This is part of a series of markets about things I could do in 2024. See: /Mira/which-of-mira-s-cool-ideas-will-mir

Summary

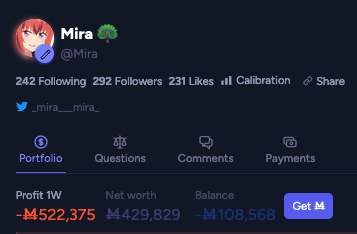

I signed up for a Kalshi account a week ago. It's disallowed for me to trade on PolyMarket, but I can think of 2 people that would be willing to proxy bets for me or purchase information. There might be other markets too, like @BTE 's upcoming prediction tournament site.

I'm mainly thinking Kalshi for this.

You can also give me a million dollars to trade with to manipulate this market, if you think I'll be profitable with the money. Mira hedge fund incoming?

Market Mechanics

Trigger condition: I transfer $2500 to Kalshi or any other real-money prediction market site. Money can be denominated in cryptocurrency or any fiat currency.

Resolves NA if the trigger condition is not met. Otherwise, resolves to the logarithmic interpolation between nearest bounding answers(or to $1 if I start this but don't make any positive profit for the entire year). Units are "profit in USD". I'll add new options at multiples of 10 as needed before resolving.

Example: I make $500 in annual profit. The nearest options are $100 and $1000. Then this market resolves (ln(500) - ln(100)) / (ln(1000) - ln(100)) = 70% $1000 and 30% 100.

"Profit" is the net profits on all my real-money prediction market trading in 2024. I will have to track it for tax purposes(Kalshi is CFTC-regulated, so I think is taxed as futures?), and I would use that number to resolve this market. If I sell information because I can't trade, the sale amount counts as prediction market profits.

Mira will not trade on this market(or will market sell if I accidentally do).

@MichaelWheatley If I'm allowed to withdraw the money, I would keep it on platform and trade with it for the year but count the free credit as profit. If it's strictly trading credit or an equity loan(including an account credit that I promise to pay back before withdrawing), I would value it as $0 but fully count any profits generated with it. If it's a loan with an interest rate, I would value the principal at $0 and the interest as negative profit.

You guys know I have at least a million dollars, right? The $100 option seems really high because it indicates I won't really do anything after transferring the money.

I checked my brokerage account and I'm up $62k in the last month and I haven't touched it in months(since the banking crisis).

That wouldn't carry over to Kalshi or PolyMarket because there's going to be less volume. And, while prediction markets don't have margin so all the returns are unleveraged, prediction markets also naturally have more leverage so you don't need it.

@Mira That's actually part of why I don't strongly believe you'll go deep into real money prediction markets. The money making aspect is nice, but you do pay with the time, and there's got to be an intellectual challenge to it, and I don't think you'd enjoy it for long and the money won't drive you either

@firstuserhere That's a good point. I could set up a Kalshi account and transfer money and do nothing while waiting for the next LK-99. And plausibly I could make $100 off of some low-risk interest rate market when nothing interesting happens or I'm busy doing something else.

Most Kalshi markets are not that interesting. Manifold has them beat there.

@TheBayesian That's the $1 option. It would be a bit rude to split the option now that people already bid it up to 31%, but I would assume the distribution of negatives is similar to the positives in magnitude.

well, i didnt ask to assess the risk of losing mana to insider trading, i asked to see if you'd still be around on manifold 🥺

@firstuserhere Not if the admins delete all my money though

I think they double-counted my TIME losses. I sized it so I would lose about 25% of my account at most. And this is more like 50%. It otherwise doesn't add up.

Only the FUH goals markets could be big enough to cause an extra M260k swing, and I actually have a 1 day profit on those so they're not it. And even the net loss doesn't add up to M260k.

@MichaelWheatley Correct - I intentionally skipped that one on all my markets because I don't need that much precision in that range.

Otherwise, resolves to the logarithmic interpolation between nearest bounding answers (or to $1 if I start this but don't make any positive profit for the entire year)

traders, keep this in mind - i'm betting $1 up because Mira's smart and likely to find more (and better) intellectually stimulating endeavors in 2024.

The reason It's likely not to be $1 is

If I sell information because I can't trade, the sale amount counts as prediction market profits.