🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ754 | |

| 2 | Ṁ41 | |

| 3 | Ṁ30 | |

| 4 | Ṁ24 | |

| 5 | Ṁ23 |

People are also trading

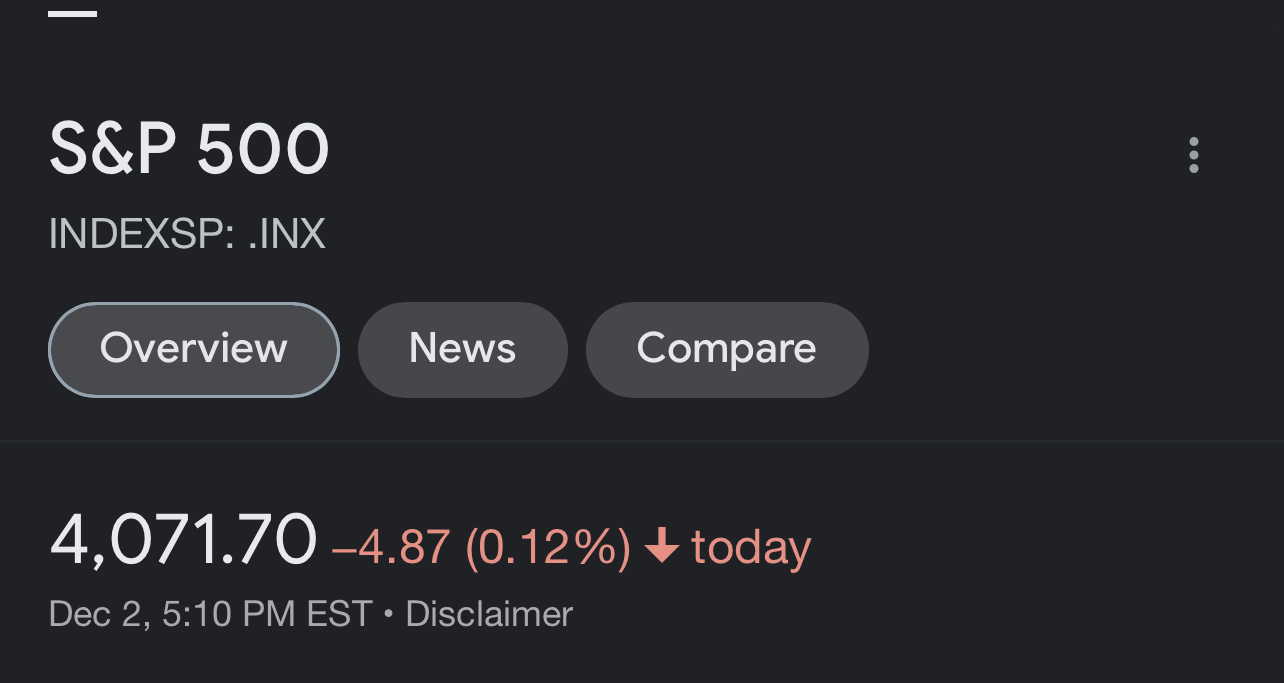

As usual, my answer to these questions is that the market already answering them via options, with massive amounts of money on the line. Here's how to calculate it: https://finance.yahoo.com/quote/%5ESPX/options?date=1672358400 has the calls expiring at EOY. Calls for 4000 are priced at 124.5 if we take the midpoint between bid and ask, while calls for 3995 are priced at 127.9. You could buy this spread, i.e. buy a 3995 strike call and sell a 4000 strike call, for 127.9 - 124.5 = 3.4. At EOY, this spread is worth 0 if the price is <3995, 5 if it is >4000, and goes up linearly from 0 to 5 in between 3995 and 4000. So 1/5 of this spread is pretty similar to this binary prediction market.

So we can roughly estimate the probability that S&P 500 is >4000 at EOY as (127.9 - 124.5) / (4000 - 3995) = 68%.

This is a rough estimate for a few reasons:

These are American options which can also be exercised before EOY, the calculation would be more accurate if you used European options. (This is probably the biggest caveat in this case)

Market participants are maximizing risk-adjusted returns, not maximizing risk-neutral expected returns

The spread does assign some value to nearby prices, instead of going from 0 to 1 at 4000 exactly as a step function.

Of course, note that if any market participant disagreed with this value, they could either buy or sell the spread - there's much more USD profits available there than here on this prediction market.