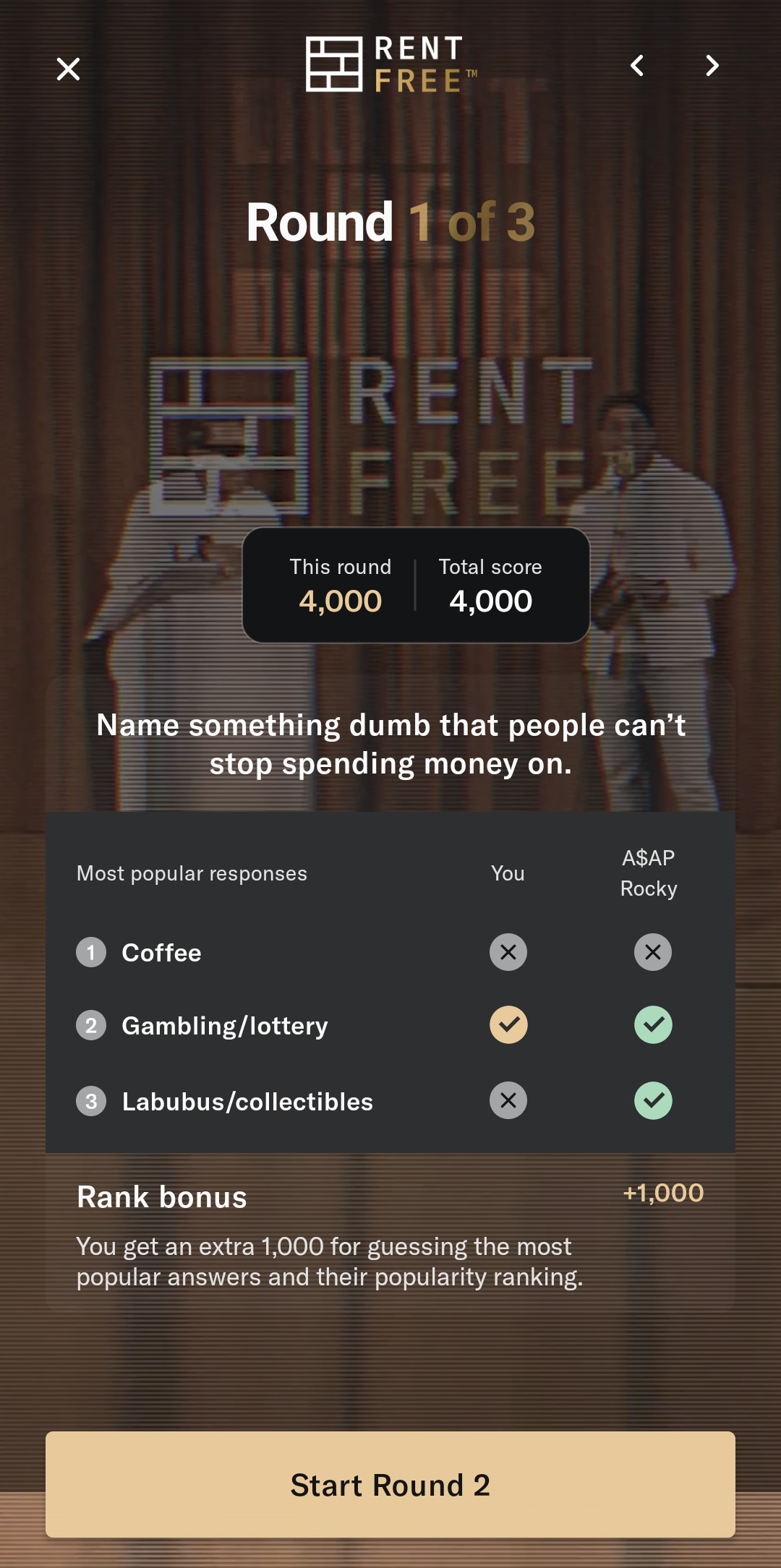

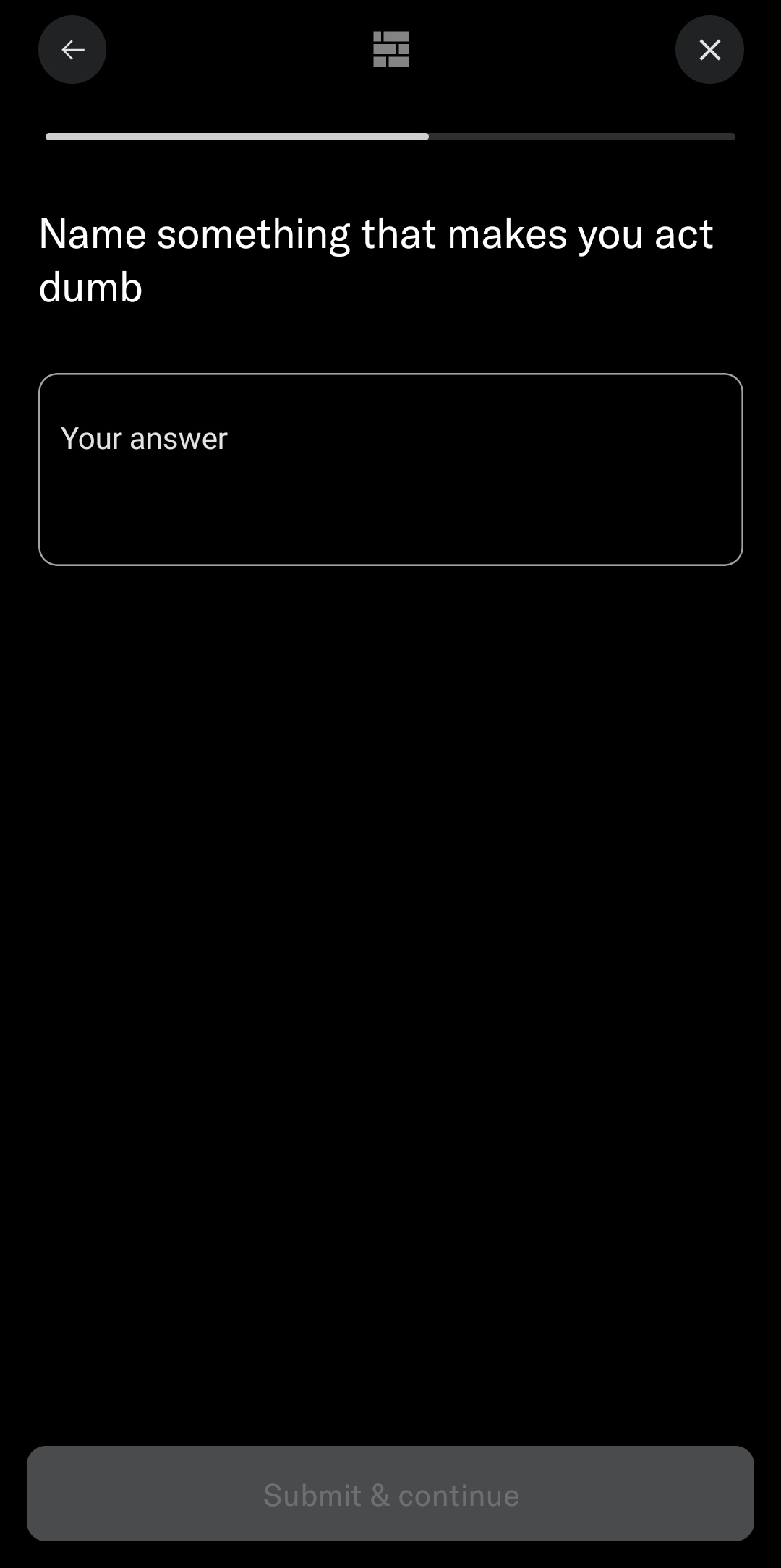

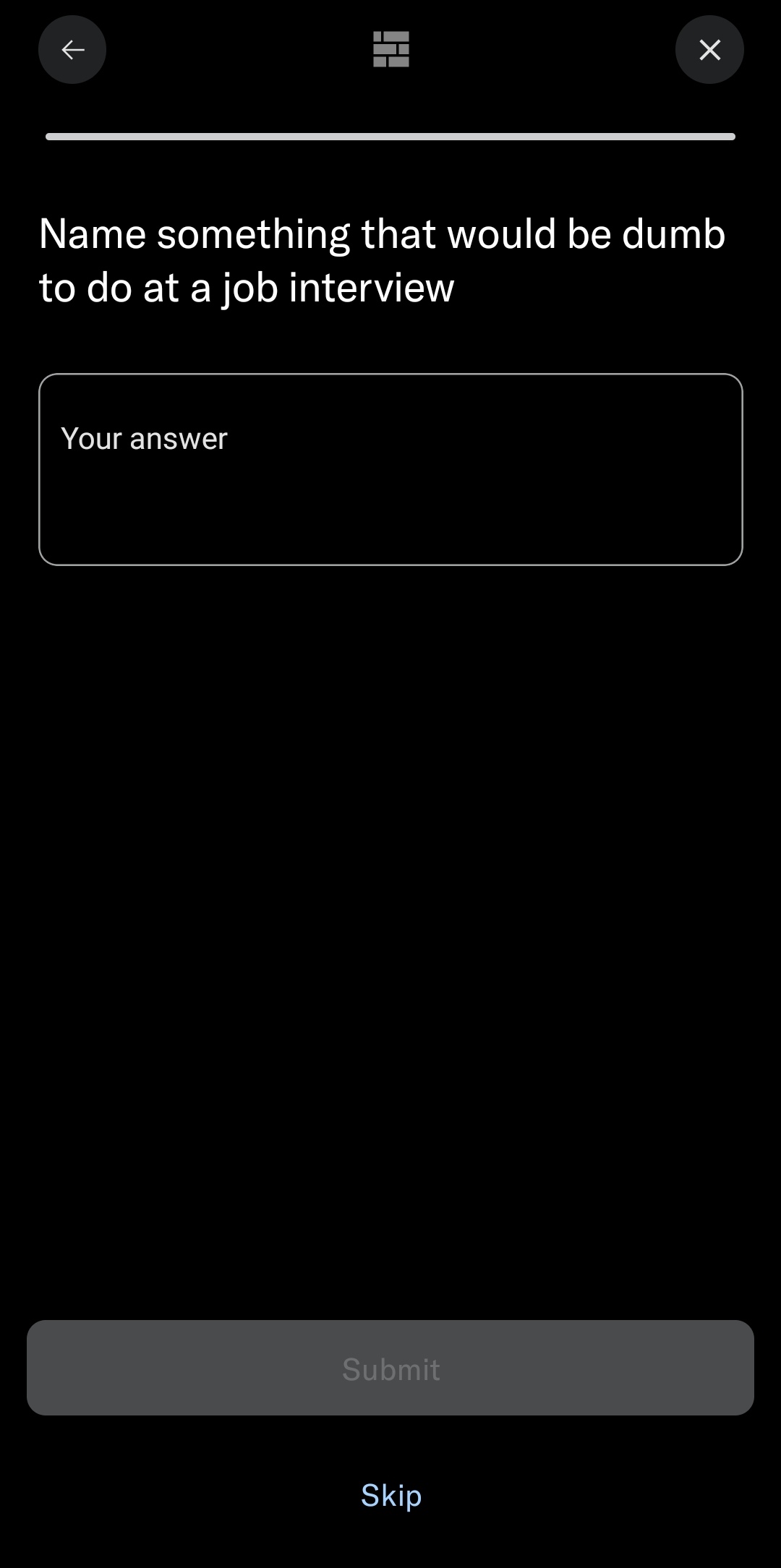

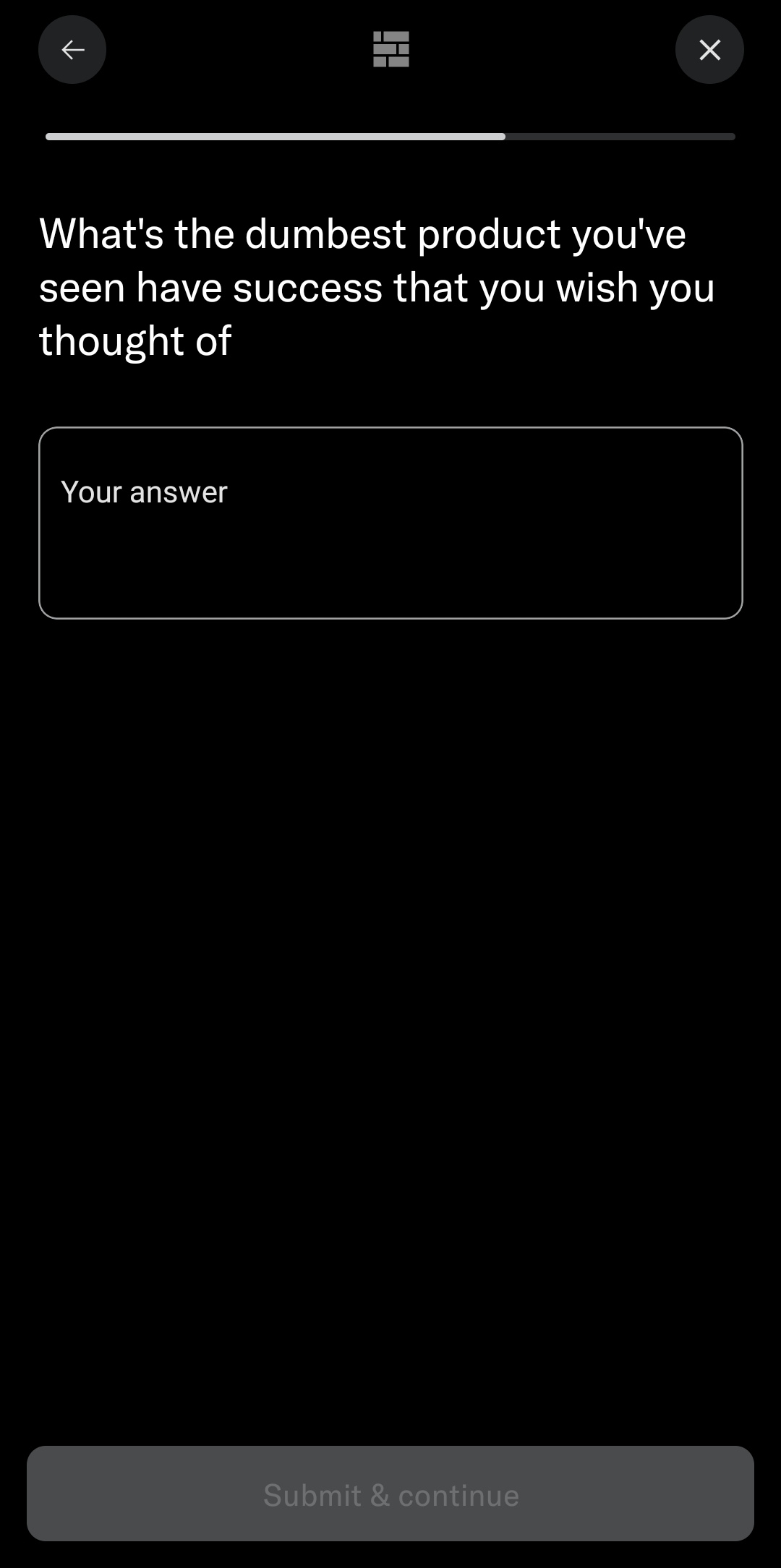

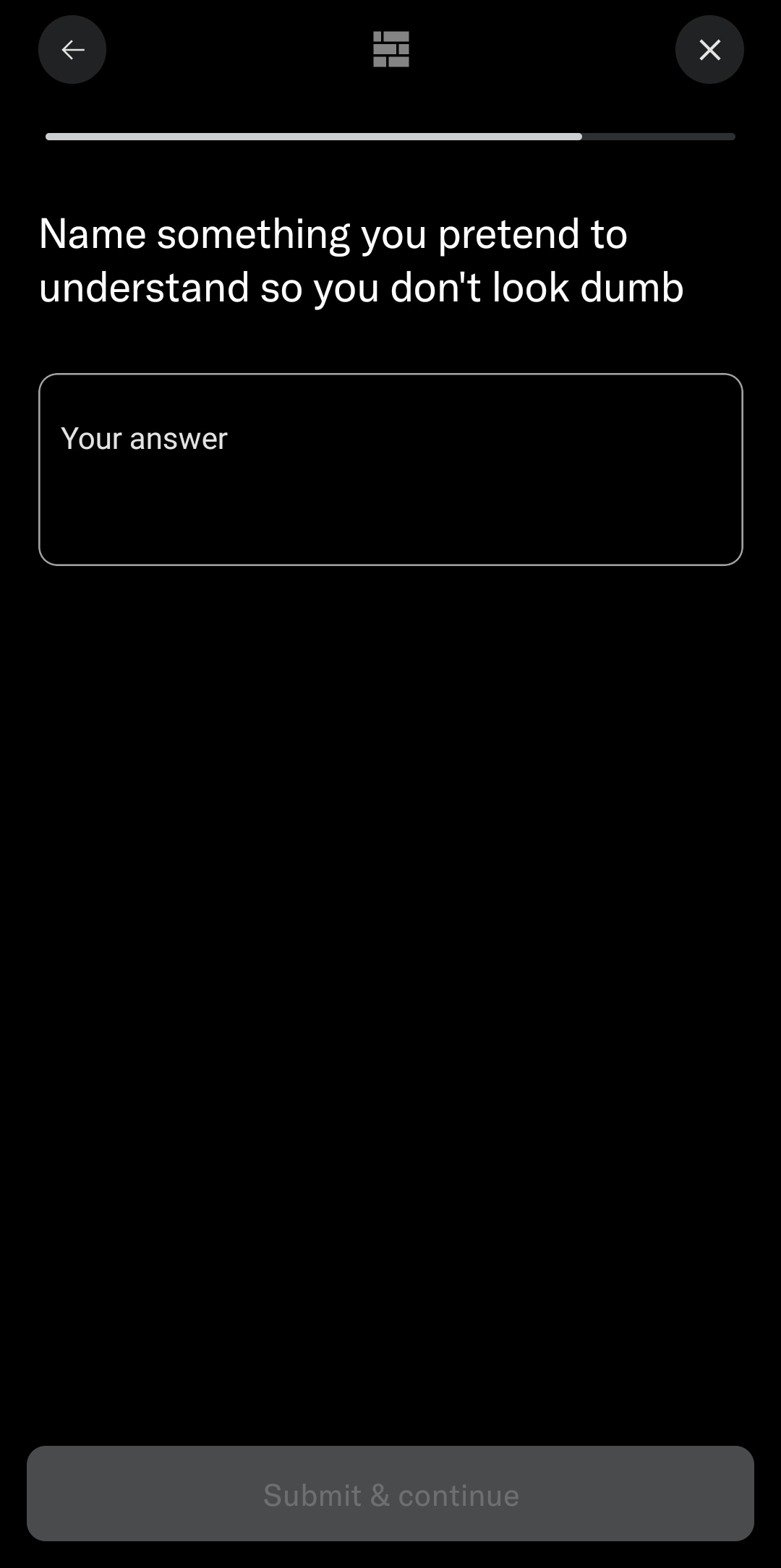

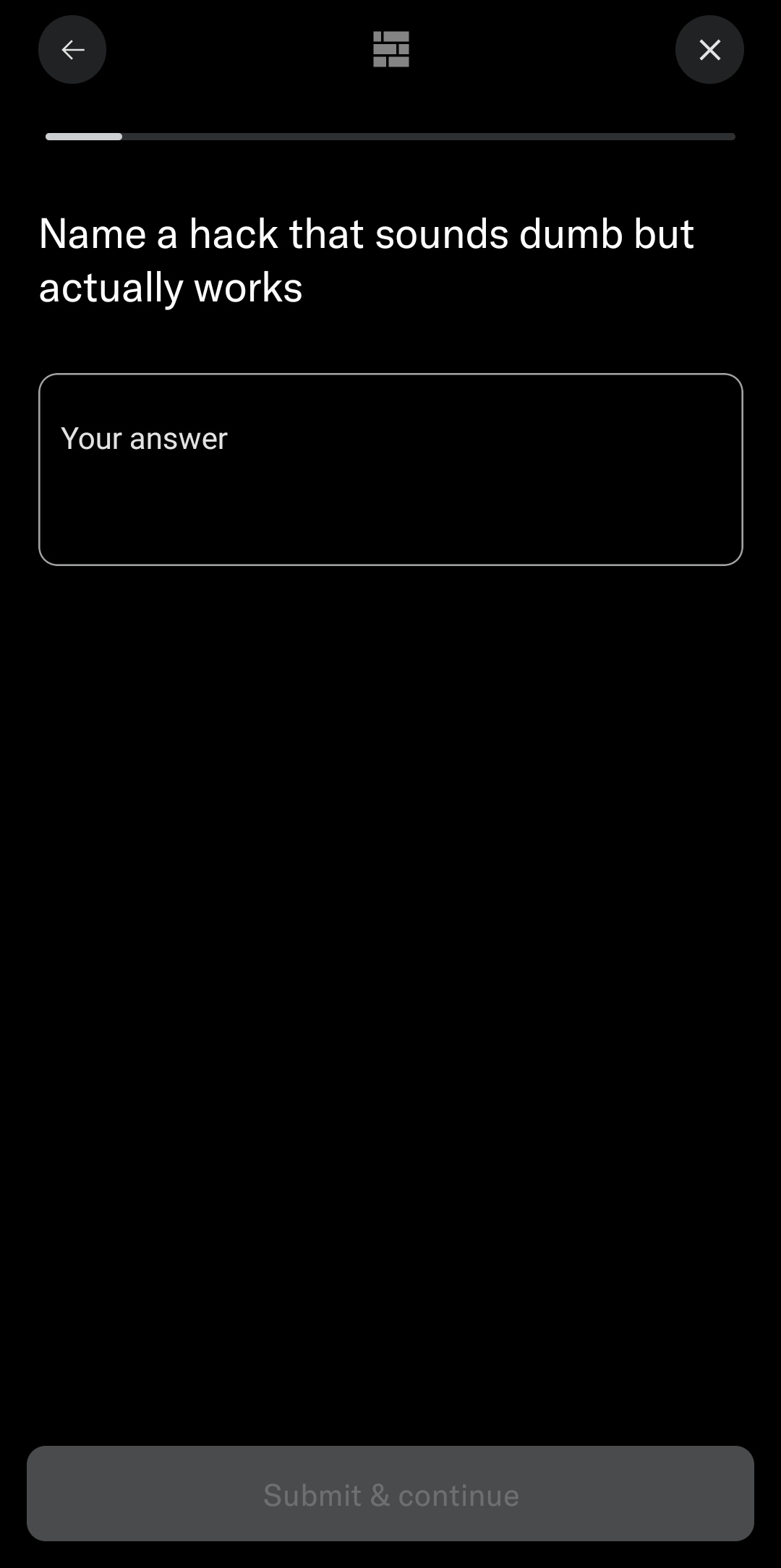

