FED pivot is defined as the change in the approach of defining the upper bound of the target federal funds range, so-called 'interest rates'. The decisions on the target federal fund range are made by the Federal Open Market Committee (FOMC) meetings.

This market will resolve to "YES" if in mentioned in the title scheduled meeting, the Federal Open Market Committee decides to decrease interest rates (over the level it was prior to the meeting), on any of its meetings.

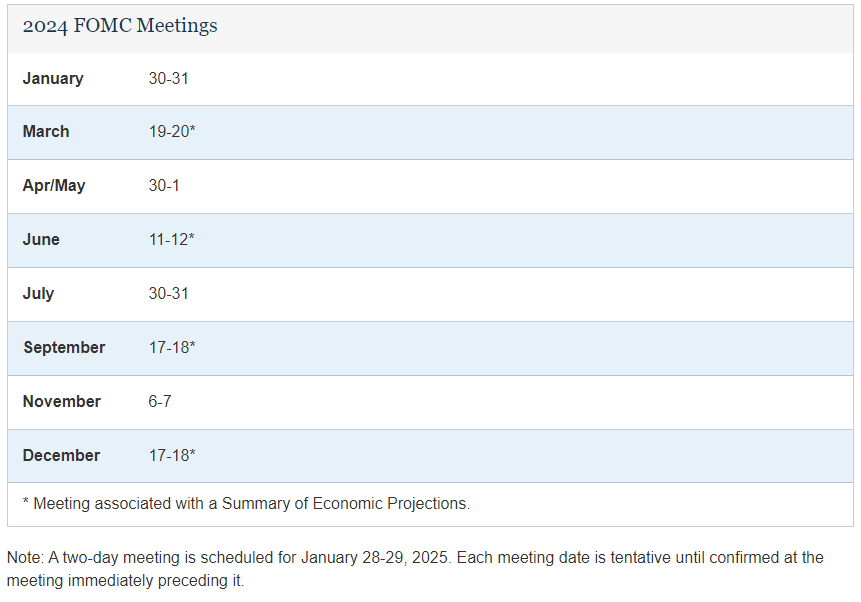

calendar of meetings

📅 FIND SUCH MARKET FOR OTHER DATES HERE

The level and change of the target federal funds rate is published at the official website of the Federal Reserve at https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ13,009 | |

| 2 | Ṁ2,033 | |

| 3 | Ṁ1,934 | |

| 4 | Ṁ1,420 | |

| 5 | Ṁ862 |

People are also trading

I think this market is simpler than Foresight Bureau suggests. Inflation still exists, and unemployment isn't that bad.

The stock market overreacted and gave people like me a great opportunity to make lots of money - nVidia hit $92 at one point! But look at any news report and you'll see that few people complain about being unemployed, while there are continual interviews about high prices.

The Fed uses weird metrics that don't correspond to reality - particularly with inflation - which is why I only put in 50M to NO. If I were in charge, I would do nothing this time around.

I'm taking a contrarian stance, but I believe the Federal Reserve will maintain current interest rates due to geopolitical considerations. It appears there is a deliberate strategy to weaponize the US dollar by keeping it strong through high interest rates. This approach aims to economically weaken China and Russia. By extracting US dollars from the Eurodollar system (as described in the Dollar Milkshake Theory), the cost of essential imports for countries like China, which is already experiencing a dollar shortage, becomes prohibitively high.

This tactic will likely lead to a recession in the US and negatively impact other global economies, including those in Europe and Japan. However, given the ongoing economic conflict between the West and nations like Russia and China, these sacrifices are seen as necessary for a broader strategic goal. The objective is to cripple the economies of adversarial nations to prevent them from financing military conflicts, potentially averting a kinetic war.