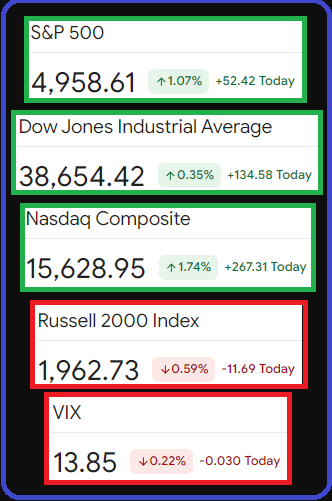

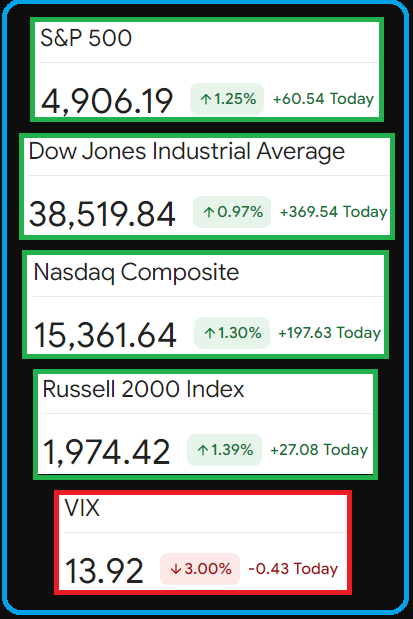

🏛 US Stocks: How Will Each Of These 5 US Indices Close On Fri. February 2nd Compared To Its Close On Thu. February 1st?

Market Information:

The markets are open from 930am - 4pm ET (1130am UTC - 9pm UTC)

This market will close 330pm ET (830pm UTC)

The official source used is *Google Finance

Resolving:

Resolves according to the display at *Google Finance at the end of the day.

Each option resolves independent of the others.

If a stock closes "Flat" (same close price as prior day) this will resolve 50/50 for the respective Stock Index.

Previous Closes:

DISCLAIMER

I DO NOT PARTICIPATE IN MARKETS I CREATE

DO NOT TRADE OFF OF UNCONFIRMED MARKET NEWS OR NEWS YOU MAY NOT UNDERSTAND. I AM NOT RESPONSIBLE FOR MISUNDERSTANDING IF YOU DO NOT ASK FOR CLARIFICATION FIRST.

If Any Clarification Is Needed, I May Temporarily Close The Market To Make Clarifying Statements & Than Re-Open ; Feel Free To Ask For Clarification Through Messages Rather Than Making A Comment. Comments are not a clarification unless posted into the description.

*If Google Has A Visual Error (eg. Green chart/negative closing price ; Red chart/positive closing price) This Will Resolve To The Closing Price Of Majority Same Numbers Reported By Yahoo/MarketWatch/WSJ/CNBC.

YEARLY DASHBOARD/LEADERBOARD

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ802 | |

| 2 | Ṁ67 | |

| 3 | Ṁ60 | |

| 4 | Ṁ29 | |

| 5 | Ṁ14 |

@Gabrielle i'd love to see your VIX and R2k trading algorithm. i don't even know how i should trade them myself.

@Lion I don't want to reveal too much, but it's basically a really simple linear interpolation that I trained on a bunch of historical data. I have a separate model for each different stock/index. So I'm not really doing anything intelligent, just relying on the market's random walk being somewhat predictable.

My first day (when I lost M$57) was before I trained the algorithm and I was just doing a really simple "if the market has gained X%, then predict a Y% chance of closing up", but that clearly didn't work well.

@Lion I really need to make my bot start thinking about the size of its position. Also its Dow Jones model seems a bit off, whoops...

@Gabrielle I exactly had the same thought 🤣. Tiger is way too much involved in this market, that's why I turned him off.

-