Let's bet on Bitcoin's value: Can it sustain a price of $100,000 for a full 24-hour period before January 1, 2025? This wager hinges on the endurance of Bitcoin's price, not merely touching but holding at or above the $100K mark from midnight to midnight, based on UTC time. It's a test of Bitcoin's staying power to consistently maintain this landmark level throughout an entire day's cycle on any recognized exchange. Predict whether Bitcoin will solidify its place above this major milestone and secure your chance for a payout if the cryptocurrency giant stands tall

Update 2024-13-12 (PST) (AI summary of creator comment): Recognized exchanges must meet all of these criteria:

Established Track Record: Multi-year history of operations and strong industry reputation

Significant Trading Volume: Consistently ranked among top exchanges by trading volume and liquidity

Regulatory Compliance and Security: Known for regulatory compliance, robust security, and transparent operations

Examples include Binance, Coinbase, Kraken, and Bitstamp.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ13,796 | |

| 2 | Ṁ3,005 | |

| 3 | Ṁ1,083 | |

| 4 | Ṁ661 | |

| 5 | Ṁ570 |

@FedorShabashev resolves YES, thanks.

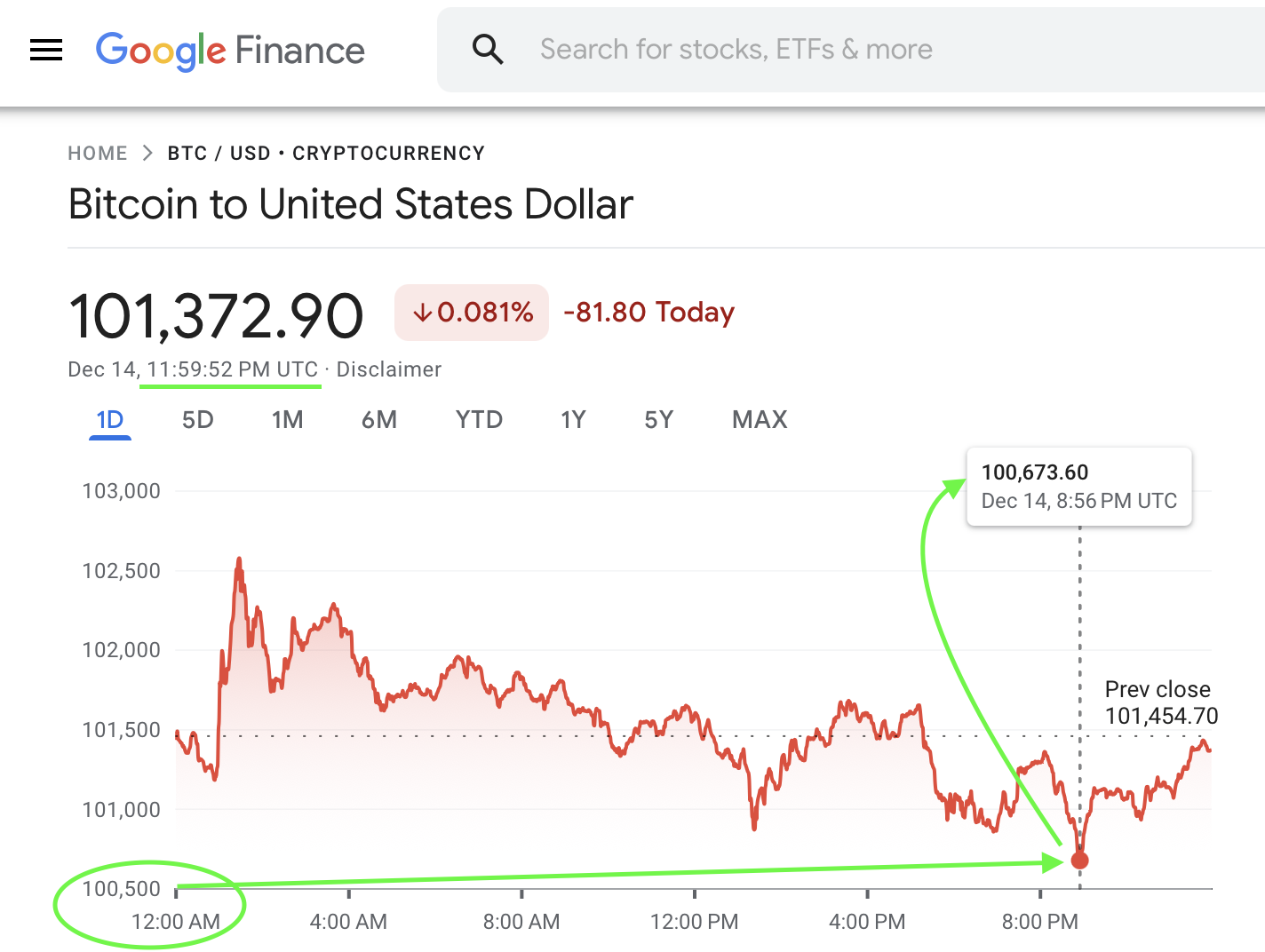

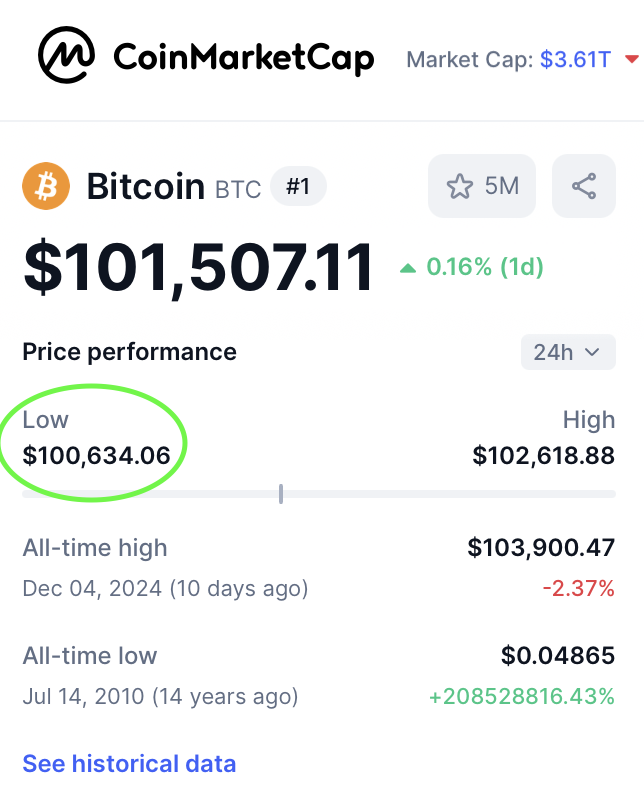

Dec 14 (UTC) lows (just one of these should be enough):

Binance $100,503.71

Coinbase $100,600.00

Kraken $100,666.00

Bitstamp $100,643

Indexes/aggregators:

