Will measure the difference between the price at 8pm ET on Friday, March 10th and the price at 8pm ET on Monday, March 13th.

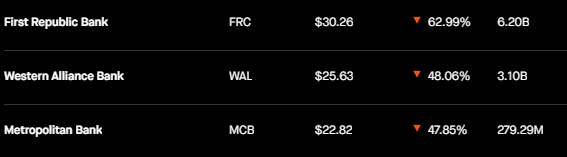

Mar 12, 1:58pm: Will a publicly traded US bank (not SVB) close > 50% down on Monday, March 13th? → Will a publicly traded US bank (not SVB) stock price close > 50% down on Monday, March 13th?

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ440 | |

| 2 | Ṁ154 | |

| 3 | Ṁ117 | |

| 4 | Ṁ83 | |

| 5 | Ṁ29 |

@SG the measure is defined in the additional context. regardless of the mechanism through which it is achieved or prevented.

@MatthewSlotkin That doesn't really clarify how you measure the price at 8pm ET on Monday if trading was halted. Would you use the last price (i.e. from Friday?)

Also, the title says "close" and close happens at 4pm, not 8pm ET. Are you using the close price or extended hours trading price?

@MatthewSlotkin Ok, can you change the question title then? And I asked because the description is not clear because some places (e.g. yahoo finance) will display only the prices from market open hours.