This market will be open for exactly one week, from 3:20 PM ET on Saturday, April 1st to the same time on April 8th. When it closes, I will determine the averge percentage the market was at over that time period, based on the displayed (i.e., rounded) percentages. I will resolve this market YES if the average is less than 50% and NO if it's greater than or equal to 50%.

Unlike "The Market", betting huge amounts of money on one side will not help that side reach victory. Will whales find some other way to manipulate this market, or will it be the market of the common man? Only time will tell.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ409 | |

| 2 | Ṁ143 | |

| 3 | Ṁ75 | |

| 4 | Ṁ55 | |

| 5 | Ṁ50 |

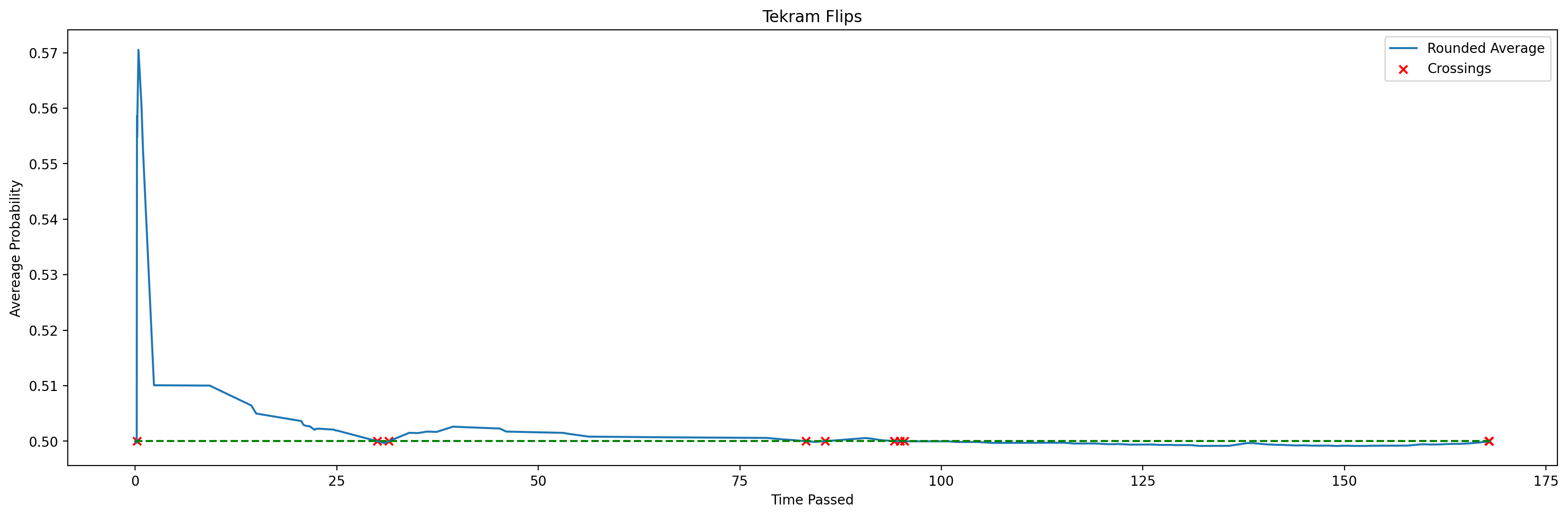

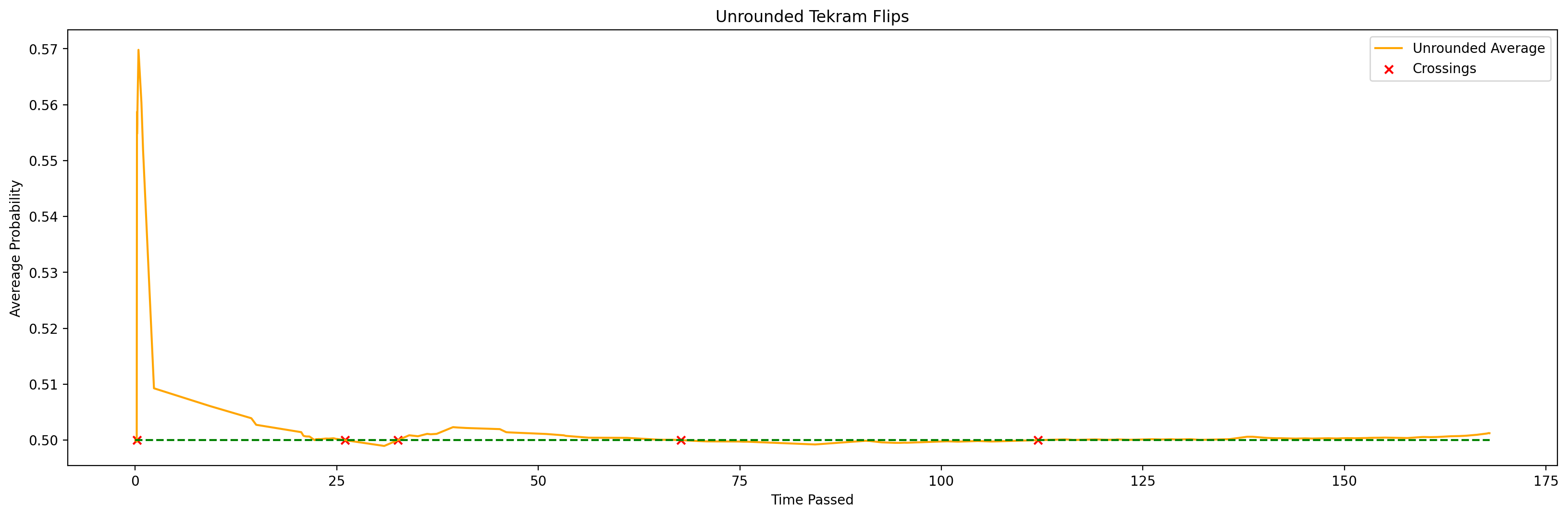

