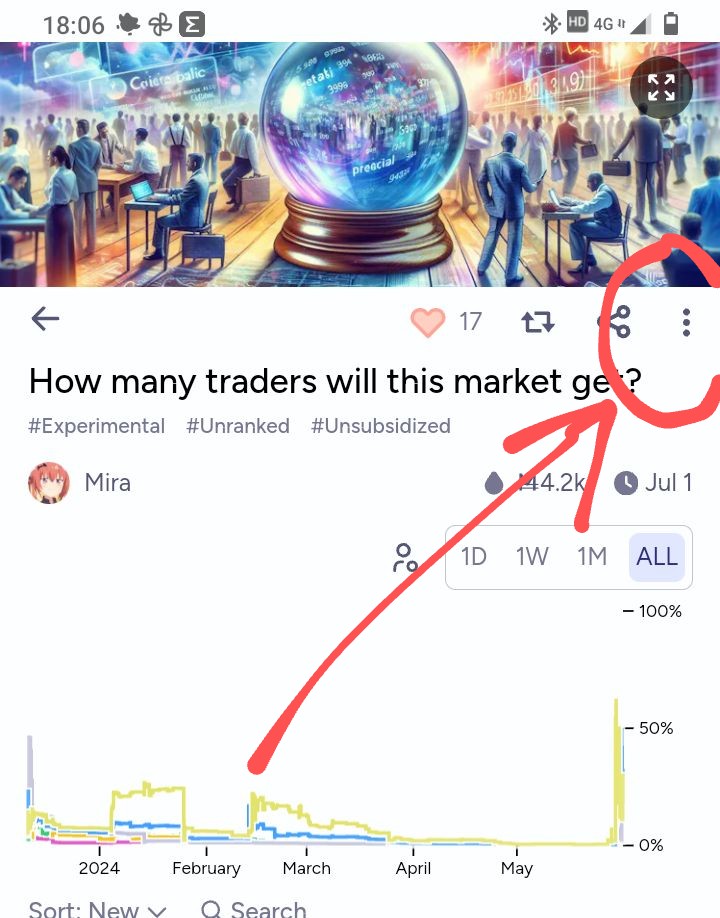

For each breakpoint above 8, each time the market reaches a new Fibonacci number of traders its close time will be extended by 1 month(starting from end of December). I will add new Fibonacci numbers to the options as necessary.

Resolves to the linear interpolation between nearest bounding answers, or 100% to an option if it is exact. If the market has exactly 1 trader, resolves 50% to both.

Example: There are 100 traders. Then this market resolves to (100 - 89) / (144 - 89) = 20% 144 and 80% 89.

Current breakpoint: 233 traders -> closes at end of July

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ3,429 | |

| 2 | Ṁ3,228 | |

| 3 | Ṁ3,039 | |

| 4 | Ṁ1,811 | |

| 5 | Ṁ1,477 |

Last 5 days 307 to 328 so added 21 and now less than 5 days to go.

If add another 21 to 349 then 377 resolves as 81%

A further speed up as the close date gets closer might be a reasonable assumption?

Where does 73-75% come from? (perhaps a longer period looking at rate of increase, but isn't a most recent similar period more appropriate? )

The last comment was 8 days ago, at 264 traders.

Now, we are at 276 traders.

Market closes after 30 days.

if we assume the same rate:

that would be 45 more traders, , = 321 total, which would resolve to

61% 377

39% 233

That is also pretty far from another extension - maybe not enough people on the website yet to reach the higher numbers. Stock in higher values is pretty worthless.

276 to 286 in 5 days is 2 per day. 25 days adds 50 so that reaches 336.

As close date approaches might get more interest which might increase the rate so that might get it closer to 377 target which may generates more interest .... so might get to 377 and cause a further month extension.

I would agree that not many markets reach 1597 traders or even 987 but it isn't clear how long you may have to wait for a small return.

Hit 307 so 21 in 15 days so perhaps wandering around from 1 to 2 per day rather than increasing as deadline get closer. This doesn't rule out an increase in rate nearer the deadline.

307 is nearer 377 than 233

If goes back up to the 2 per day rate adds ~20 and takes us to ~327, is another 50 on top of that likely? Possible with some effort to attract new uses but otherwise doesn't seem likely.

A low rate of 1 per day takes us to 317 and 377 would resolve at 58%

233 would resolve at 42% maybe less with a rate rate of new users

BTW

Fewer numbers can can change percentages more rapidly at

https://manifold.markets/ML12d1/-for-which-x-will-this-market-get-x

hit 234 on 3 June per comment below. At 265 now so 31 added in 23 days. At that rate could reach 36/23*31 +265 =313

That is nearer 377 than 233 but still a decent increase from current 8% for 233. Trouble is this question may get more attention as it approaches its current Aug 1 close date and attract more new traders as that date approaches. Perhaps particularly so if 233 has a higher %age.

