The resolution is to the first nominee formally selected by the Democratic Party (which happens at the Democratic National Convention). If the nominee is later replaced (for example, due to dropping out of the election, death, etc) that does not change the resolution.

If a candidate becomes presumptive nominee after securing a majority of pledged delegates, that is not sufficient for resolution, until formally selected as nominee.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ1,335,915 | |

| 2 | Ṁ895,248 | |

| 3 | Ṁ326,221 | |

| 4 | Ṁ245,477 | |

| 5 | Ṁ233,313 |

So this market, one of our largest ever, climbed from 15 to 30 on Friday, and hung at the 30 mark for two days right up until Joe tweeted. Implies Manifold is not yet big enough to have insider-trading moles in the White House.

Kudos to @FlipPidot ... that's got to be one of the most legit non-market manipulated Manifold wins of all time.

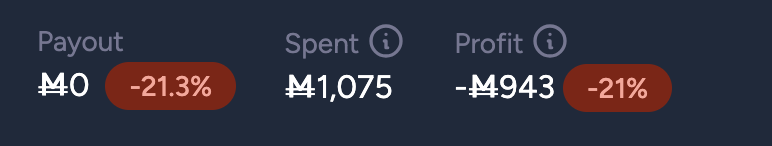

Just logging in after being in rural Wisconsin this weekend. Obviously I am disappointed to see my wavy line theory didn't keep holding out, but my main take away here should be, I didn't cover my wavy lines in the form of a limit order in the opposite direction, particularly since I went off grid. As a result I got my ass handed to me, after having been up something like +1000...woopsie daisy. So lesson learned, wavy lines don't always wave the direction they are supposed to.

It wasn't a disaster, it was only 5% of my net worth. You should never risk more than you're willing to lose on any bet.

Guys I'm sorry

I'd agree this is arguably premature. Not to the level of rating the resolution as dishonest or anything (unless he does end up as the nominee somehow haha), but a market oriented around who the official nominee is shouldn't resolve until there is an official nominee - for the same reason this (correctly) wasn't resolved when he won enough delegates to secure the nomination.

Certainly a good point, though I don't think I'd agree It tips the scales personally. People can always sell early if they want their mana.

(I should re-emphasize the point I made above - I don't think Nathan has acted dishonorably in resolving this early, I just think it raises an interesting point of conversation about norms on Manifold. As I am wont to do, I'm arguing for the 'technically correct' and more rigorous interpretation over the "general dude on the street" interpretation as I think that's in the best interest (long term) of Manifold's viability as a serious prediction market venue.

It certainly seems premature to resolve this before there is an actual nomination. It is possible that, for reasons of campaign finance laws, the Democrats could nominate Biden and then have him withdraw after being nominated. Biden has only made an announcement; he has not taken an action to end his status as a candidate.

Fun fact: None of these filings are actually relevant for the purposes of nomination. Also, none of them officially end Biden's campaign, they only establish Harris's campaign.

Delegates are still entirely legally permitted to vote for Biden, and arguably legally obligated to do so unless he gives them written permission freeing them of that obligation.

OK. I guess they believe they have answered the FEC question. That doesn't preclude Biden from being nominated. While the likelihood Biden is nominated seems remote, I would argue that, from a hygiene perspective, a market that says it resolves on the "the first nominee formally selected by the Democratic Party" should not resolve until the party formally selects a nominee. I understand there may be practical reasons to end it but early. A better practice might be to provide notice of the intention to do so first.

Mods gave it a 👍 in General & Public conversation in Discord.