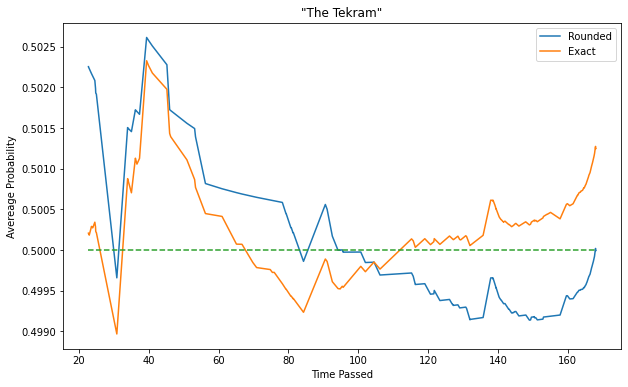

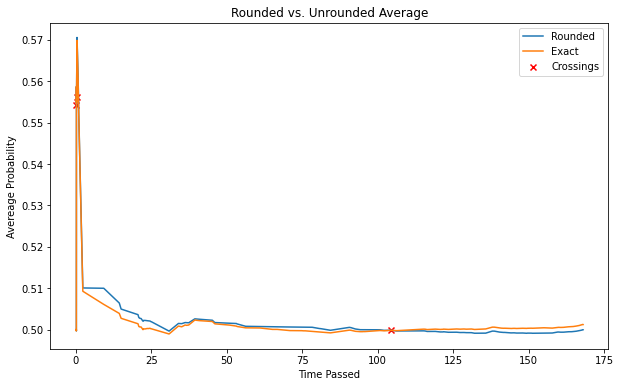

I made some visualizations of this market. Note that I only calculated the values at the times when trades were made, so the values of the averages, etc., at times between trades are not exact, they are just being linearly interpolated by Matplotlib. First, here is the graph of the average percentage over the whole time the market was open:

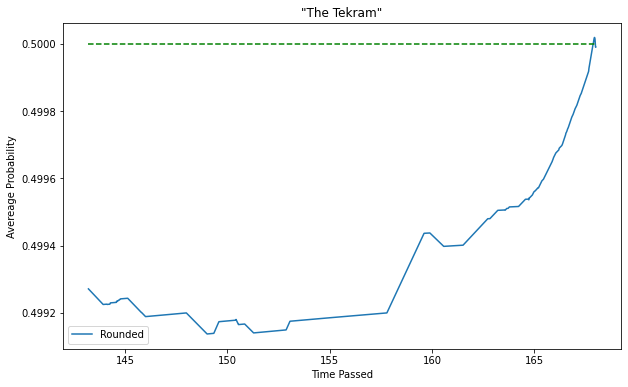

It's hard to see most of it because of that spike at the beginning, so here's what it looks like with the beginning cut off:

The final average was 49.99904%. The graph makes it look like it went above 50% at the very end, but actually that's showing what happened about 4 minutes before the end, where the average briefly flipped above 50%, only to go back down.