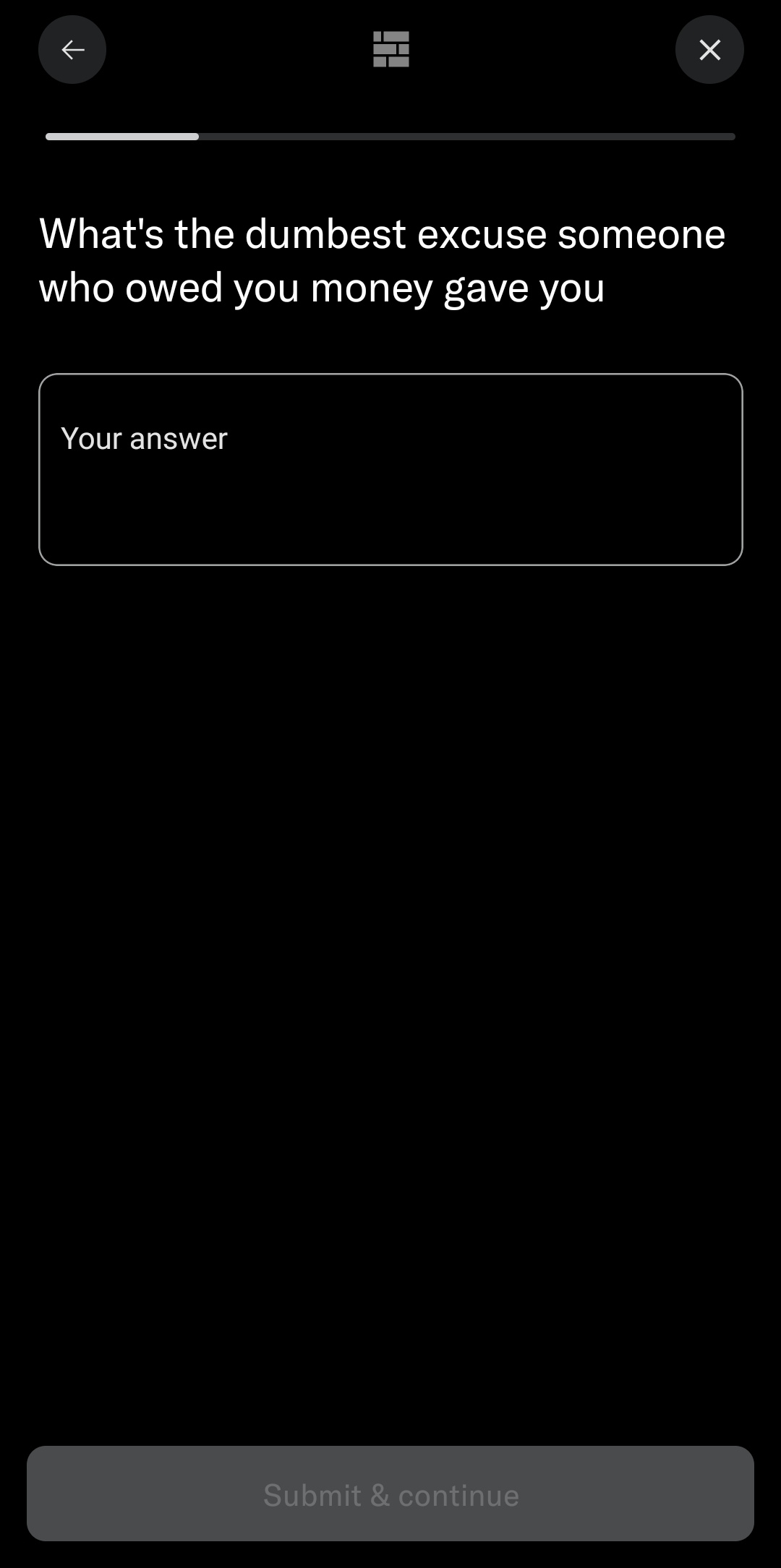

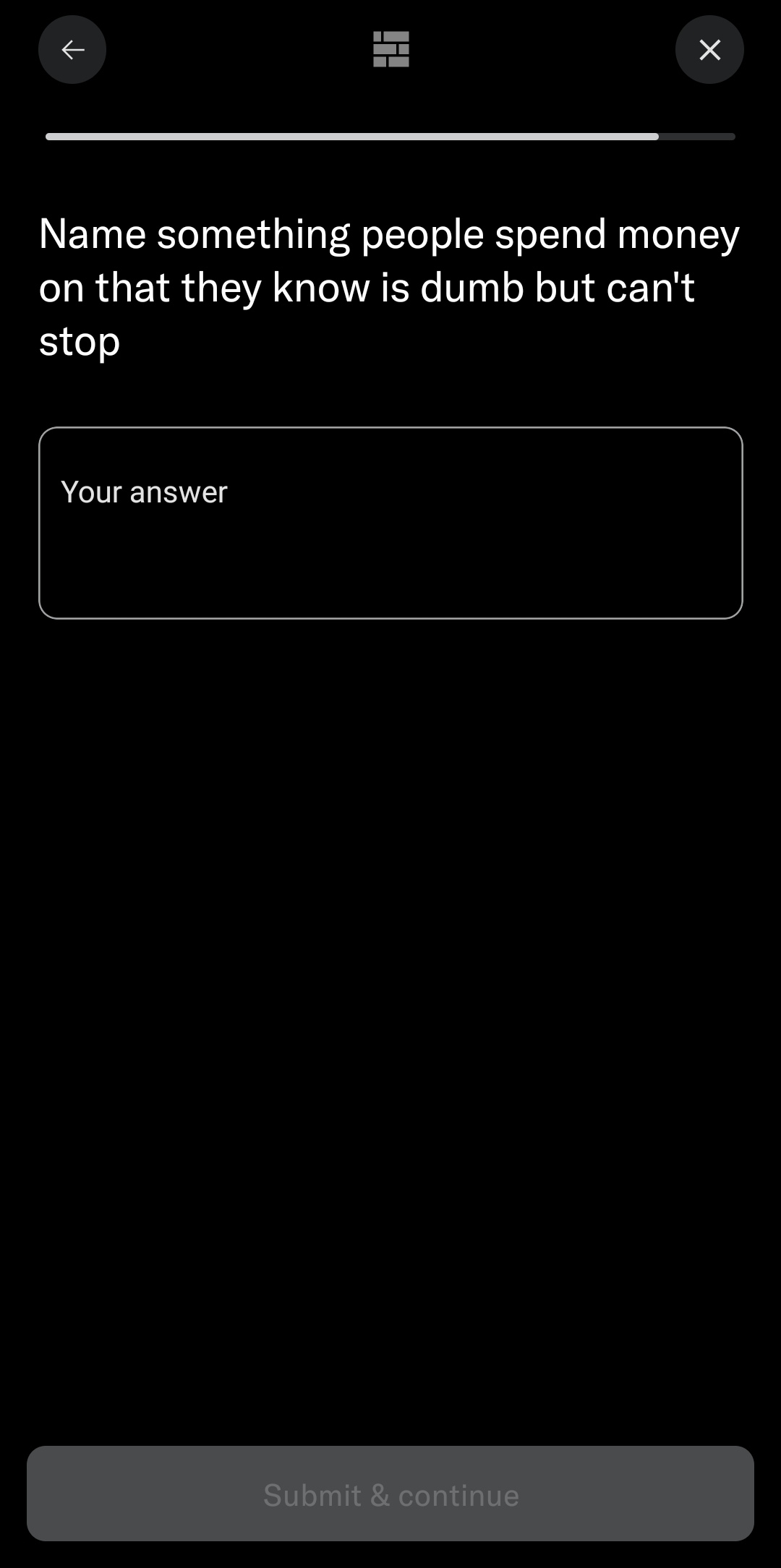

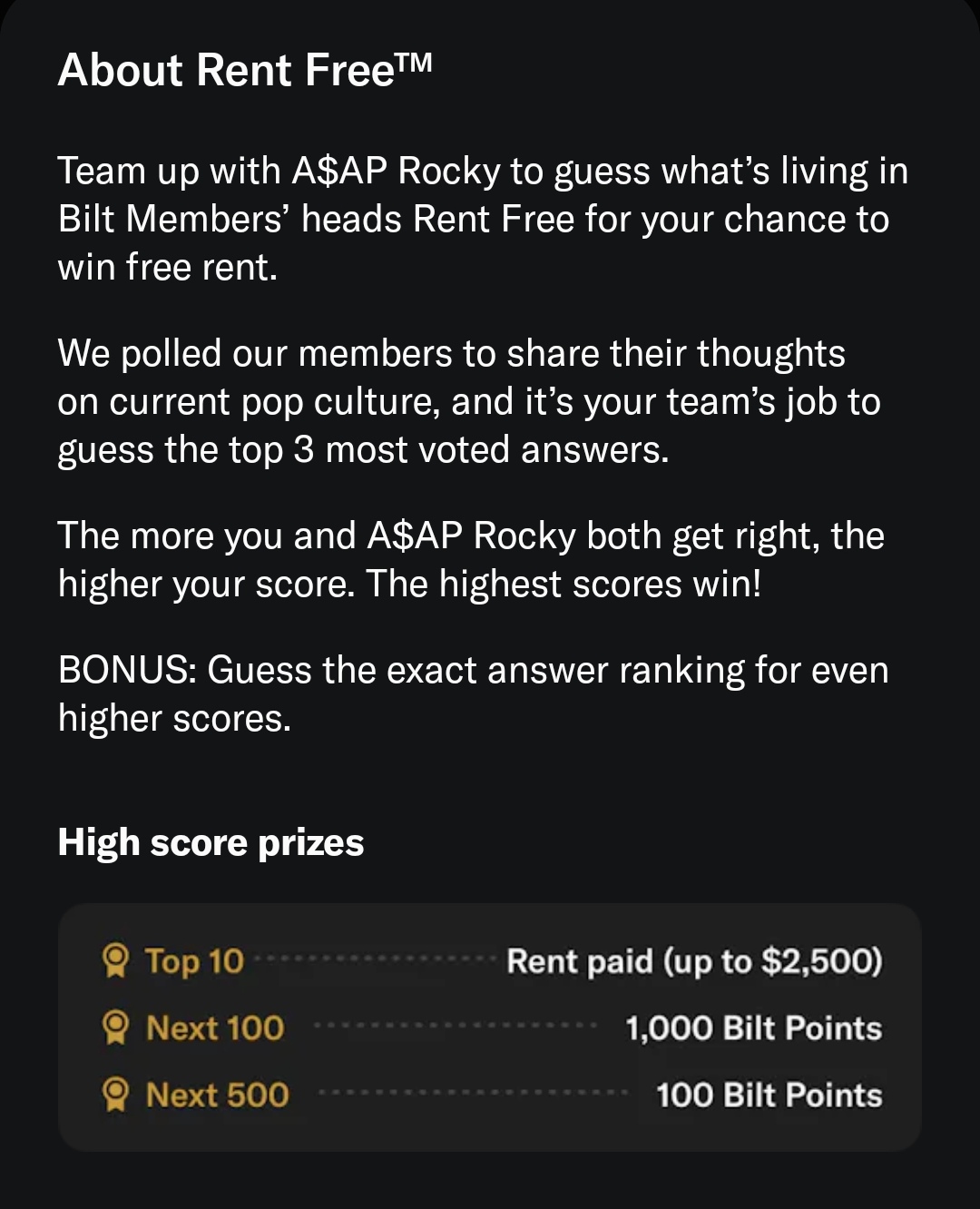

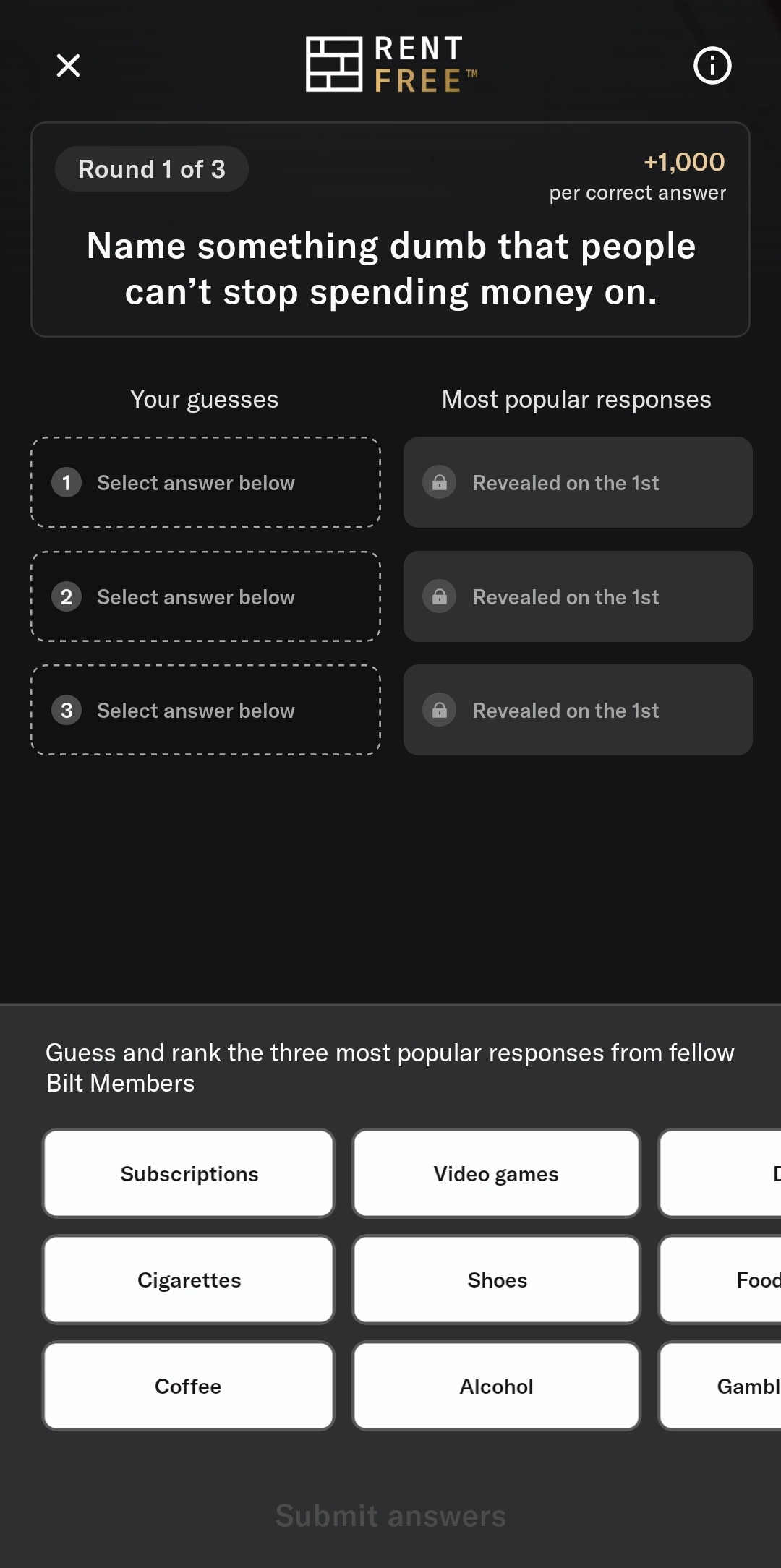

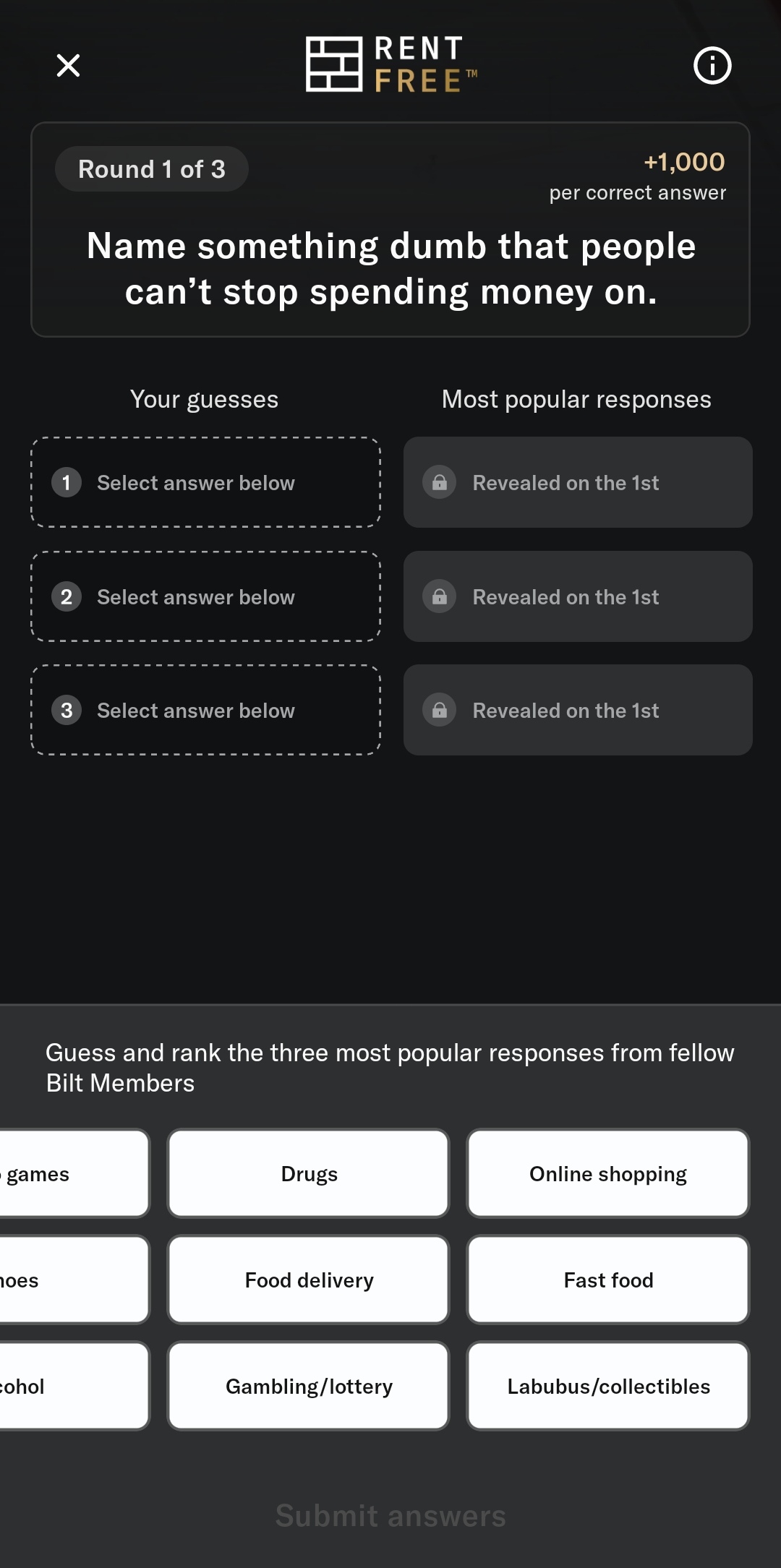

Bilt is a credit card company that has