🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ204 | |

| 2 | Ṁ66 | |

| 3 | Ṁ63 | |

| 4 | Ṁ40 | |

| 5 | Ṁ31 |

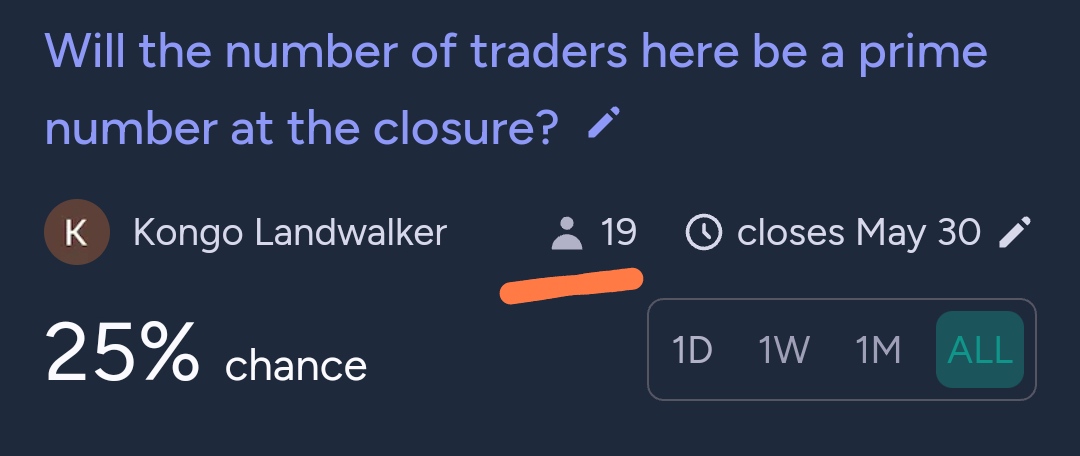

Does the resolution criteria count the number of traders who have traded or the number of non-zero positions held at the time of close?

i.e. if there have been 18 unique traders in the market and then one of them sells their position such that there are only 17 positions left. Will this count as 18 or 17 at the time of close?

@ShitakiIntaki just this number. I don't want to complicate with subtracting those who cashed out.

@SavioMak At this scale the problem should be solved discretely, and not continuously. The density of primes around 23 (+-3) is 14%, and around 40 it's 43%, i.e. it's not monotonic. Approaching a certain number of unique traders this market will actually go up, before going down again.

But it's too early to tell, we still have 5 days to go.

@MayMeta Based upon the criteria you don't ever have to worry about there being less traders, only more traders. So it seems to be more of a time decay problem for the rate of new traders joining the market and whether the last trader is prime. Selling out of all positions does not reduce the number of traders so the primary manipulation in this market is recruitment of more traders. It is certainly easier for this to resolve NO since a composite number always follows a prime greater than 2 but a prime number does not always follow a composite number.

@MayMeta the moral question is whether it is cost effective to boost this market as opposed to other illicit alternatives for recruiting unique traders.

@ShitakiIntaki 👀

I'd only boost it if I had a lot of mana stuck on NO and I was afraid to lose it all