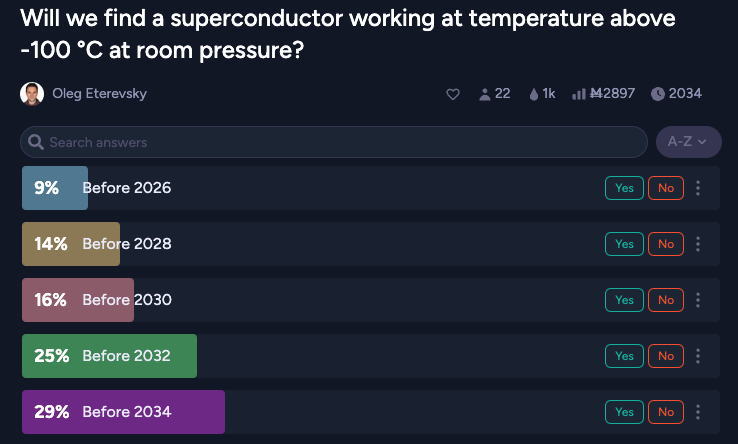

buckets:

above/below thresholds:

@Odoacre Doing both is certainly ideal, but requires more work, e.g. the expected value calculation won't be the same. But given the results it does look more important to prioritize than I would've thought

@ian I don't know what you mean for EV calculation. It's hard to say without knowing what you have in mind (maybe you mean to make a new kind of market that behaves differently from the existing multichoice and the images you posted are just for illustration? In that case disregard the following).

However taking those images at face value they are basically the same thing, both are buckets, but one of them is mutually exclusive and one is not.

So the simplest thing would be to ask the user for a range and bucket size, generate a multichoice market prefilled with the correct buckets and have the user pick mutually exclusive or not.

@Odoacre I think I’m just going to let the user choose on the numeric creation screen between buckets and thresholds

Is there a good design for a floating date/floating number market? Like over/under but with a median value which costs 50% on either side

Nothing stops there from being not just this 1:1 line but also 3:1 and 1:3 lines too where people give it get odds against more unlikely values.

This system has the benefit of not having to prescribe buckets and risking being wildly off in duration or resolution of the interesting area for predictions

@Ernie Not that I know of, although adapting the multi-choice with 'other' option to a numeric range that adds more answers when the current answers probs get low enough/'other' option gets high enough would be interesting.

@SG See DP's comment: thresholds are easier to bet on for traders and surpassed threshold answers can be resolved early