Do not bet on "Other". That is an error that I don't know how to correct yet. :-)

Public cloud means that other random organizations can use the infrastructure too. So no private or community clouds.

Classified information means for example Restraint UE, NATO Restricted or similar.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ52 | |

| 2 | Ṁ42 | |

| 3 | Ṁ11 | |

| 4 | Ṁ10 | |

| 5 | Ṁ9 |

Hi people. I may have a problem resolving this. Can you help me?

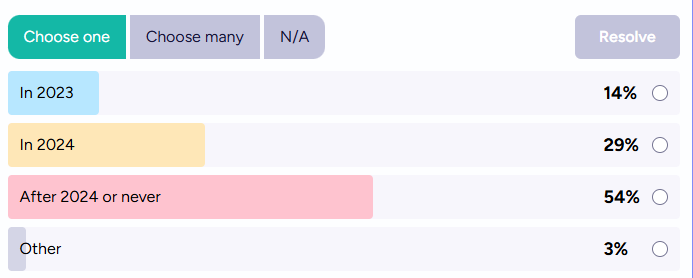

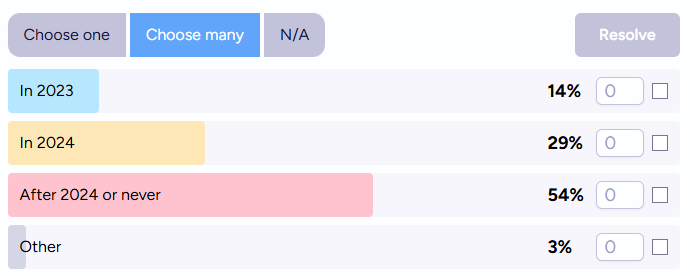

I have this option:

And I have this option:

But both seem to close the whole question at once. Closing all options at the same time.

Is there a way to just resolve 2023 to NO and leave the rest open?

@uair01 For this type of question, you need to wait until the one correct answer is known, it does not support partial resolution.

Also, do governments already do this? AWS handles protected data from the Australian Cyber Security Centre. Microsoft’s “classified cloud” is just an Azure hybrid cloud offering with “zero trust” authentication.

@Tik Are you sure that that's not using a separate backplane? Then it would not count. See the definition of "private" above.

But I'm open for discussion on this. That's why I made this market :-)

@uair01 Can you clarify your understanding of that? I may be a layman who’s gotten in deeper than he bargained for here.

@Tik AFAIK there exist secret clouds using public cloud technology. AWS does this for the UK secret services. Microsoft does that for US DoD. But these environments are "airgap separated" from the standard public cloud services. I cannot buy an account on those secret clouds.

@uair01 Thanks, I’d be shocked if a Five Eyes country springs for that anytime soon. What advantages would it offer a government?

@uair01 Why not bet Other? It should be safe to bet NO towards zero if you do not plan add any new options..

@Irigi Can you explain that further? I'm not yet experienced in those technicalities. Using an extensible list was a beginners error.

@uair01 If you hold YES of Other, you get the same amount of YES in any new answer that is later added. So if you do not plan to add any new answers, it makes no sense to buy YES. (The market never resolves Other, I think, but could resolve to new option spawned from it - but not in this market, I take it).

If you buy NO, you normally get payout if the market resolves to something else. If new option is added later, your NO shares in Other are transformed in the same amount of YES in every other option, as it is equivalent. (Again not the case of this market).