Will 27 or more people put in a prediction on this market?

Bots don't count towards the total. If I predict, I do count.

I may close this market early if the answer is YES but I won't extend the close date if the answer is NO.

This is the latest version of this market - each time the target increases by one so it should be a bit less of a certain thing.

@MpP has set up a meta-market about these market iterations here:

Here's how the previous markets went:

Six or more? Target hit in 7 minutes

Seven or more? Target hit in 1 hour 37 minutes

Eight or more? Target hit in 2 hours 12 minutes

Nine or more? Target hit in 12 hours and 8 minutes

Ten or more? Target hit in 29 minutes

11 or more? Target hit in 1 hour 32 minutes

12 or more? Target hit in 4 hours 14 minutes

13 or more? Target hit in 15 hours 35 minutes

14 or more? Target hit in 12 hours 33 minutes

15 or more? Target hit in 28 hours 47 minutes. This time five non-bot users had positions on NO at the end - the first time that so many people thought that the target might not be hit!

16 or more? Target hit in 6 hours 41 minutes - significantly faster than the previous three iterations!

17 or more? Target hit in 13 hours 59 minutes

18 or more? Target hit in 23 hours 28 minutes

19 or more? Target hit in 14 hours 59 minutes

20 or more? Target hit in 21 hours 51 minutes

21 or more? Target hit in 19 hours 14 minutes - now with six people holding NO positions at close!

22 or more? Target hit in 13 hours 23 minutes

23 or more? Target hit in 5 hours 4 minutes - the quickest since 12!

24 or more? Target hit in 17 hours 30 minutes

25 or more? Target hit in 22 hours 18 minutes - the slowest since 18

26 or more? Target hit in 38 hours 36 minutes - the first time I didn't think it was going to happen and I bet on NO!

What will 27 bring?

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ264 | |

| 2 | Ṁ44 | |

| 3 | Ṁ25 | |

| 4 | Ṁ23 | |

| 5 | Ṁ19 |

An interesting pattern this time…

Stagnation on about 17 or so predictors for quite a few hours. When that lasted for so long that it looked like we were sputtering out, the market was bid down to 60%, which kicked off a flurry of activity and the final ten predictors in a bit over two hours!

28 is up next:

And if you’re interested in predicting on something important in the real world rather than just these fun markets, I’ve put up some markets on when (if at all) the US debt ceiling will be raised:

@Erwan Anyone who traded regardless of whether they sold out their position.

So it’s the number of predictors shown at the top of the market (currently showing 29) minus the number of bots (we’ve currently got four bots who have predicted on this market).

So someone who’s already predicted can’t do anything to make the number go down!

Here is the code if you are interested: https://drive.google.com/file/d/1VK9ApGUkuvW1pTLZuk6fttgnbmYsoAcB/view?usp=share_link

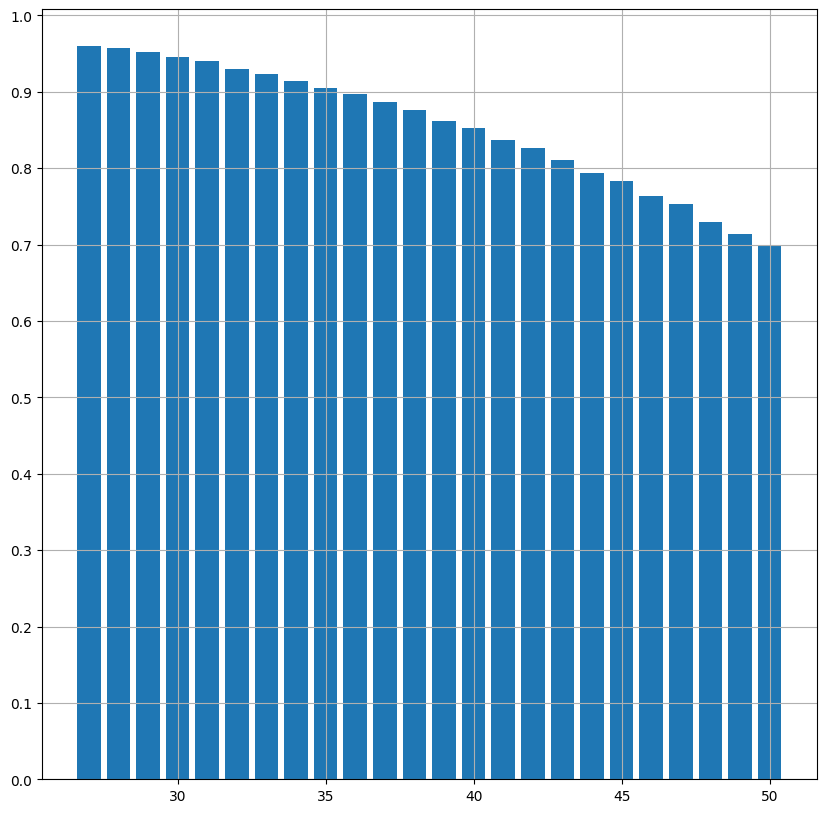

@MpP Yes of course! The idea is that people arrive at a random time described by a gamma random variable (https://en.wikipedia.org/wiki/Gamma_distribution) this is a strong but not unreasonable assumption. A better known distribution is the exponential one, which is the only random variable "without memory", meaning that it assumes that people arrive at random times, in a way that doesn't depend on how long the market has been open for. The exponential distribution is an example of the gamma one. Specifically the gamma distribution has 2 parameters, referred to as the "shape" and the "rate", the exponential has only the "rate" and is the gamma distribution with "shape"=1.

Gamma variables have interesting properties, specifically if you have n independent gamma variables with all the same values for "shape" and "rate", the sum of these variables will still be a gamma, with the same "rate", but "shape"=n*"the shape of the independent gamma vairables".

One can use this fact to proceed with the assumption that people arrive at random times (if you are using dark theme change to light to read the formulas)

and then it follows that a market that asks for n people to predict will resolve in time:

The data reported in the market therefore describes "independent" (this assumption is probably wrong and one should intuitively correct for it) samples from the last model.

Having said that, one needs to have a way to use these data to compute the values of alpha and beta. One possible choice is that of Bayesian inference. This is more complicated and I cannot explain briefly, but I can point in the direction of a smart introduction provided by @EliezerYudkowsky https://www.lesswrong.com/s/6xgy8XYEisLk3tCjH/p/XTXWPQSEgoMkAupKt

there is also a beautiful video on the subject here https://www.youtube.com/watch?v=lG4VkPoG3ko&t=315s

But these only discuss the application to the case of a finite number of hypotheses. In this specific case instead we have infinite many (all the possible values that alpha and beta can assume), if you want to become a pro at Bayesian inference, and want to also apply it to these models, you should study from books, my recommendation would be: http://www.stat.columbia.edu/~gelman/book/

Hope this helps =D

@BrunoUrsino That’s really interesting, even if most of it goes over my head!

Like you say, the biggest assumption is that people coming here and trading are acting independently rather than being influenced by how many traders there have been and the odds when they come along.

I’d be interested to see how the reality compares to a model which assumes that people are acting independently and ignoring the odds - maybe I’m just finding a pattern in random data!

@Irigi It is, but this information gets incoroporated in the resolution time, and is described by the "shape" parameter. Of course this works only if the model is used to predict what happens from the start of the market to the end. One cannot reliably use it to consider the market at time t1, for instance I cannot use it to predict the probability of this market ending on Yes, only of the next ones

A more ambitious market, for anyone interested: https://manifold.markets/seaton/will-this-market-have-100-or-more-u