THIS IS A CONDITIONAL AND AMPLIFIED MARKET. PLEASE READ THE DESCRIPTION CAREFULLY.

This market will resolve to yes if Oliver Habryka spends 40 hours or more putting in a genuine effort to become the CEO of twitter within the next month, and he is announced as the CEO of twitter within a year (Dec 23 2023).

If Oliver Habryka spends 40 hours or more putting in a genuine effort to become the CEO of twitter within the next month, and he is not announced as the CEO of twitter within a year (Dec 23 2023) I will use a random number generator to get a number between 0 and 1 and settle the market to no if that value is less than 1/10, otherwise the market will setlle to N/A (more explanation below).

This market will resolve to N/A, if Oliver Habryka does not spend 40 hours or more putting in a genuine effort to become the CEO of twitter within the next month. I (Ronny Fernandez) will determine whether Oliver Habryka spent 40 hours or more putting in a genuine effort in part by asking him. (A month here just means four weeks from today (Dec 23 2022)).

EXPLANATION OF AMPLIFICATION:

Because 9/10 times that Oliver does not become CEO of twitter conditional on his making a serious effort (as defined above) this market will resolve to N/A, your fair price on this market should be ~10X the probabiltiy you assign to Oliver becoming CEO of Twitter conditional on his trying hard.

For example:

If your actual conditional distribution is 0.1% YES, 99.9% NO, you should expect this market to resolve with probabilities 0.1% YES, 9.999% NO, 89.901% N/A, conditional on Oliver trying hard as defined above, which means that your fair price for a YES share should be ~1%.

Some other values, for calibration (using the formula YES' = YES/(YES + (1-YES)/10), where YES' is the price for this question, and YES is your actual probability):

0.1% YES => 1% YES' (actually 0.99%)

0.2% YES => 2% YES' (actually 1.96%)

0.5% YES => 5% YES'

1% YES => 9% YES'

2% YES => 17% YES'

5% YES => 34% YES'

10% YES => 53% YES'

20% YES => 71% YES'

50% YES => 91% YES'

I (Ronny Fernandez) will not be trading in this market.

People are also trading

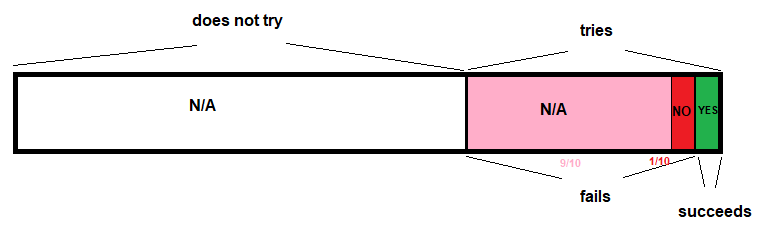

@JonasVollmer Here's an attempt at a visual:

I think the math is correct. For example, if the probability of success conditional on trying is 10%, then the ratio of green to red+pink is 1 to 9, so the ratio of green to red is 1 to 0.9. The market expected value is based on green / (green + red), which would be 1/1.9 in this case, or 53%. Unfortunately, an N/A resolution will retroactively cancel all bets and profits, which means people mostly don't have a selfish incentive to bet.

@StevenK I see, I didn't understand that there would be the pink N/A answer in addition to the white one.

I'm still confused: What's the purpose of the amplification? I have several hypotheses (lack of decimal places on Manifold, or wanting to change the incentives such that precision is more strongly rewarded, or something else)

@JonasVollmer I think the worry is prediction markets don't work well for events with probabilities near 0 or 1 because there's a few percent points of error from things like the time value of mana and misresolution risk. But I think amplification doesn't improve the incentives because traders don't gain anything from an N/A resolution. As I understand it, even if you bought low and sold high, N/A takes back your profits on resolution, so you can't profit much on the Keynesian Beauty Contest aspect of it either, the way you could if it never resolved at all.

I admit, these amplified markets confuse me when used for long term markets, because there I think the current structure for loans fails to make the math work out quite the way I'd suspect one would want this to work, and the 'invisibility of N/A' outcomes prevents me from pricing in my own model for what those implications are.

I'm generally looking for short term investments that I can finish, and pay out my loans, rather than for long-term loan accumulation.

This particular market is conditioning heavily on Oliver taking an unlikely action and on loans incentivizing well over a one year timeframe and on amplification.

I'd love to take a large bet that this will resolve N/A. I'd even love to be able to dial in why it will resolve N/A, either through lack of effort or through failed fair die roll during amplification, and I'd love if I was wrong for that bet to effectively subsidize the basic Y/N results of the market.

It does strike me that we lack a good mechanism for folks to bet on the failure to meet conditionals of another market, other than creating a secondary market that resolves to Y or N depending on if the original market resolves to N/A, but by structuring it that way you can't ensure that you can use the eventual proceeds from a non-N/A result to subsidize your Y or N bet.

I guess what I'd really want is a market that lets you bet Augur-style on all 3 outcomes: YES, NO, INDETERMINATE, requiring one of each type of share of each to exit prematurely. I suppose we do have a way to do this. One could offer that by making a multi-choice market with those outcomes, but I do admit the betting tools available when working with multi-choice markets are a bit more primitive, no limit orders, chunkier selling options, etc.

I suppose if I set up such a market to track this one, one could use it to try to get visibility into the relative likelihoods of different N/A flavors, and to effectively subsidize the Y and N by the amount of confidence it will make it past N/A.

The problem with this market for that is that the censoring isn't just on the NO devolving into an N/A, but also on whether Oliver puts in effort. So you get a tree:

Oliver works hard?

YES -> Oliver becomes CEO of Twitter?

YES -> YES outcome

NO -> 1 in 10?

YES -> NO outcome

NO -> N/A outcome due to amplification (presumably resolving after a full year)

NO -> N/A outcome due to failed preconditions (presumably resolving early in a month)

Notice N/A outcomes occur at both the outside of the tree and the inside of the case tree.

Of course one could model all these cases you might want, like N/A for any reason, etc. by creating more markets for tracking those sums of outcomes, but you can only spend the benefit without tying up even more Mana in cross-market arb if you actually have opinions on how all those detailed slices and conditional probabilities will break down.

I'm about 20% confident that he can do this conditional on trying pretty hard. Like the actual mechanism seems to be "he spends a bunch of time trying, and there's no one better?" I'd also be surprised if he can, or does, spend this much time trying to become CEO of twitter without at least a reasonable chance of success by his model.

Does he either know elon musk personally, have experience as CxO of a large company, or have some other thing beyond 'being a somewhat-popular rationalist' and 'trying hard'? There are probably a number of people indiviudally who 'know elon', 'were CxOs at a large company', or have other specific qualifications for the job, and who will "try very hard" to become CEO of twitter because being CEO is interesting/powerful/etc.

@jacksonpolack sure but those people aren't actually expecting to be CEO, aren't as well calibrated as Oliver, and didn't put 40 hrs into it