Google Finance

CoinMarketCap

CoinGecko

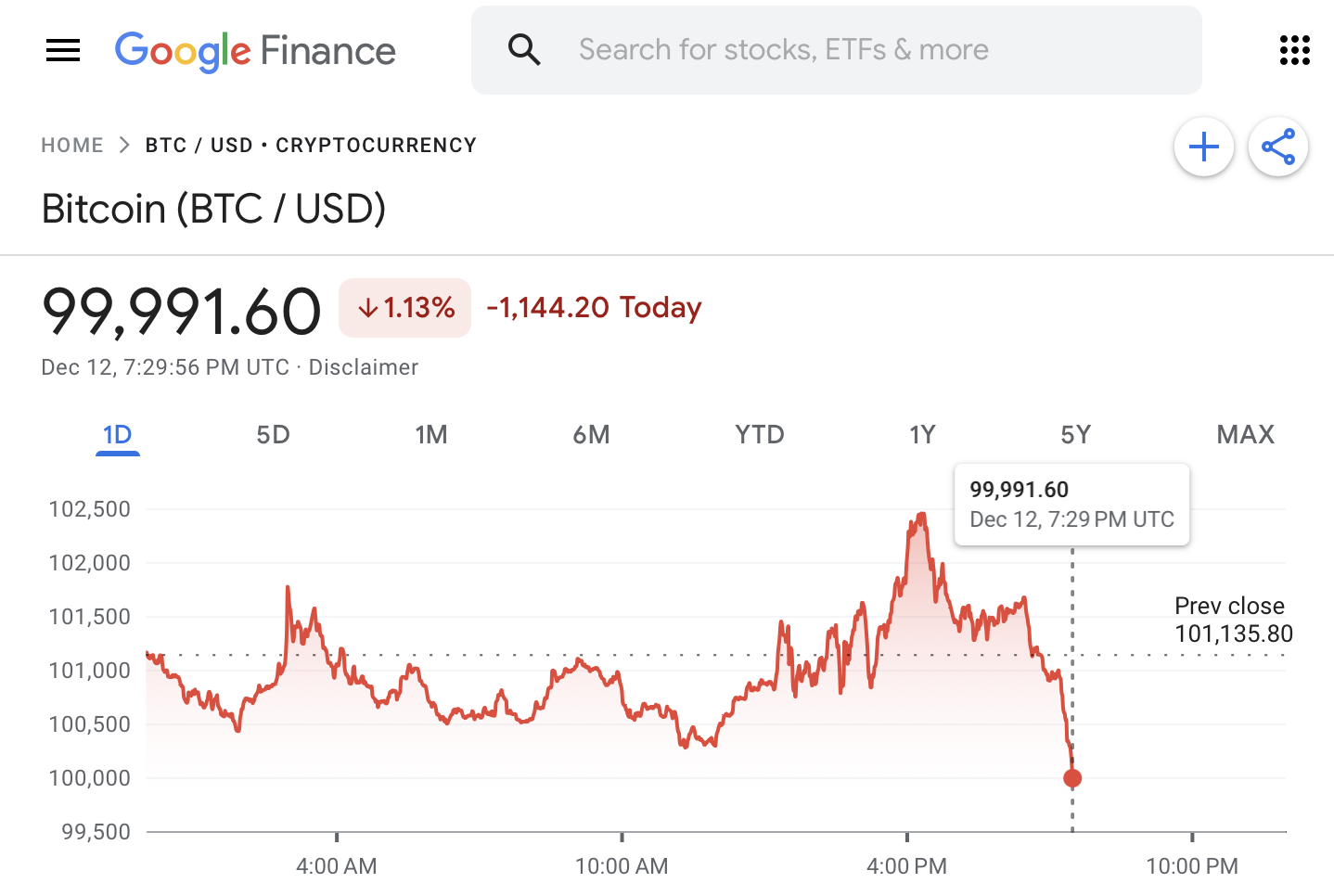

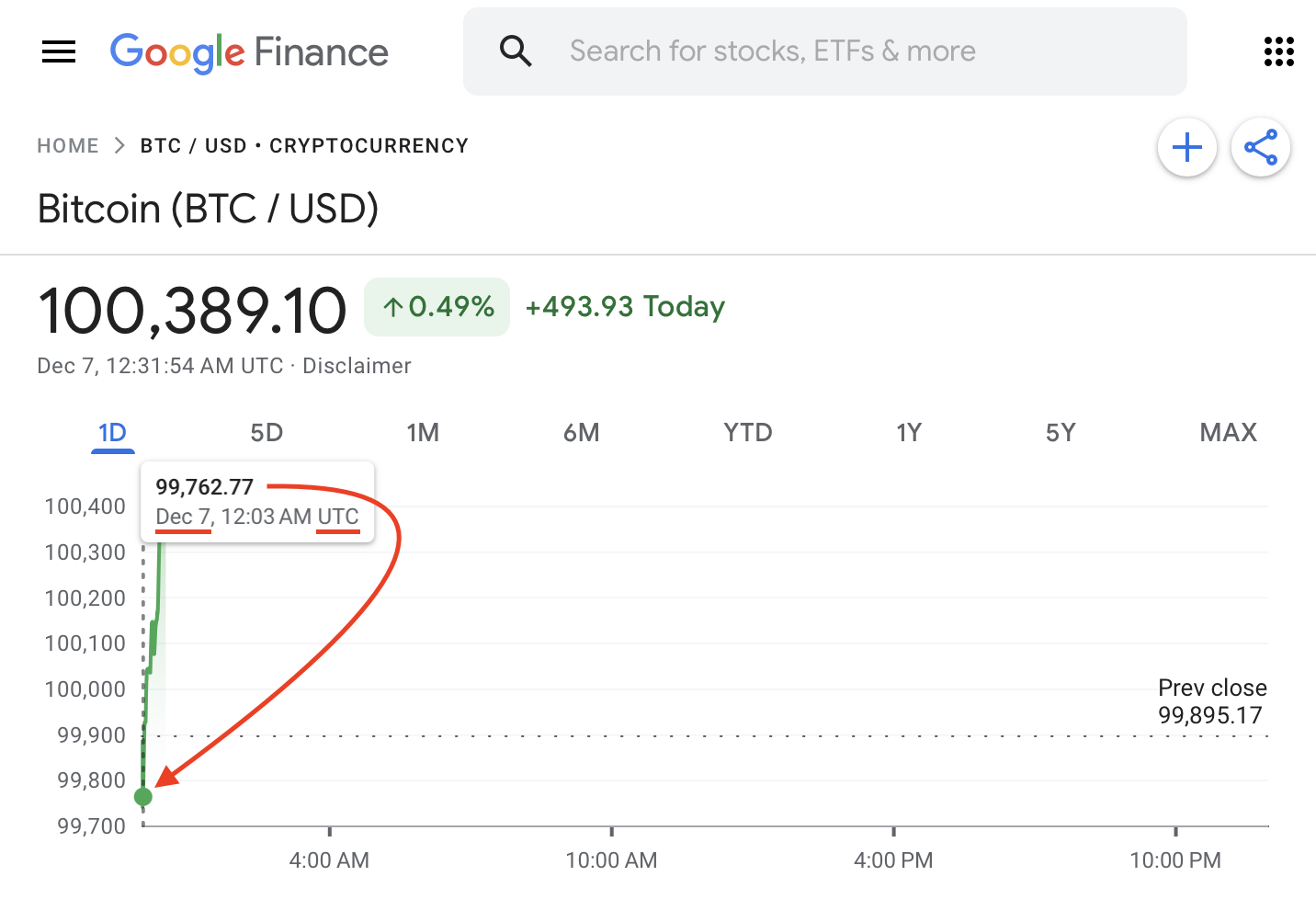

Today (Dec 7 UTC) has been foiled as well (all sites I've checked have similar <100k open right after midnight UTC). 24 days left!

@FedorShabashev "for a full 24-hour period" but not any 24h period, only midnight to midnight, correct? Also, can you specify what you would consider "any recognized exchange"? Thanks.

@deagol

Yes, that’s correct. By "a full 24-hour period," we mean a single, continuous day measured from midnight to midnight UTC. Specifically, we’d look at a day starting at 00:00:00 UTC and ending at 23:59:59 UTC. If Bitcoin’s price remains at or above the specified threshold for the entire duration of one such day, it would meet the criterion.

As for "any recognized exchange," we’re referring to major, reputable cryptocurrency exchanges that meet all of the following conditions:

Established Track Record:

Exchanges with a multi-year history of operations and a strong reputation in the industry.Significant Trading Volume:

Platforms consistently ranked among the top exchanges by trading volume and liquidity, ensuring the price is not easily manipulated by low-volume conditions.Regulatory Compliance and Security Measures:

Exchanges known for regulatory compliance, robust security, and transparent operations.

Examples of such recognized exchanges include Binance, Coinbase, Kraken, and Bitstamp. The idea is to rely on data from well-regarded marketplaces that collectively reflect a broad and reliable consensus on Bitcoin’s price, rather than from niche or unverified sources.