So it is not too difficult to see 233 becoming worthless.

@Mira_ I believe we are owed another month, to the end of July, and the description still says 144 -> closes in June.

@deagol I've extended it. But if the market does close, it would send me an email and I'd reopen it. So don't worry too much if the close date is earlier; you'll still get the extra month.

@Mira_ Thanks. I was wondering if some casual traders might not have been aware of the real (current) close being almost 2 months away, but I guess that's on them.

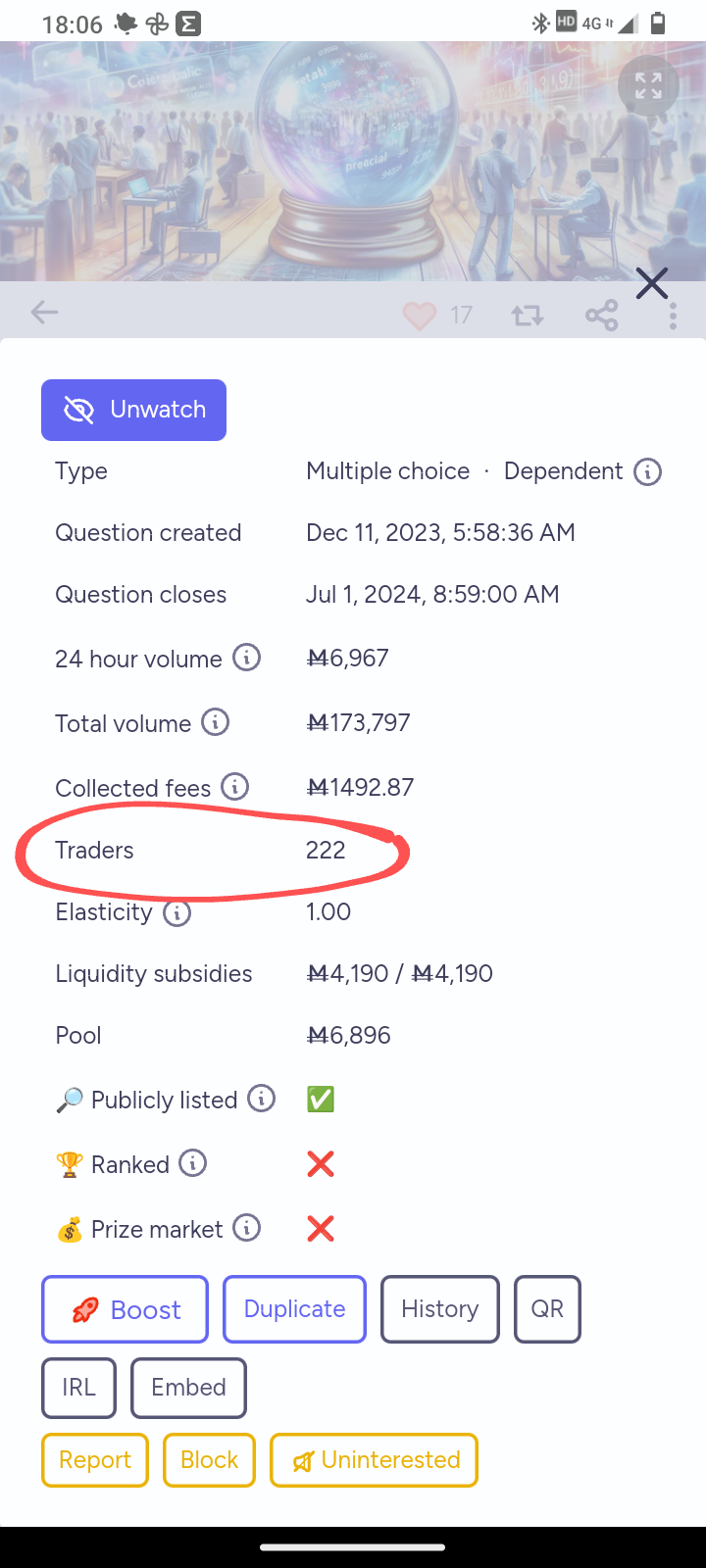

why doesnt it show unique traders? doesnt that only limit who knows to who writes a bot to sort count the 1.5K Trades via API? (I swear it used to show it at top...?!)

Currently at 194 traders, so only 39 until it crosses the 233 threshold and "144" becomes worthless. Seems hard to imagine it won't get 39 more traders in a month given the strong incentive.

@MugaSofer Yep esp with 96 new traders in last 40 hours even if it is 39 needed that is less than half of new traders in last 40 hours