This market will end with the choose of the president of USA.

Yo iba a decir que este mercado tiene malos criterios de resolución, pero eso es incorrecto: el mercado no tiene criterios de resolución.

I was gonna say this market has poor resolution criteria, but that's not correct: this market does not have resolution criteria.

@BrunoParga Si tenemos en cuenta que el mercado es alcista debido a las elecciones, el criterio de resolucion es legítimo. Pasado el periodo, se determinara cuál es el objetivo con el nuevo presidente. Esto funciona por ciclos

If we take on consideration that the market is bullish due to the elections, the resolution criteria is legitimate. After the period has passed, it will be determined what the objective is with the new president. It operates in cycles

@graspthenet dude

Your options read like mutually exclusive but the market isn't set up for it

Your question title contains an undefined reference ("esto")

As currently written, this market is not really good.

@BrunoParga I accept the criticism. I will try to make it better in the future.

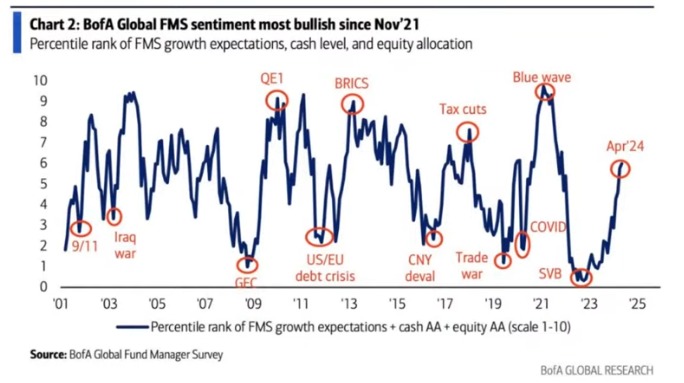

Anyway, the market is bullish because the liquidity going into the market and the share buybacks (liquidity too). It is happening because the country wanna show we all how strong the USA's economy is as the finances into the context of global confict while China is selling the USA's bonds as ever before. We may talk many more things about but the goverment is the one who open and close the door's liquidity at the end. It is not an opinion.

If there is not election's year the market would not be bullish probably.

@graspthenet first and foremost you need to define which country you're talking about – it is not clear if it is the USA or Spain or what.

Then you need to make it extremely clear that the market is about predicting future inflation in that economy. You define a specific source and a specific index (as there are various forms of calculating inflation).

Then you define, for each of the options you created, an extremely clear and unambiguous criterion. I'd recommend stuff of the form "this option resolves YES if the index is above value X on date Y, and NO otherwise". Make sure X and Y are as consistent as possible with the current vague phrasing.

You also remove analysis you posted anywhere in the question, starting with the title – as I said, the current title makes no sense for a question here. You're not trying to persuade anyone of anything, you're asking a set of questions for people to bet on. If you believe they are betting wrong, you bet against them and make money. If you really cannot resist posting analysis, do so in a comment, not the title or question description.

Last, and most important at all – once you've made the changes, offer to reimburse the traders and the person who subsidized the market if that wasn't you.

@PGeyer Gracias por el enlace. Los resultados de la economia española son bastante decepcionantes, sobre todo teniendo en cuenta los niveles de deuda que esta aceptando y en los que está basandose para construir su crecimiento.

La situacion del dolar es más preocupante, niveles de deuda insostenibles, pagando más intereses que lo que destina USA a presupuesto militar y con unos problemas inflaccionarios que no interesa aceptar debido a las elecciones. En este contexto, el mercado debe ser alcista por el periodo electoral. Será interesante ver que ocurre al final del año.

Estamos viviendo un periodo histórico de cambios y revoluciones tan interesantes como intrigantes.

@graspthenet En inglés: I understand your concern, and I agree that current deficits are unsustainable, and have been since Trump made his tax cut without reducing spending.. He increased the deficit every year. Biden played the same game to a lesser degree. However, I use the balance sheet perspective to relax my concerns. The total equity value of the US is likely over $200 trillion. Its total debt is a fraction of that. For instance, as of September 13, 2023, the total value of the United States' real estate and domestic businesses was $100.3 trillion and $55.1 trillion, respectively. These two asset classes make up 78% of the country's total consolidated assets. https://en.wikipedia.org/wiki/Financial_position_of_the_United_States?wprov=sfti1

Once inflation unwinds, interest rates can drop, so interest burden would drop. However, total US government taxes must rise to at least 19% of GDP for sustainability. Gradually higher tax rates on corporations and individual investment income will accomplish that, but the punishing transition would require anticipatory offsetting monetary stimulus, with low rates and more quantitative easing.

@PGeyer It is more bigger than Trump or any other president but you are right again. The value of the dollar gonna dissapear because there is not anykind of value in the background.

It is the model of growing we hold by debt. The human sociaty has a toxic relationship with the debt from it exist. History says too much

The time when the inflaction begins to down doesnt look close. We gonna get second inflacionary round, a greastest one.

It is something funny to see how the most important currency has no value at the same time it gonna extract the value of we all, dont you think so? tragic but pretty funny.

@graspthenet Inflation has dropped significantly in the last 21 months and the dollar is crushing many currencies, especially the yen. Trump raised the debt over $8 trillion and no one blinked an eye. When you look at a graph of annual deficits, you will notice that under Republican presidencies, the deficits rise, especially near the end of their terms, going back to Nixon, Reagan, the Bushes, snd Trump, and then Democrats come in and reduce the deficit. It is a reliable political economic cycle repeated over the last half century. https://fred.stlouisfed.org/series/FYFSDClinton, a small government Dem, even got us to four years of surpluses. Then Bush came in and broke with history going back to ancient times: he started two wars and cut taxes on the rich, a fiscal crime!

Do not overthink inflation. Globalization, automation, worldwide productivity enhancements, these will continue to put downward pressure on inflation. As long as the year on year measures of inflation continue to abate, all is well. And next year, Trump’s tax increase kicks in. Remember? That was what he signed into law back in 2017.

https://www.cnbc.com/amp/2024/05/18/trump-tcja-tax-cuts-are-slated-to-expire-after-next-year.html

Our government is not the rat’s nest of debt that China has going on. They have a fiscal nightmare getting worse every year.