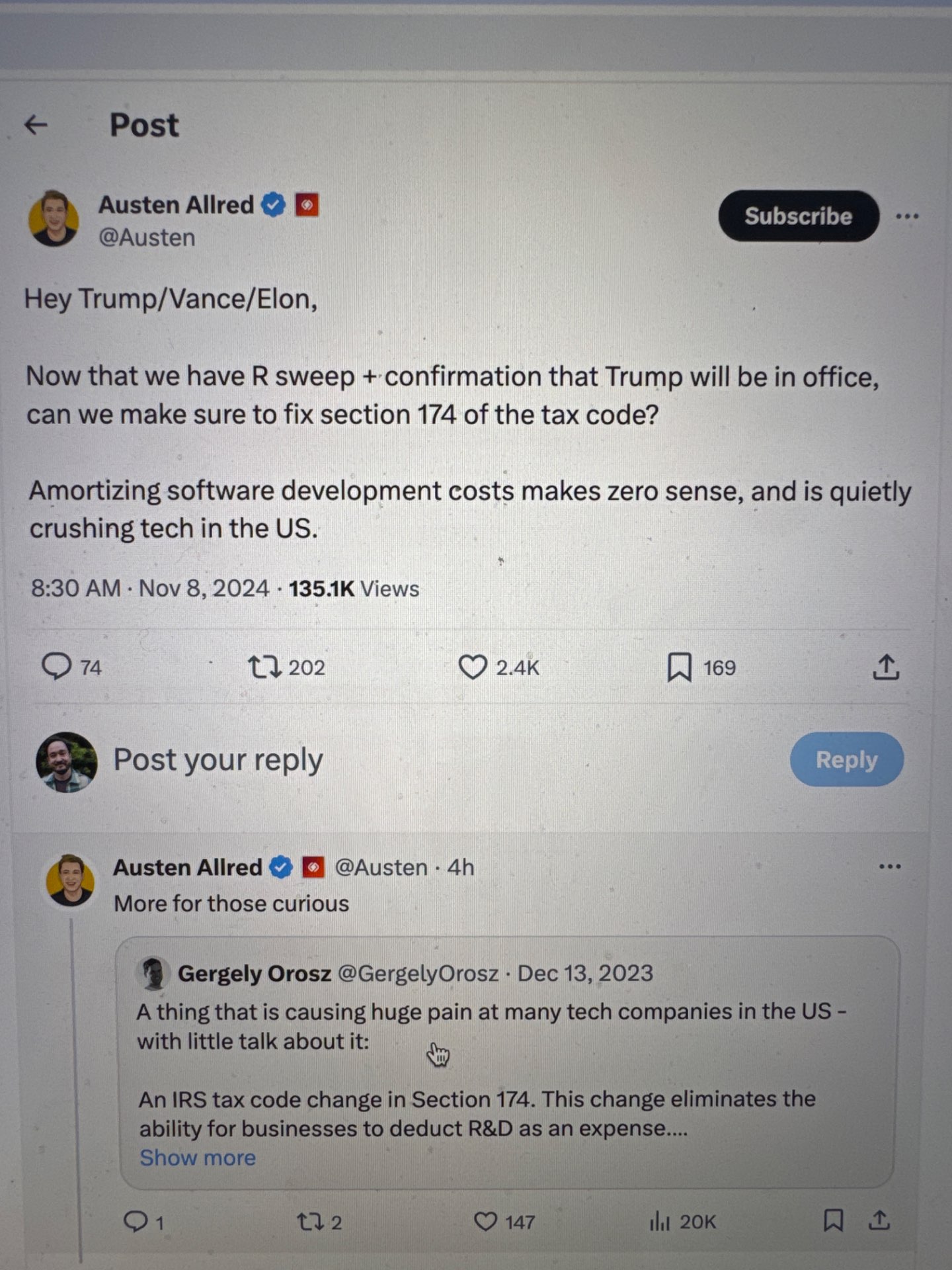

Will Section 174 Allow Full Expensing of SWE Salaries for R&E in 2025?

4

Ṁ1kṀ1.3kresolved Jul 5

Resolved

YES1H

6H

1D

1W

1M

ALL

To resolve to "YES," legislation or regulatory guidance must be enacted or clarified that allows businesses to fully expense software engineer salaries related to research and experimental (R&E) activities in the same year they are incurred, rather than amortizing these expenses over a five-year period. This change would mean that SWE salaries tied to R&D projects can be immediately deducted from taxable income, restoring the pre-2022 treatment under Section 174 before the Tax Cuts and Jobs Act (TCJA) imposed amortization requirements.

The revision does not have to apply to the 2025 tax year.

https://open.substack.com/pub/pragmaticengineer/p/the-pulse-will-us-companies-hire

https://www.perplexity.ai/search/c86e815d-210a-4677-841d-0caecdef9839

This question is managed and resolved by Manifold.

Market context

Get  1,000 to start trading!

1,000 to start trading!

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ405 | |

| 2 | Ṁ83 | |

| 3 | Ṁ44 | |

| 4 | Ṁ27 |