There is currently a bank run on Silicon Valley Bank (SVB) and in 2008, the Fed provided liquidity to allow Wall Street to survive the financial crisis. Since then, better controls have been put in place for risk estimation but there is still a chance that the bank run will hit SVB hard. See more information here: What Happens When Banks Face A Liquidity Crisis - Finance Blvd

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ415 | |

| 2 | Ṁ212 | |

| 3 | Ṁ96 | |

| 4 | Ṁ84 | |

| 5 | Ṁ59 |

People are also trading

@MarcusAbramovitch hang on - could you argue why it's so clear? FDIC resolution counts as monetary assistance from the Fed? The FDIC is not the Fed.

I tried to find evidence SVB had used the Fed's Bank Term Funding Program (which previous discussion was expecting was what would resolve this market) and have not found it.

@MarcusAbramovitch I believe that is a fine assertion. Excuse my inactivity, stopped using Manifold Markets for a long while!

I guess this closes as YES: Fed announces new emergency loan program for banks to ease SVB contagion risk - MarketWatch

@EsbenKran, Resolves yes

https://www.fdic.gov/news/speeches/2023/spmar2723.pdf

Impact on the Deposit Insurance Fund

The FDIC estimates that the cost to the DIF of resolving SVB to be $20 billion. The

FDIC estimates the cost of resolving Signature Bank to be $2.5 billion. Of the estimated loss

amounts, approximately 88 percent, or $18 billion, is attributable to the cost of covering

uninsured deposits at SVB while approximately two-thirds, or $1.6 billion, is attributable to the

cost of covering uninsured deposits at Signature Bank. I

@RobertCousineau: FDIC resolution doesn't seem relevant to "monetary assistance from the Fed". "the Fed" is shorthand for the Federal Reserve, which can provide temporary liquidity to banks through its monetary policy programs.

@chrisjbillington The people who need their unsecured deposits to pay their employees next week do. No purchaser is going to assume this liabilities out of the kindness of their heart. They will buy it BECAUSE it's covered by the Fed.

@BTE it is still possible that SVBs assets are enough to cover deposits alone, and that other creditors will be taking a haircut

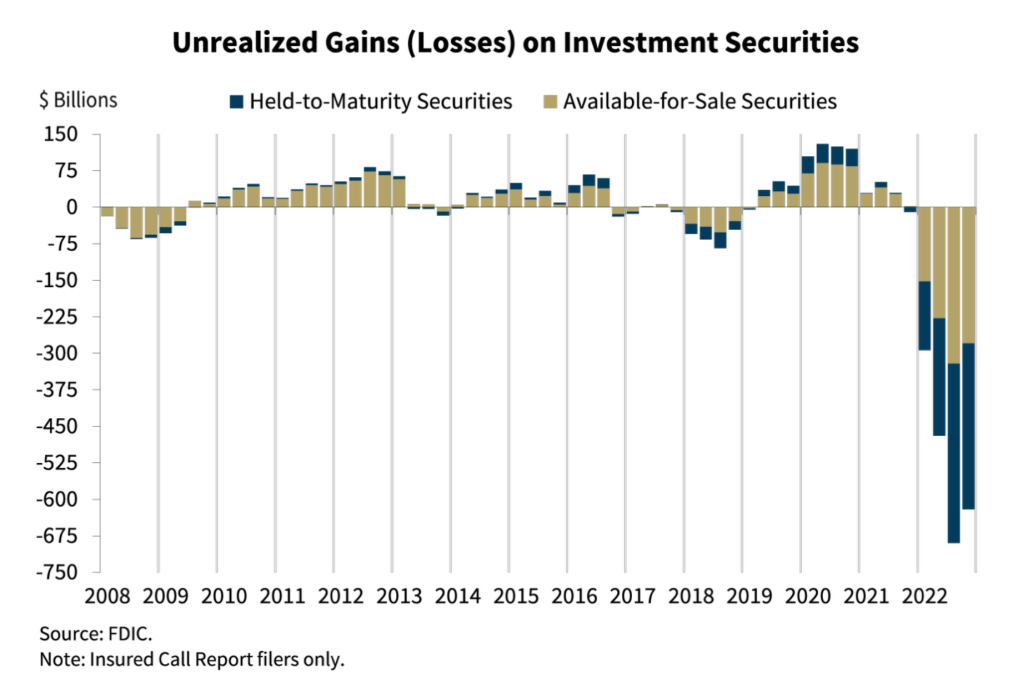

@chrisjbillington No because they have mostly "hold to maturity" instruments that had not been marked to market until they had to sell some on Thursday, at which point they had to market it to market and their total asset value plunged and can't recover until they figure out how to sell the rest of those hold to maturity products without further crushing their balance sheet. The assets simply can't retain value AND give cash.

@BTE I understand that, and that is an argument that they are insolvent in the short-term, and won't be able to pay all creditors. However, they have creditors other than depositors, and depositors get paid first. We do not know that they are in negative equity at mark-to-market prices by a large enough margin that they could not pay all their depositors, defaulting on other liabilities instead.

@chrisjbillington We know they failed to raise enough equity last Thursday in the General Atlantic private placement so if they couldny do it before being seized, why is it gonna happen now? The reason they bought hold to maturity products is because they haven't been able make loans to their customers so they don't have interest payments coming in like they did maybe 5 years ago. I guess they could maybe sell equity they own but it's mostly in illiquid investments so... Idk, what do you think they could do??

@BTE you are missing the point I I'm making.

All your arguments are that SVB must default on some debt. I am actually unsure if that's the case. But even if it is, not all of their liabilities are to depositors. It is possible they could default on other debt, and still pay depositors, despite being in negative equity.

For another argument, notice this market isn't trading near 100%.

@chrisjbillington I am not saying they default on anything so I don't think I am missing the point. I am saying they have nothing to sell to cover liability because if they sell they value of the pool continues to fall because they are selling at whatever they can get. They can't default on a hold to maturity bond because they don't owe anything on them, they paid the full price at acquisition and have held that value since. How could these instruments result in default for SVB? Am I making sense now?

@chrisjbillington I do. And I read about SVBs yesterday. And they could not do what you are suggesting. Which is why they couldn't raise equity.

@BTE I'm sorry but you are confused. I am unsure exactly of the source of your confusion, so apologies if this comes across as patronising. "Liabilities" is what the bank owes others. The government bonds they own are assets, not liabilities. They owe their depositors cash, that is one liability. And they may have, for example, issued bonds of their own such that they owe bondholders payments in the future. Essentially, they may have borrowed money from people other than their depositors.

They have made losses on their assets, yes, and if they realised all the losses, they may not have enough to repay all their liabilities. That's true.

But do you see that there is a possibility that they could repay their depositors what they owe them, but not pay other debt that they have?

If you owe two people money and you don't have enough to pay them both, you could prioritise one and pay them in full, and default on the other.

SVB may be able to pay depositors in full, but default on other liabilities they may have. Because deposits likely do not comprise 100% of their debt.

@chrisjbillington I know the difference, but you saying “they might” and “there is a possibility”. Cool, but what did they actually hold? I am searching right now to find exactly what liablities and it appears they do not have any other significant liabilities currently, which is probably what lulled them into a false sense of security that allowed the run to demand intervention. I had read something about mortgage securities, but have been able to find it again. I am tired and need a nap. Sorry to be so braindead this evening.

@BTE yes, its just a possibility, I don't know what liabilities they have. But it's uncertain enough that I regretted buying this market up as high as I did, so I sold back a bit! And it seems nobody has bought it back up in the meantime which makes me consider it's a real possibility.