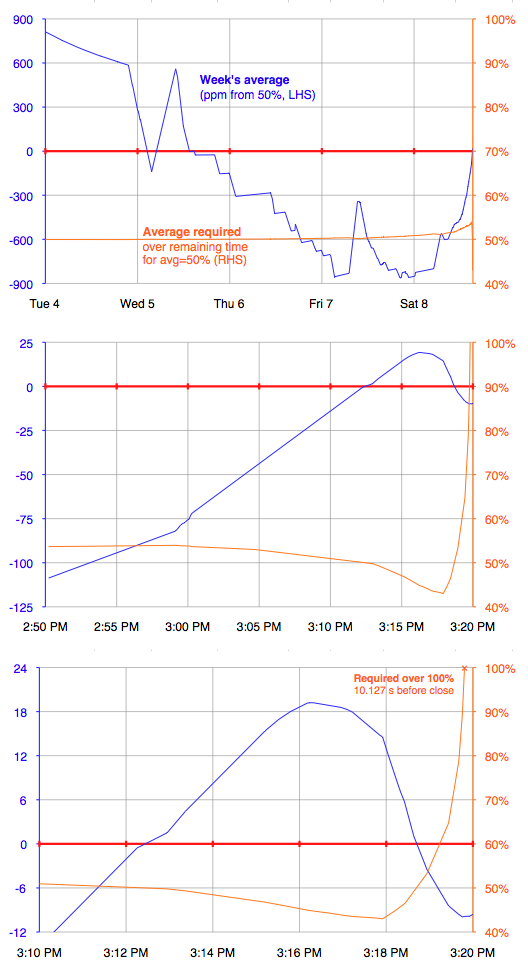

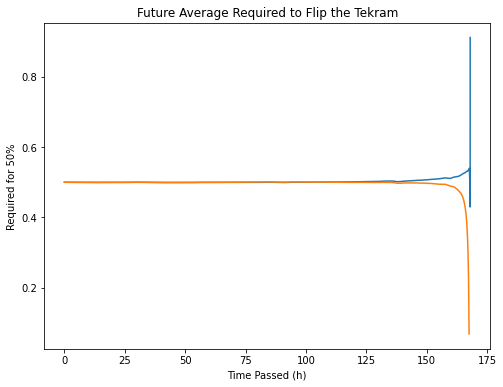

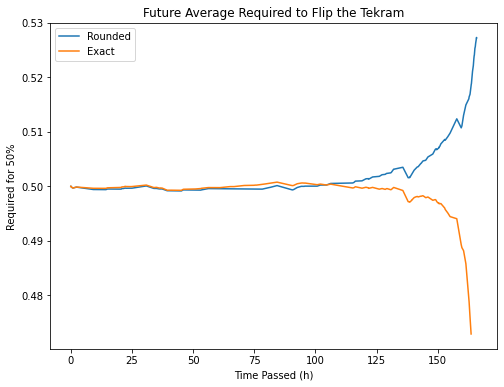

Now, here's a graph of the average that would have been required to flip the Tekram at each point in time (That is, at time t, what would the average over all future times have to be for the final average to be exactly 50%?):

Unsurprisiningly, it's pretty much just 50% for most of the time, though here's a zoomed in version of those earlier times:

The final result wasn't determined until about 10 seconds before close. The final result for the unrounded average was determined earlier, about 21 minutes from close. But the results were opposites of each other.

The rounded average crossed 50% ten different times, while the unrounded average crossed 50% five times.

the Matplotlib graph makes it look like it flipped at the end, even though it didn't

But it did, about 4 min to close, then flipped back below. You can see that in the charts I posted at the time

@deagol Oh right, I forgot about that. I was thinking the graph made it look like the final average was above 50%, but actually, it's just showing the time the average flipped just before the end. I can see it more clearly on the even-more-zoomed-in version.

I edited the original comment to correct my mistake.

