At one point, someone half-jokingly asked Conflux if "The Market" was resolving according to the arithmetic mean or the geometric mean. So obviously, I have to see how it would play out if it really was based on the geometric mean.

This market will resolve YES if the time-weighted geometric mean of its probability is greater than 1/e ≈ 0.36788 after it closes. I will be using the exact probabilities, not the rounded values displayed by the market, since otherwise Team NO could easily win just by betting it down to 0.0% at any point in time. The value of 1/e was chosen because it is the geometric mean of all values between 0 and 1, and therefore, it is theoretically the most fair value to use (using 1/2 would give Team NO an advantage, since the geometric mean is smaller than the arithmetic mean).

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ3,576 | |

| 2 | Ṁ2,302 | |

| 3 | Ṁ1,262 | |

| 4 | Ṁ1,190 | |

| 5 | Ṁ471 |

@MarcusAbramovitch Funny that, until just now, this one was at the most extreme odds even though it's actually the easiest one to flip. I guess it's because YES was further ahead here than NO was in the other two for a while, but since YES can never be guaranteed a victory in this one, the required probability doesn't approach zero as fast.

@JosephNoonan “easiest to flip” nah, the reason is the history and entrenched positions, way more YES to fight here than the others for NO. Just look at the limits that need to be broken here vs. there.

@deagol Yeah, actually that's probably true. Even though the required percentage is slightly more extreme, the RMS market is probably easier to flip than this one given the lack of limit orders and fewer opponents. I still think the exponential mean would be harder to flip, though.

@deagol interesting. You could have asked me btw, I could have easily adapted my average script (that I had since starting MPC 3).

@harfe Yeah, this is the code I am using: https://pastebin.com/5Z1Xv78W

Obviously, I will comment out the END_TIME = NOW line when calculating the final average.

@harfe thanks, yeah as I said elsewhere I’m not planning to do the work needed to be able to run any scripts, I’m happy to load semi-manually into excel. I got an old, stubborn brain, I guess.

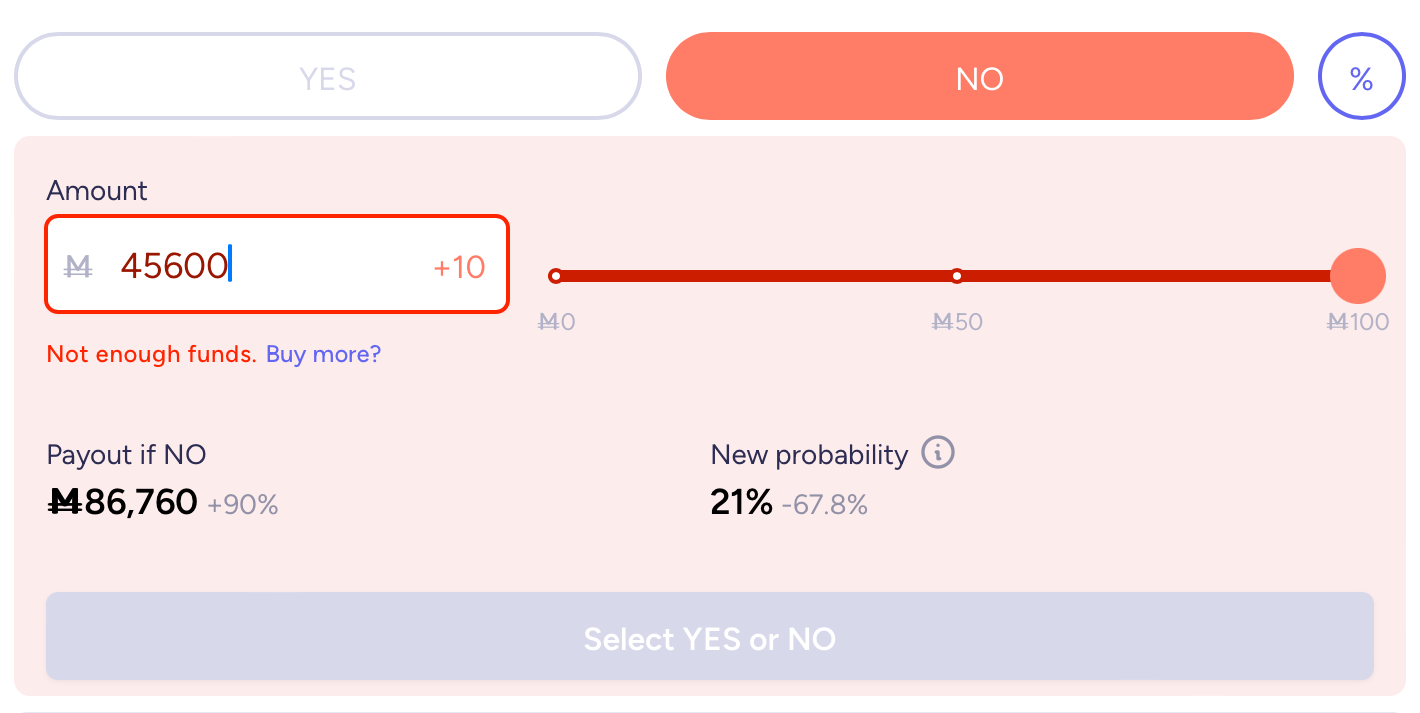

@b9cd That was the geometric mean over the remaining period that would be required for NO to win. Now it's down to 19%. You can calculate it based on the current mean, the current time, and the times of the market's creation and closure.

@b9cd downloaded the time and prob data from my browser, loaded into excel, took the log of the probs (yes all negative numbers) then time-weighted avg of those, then solved for what’s required over the remaining time to get the whole time avg to add up to -1, call it x, then exponential of that e^x

there’s a chance if can hold it at 1% for a whole day, that would be quite impressive (requires even bigger whale than @IsaacKing)

@deagol Holding it at 1% for a day isn't feasible. Even holding a market at a much less extreme probability for only an hour, when that was the entire goal of one side, didn't work:

https://manifold.markets/IsaacKing/will-this-market-stay-above-90-for