a monthly game show where they survey their users for their answers to various questions. Top scorers in the actual game get their next month's rent covered by Bilt.

The top 3 answers reported on the actual game (not this prediction market) will resolve YES 100%, regardless of their order. The rest resolve NO.

The results post at 4pm EST, Jan 1, 2026. I was one of the surveyed users this month. However, I do not know the correct answers, so I can trade on this market.

This is my referral link if you wish to sign up / apply and play the game yourself:

Referral code 0ZY5-58A2

Click here for a dashboard to other Jan 1, 2026 Bilt Rent Free markets.

There will be no AI clarifications added to this market's description.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ64 | |

| 2 | Ṁ38 | |

| 3 | Ṁ21 | |

| 4 | Ṁ20 | |

| 5 | Ṁ14 |

Anybody with a buttload of mana now from New Year's resolutions can get a quick turnaround on these markets! They close up at 3:30pm EST.

@prismatic @JeromeHPowell Remember, 25% of all answers here will resolve YES. Assume 25% is the base rate across the board.

@JeromeHPowell It's fiiiiine. These markets usually get a few people to sign up to Manifold and trigger referral bonuses to counter any mathematical losses incurred. (People like to Google the answers to Bilt's Rent Free game.)

I like the new trader bonuses for making the market more liquid. I just wish I could set the starting setpoints to 25% and have the liquidity immediately present.