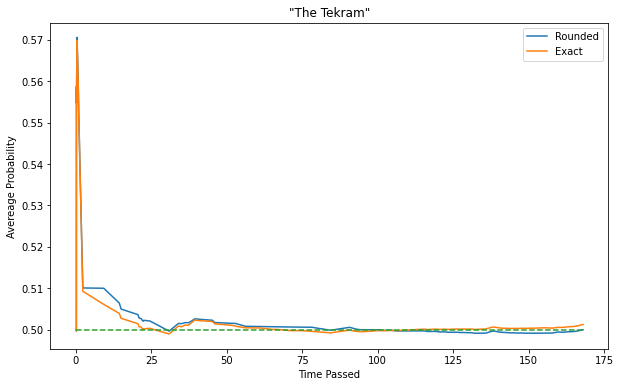

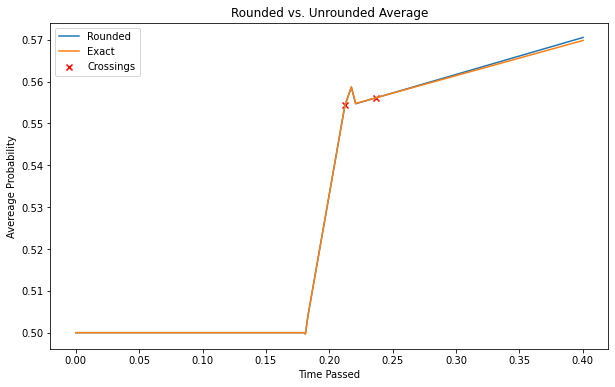

@JosephNoonan One last visualization of when the rounded and non-rounded averages crossed over with each other. This only happened thrice, with the first two occuring very early on.

Zoomed in view of the first two. The averages crossed over but quickly crossed back.

@JosephNoonan No harmonic mean? Oh and what about my joke suggestion for the log-odds mean?

@deagol I didn't do the harmonic mean because the harmonic mean of [0,1] is 0, so it would be impossible for Team NO to win if I used the same method for determining the threshold they have to beat as I did in the other markets. A log-odds market could work, though.

People thought nothing would happen here, it’d be 50% all the time. Not at all. Granted it’s tiny profits compared to The Market, but I worked patiently on it over several days, subtly and surreptitiously buying a stake, and finally @JosephNoonan helped out in defending the close snipers. At one point I even gave up and cashed out, reassessed the data, and came back last minute.

Again tiny profits, but contrast the exciting end of this compared to the boring, predetermined last couple of days of The Market.

@deagol Yeah, I'm not sure exactly when the final result was mathematically determined, but I'm pretty sure it came down to the last few minutes, possibly even the last minute.

@JosephNoonan According to my calculations, it became a guaranteed YES only on the 5th transaction from the close with just over 10 seconds left, where @cloe bought M$10 worth of NO sending the price from 51% to 50%.

But in reality it was predestined to flip back to YES a couple minutes earlier, when you dumped a lot, and a few NOs piled on, which sent the price into the low 30s even high 20s for enough time to make a dent, well below the 43% minimum that the NO team was required to stay above of, and then you started buying YES again, all of which happened within two minutes of the close.

I think I saw you dump, then start buying back, and just knew you were looking at the required average, so I blindly followed your lead as fast I could (including tripping over one of my own limits lol).

@deagol Wow, that's pretty amazing that it was only determined 10 seconds before close, even though the eventual result was obvious a little before that. I was expecting that there wouldn't be a mathematical guarantee until pretty close to closing time, given the nature of the market, but I didn't think it would be that close.

@JosephNoonan the average went over 50 around 7-8 min to close (I think that’s when I bailed) then it peaked near 20 ppm (parts per million, or 0.002%) above 50% about 4 minutes from close, then tanked fast to -10 ppm below the bar.

@JosephNoonan I'll wait a bit just to make sure there are no objections to this number. It's more specifically 49.99904%, so it was indeed decided by less than 0.001%. And the average without rounding was 50.12%, so using rounded percentages indeed flipped the market.

@deagol Yeah, I got worried at the end that it might actually close at exactly 50% and make us lose that market.

@8 Yes, if you look in the comments below, you can see the script I'm using. I stole it from someone who used it on "The Market". Currently, it says that if the market stays at 52%, the final average will be 49.99%.