes you think that it will?

@MarkIngraham Those are the current rates. The question is about the May I-bond rate that will be announced for May based on the March 2023 CPI-U report.

@MarkIngraham That is not the I-Bond rate. The I bond rate is the March CPI-U number (not yet announced) minus the September CPI-U number divided by the September CPI-U number times 2 plus a base rate that is usually less than 1.

It is in no way formally linked to the Feds rate though the feds are trying to lower inflation which will lower the I-Bond Rate.

@MarkIngraham It will be whatever the fixed rate is if inflation is zero (current fixed rate is 0.4% but the May number hasn't been announced.

@SuperTaxGenius August 2022 inflation was 8.3%, february 2023 was 6%, 6-8.3=-2, divided by 6 is -.3, times two is -.6, plus .4 is -.2, so April bonds are -.2%?

@MarkIngraham The April rate was set based upon numbers from 6 months ago. CPI-U numbers NOT the published inflation rates.

@MarkIngraham here is a better explanation

@SuperTaxGenius OK that's different math, but I still expect a massive fed increase to drive the base rate to 6% or so.

@MarkIngraham as a bond holder...I hope you're right....as a predictor...I believe you are wrong ;)

@SuperTaxGenius base rate is normally increased when fed policy changes, fed is raising faster than ever

@SuperTaxGenius I'm guessing 5 to 6 final rate - but that is also based a bit on hope.