This will resolve as YES if Peloton Interactive Inc files for bankruptcy. It will resolve as NO otherwise.

🏅 Top traders

| # | Name | Total profit |

|---|---|---|

| 1 | Ṁ291 | |

| 2 | Ṁ204 | |

| 3 | Ṁ193 | |

| 4 | Ṁ146 | |

| 5 | Ṁ50 |

People are also trading

Current Peloton Interactive Probability Of Bankruptcy

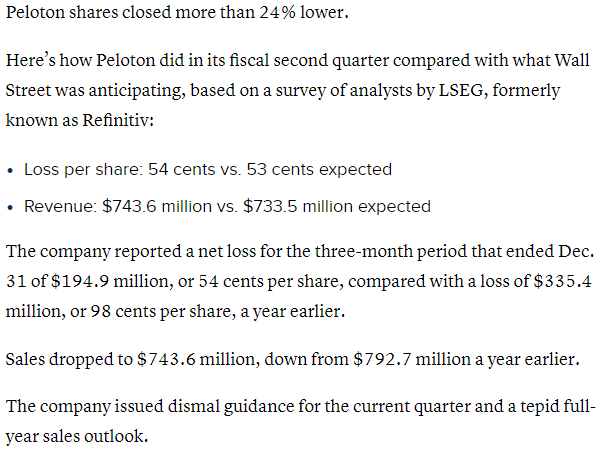

THEY ARE OUT OF CASH FLOW! Already using assets and layoffs to paydown debt, but as you can see, it is not helping, and getting worse.

@SirCryptomind Current assets exceed total liabilities by $900m.

What’s the time period for that bankruptcy probability? I’ve seen much more distressed companies last longer than a year.

@ByrneHobart

Good question.

My person probablilty for 2024 would be 21%.

I actually think acquisition is more likely in the next 6 quarters.

-

$300m in annual cash burn, improving for a couple quarters now; $750m in cash and equivalents on hand. I don't see any reason for their cash burn to ramp up so fast from here that they'd go under, especially because the gross margin and working capital situation improves as more of their revenue is from subscriptions vs equipment.

What proof are you using?

Does an acquisition count?

Do assets from bankruptcy sale to continue brand count by new management/ownership count?

@SirCryptomind Hello, Thanks for asking for clarification. I added some description. Filing for bankruptcy (any chapter) will resolve as YES. Acquisition or other transactions will resolve as NO.